7 Key Takeaways from CrowdStrike's Latest Q2 FY 2026 Earnings

Strong Comeback, even Stronger Earnings.

Dear Investor,

Zee here. We decided to do another bonus issue of Kintsugi Stock Saturday, because CrowdStrike just reported, and the Company comeback story is too interesting to delay..

When a cybersecurity company causes the largest IT outage in history, most investors would write the obituary. The July outage paradoxically demonstrated CrowdStrike's criticality. When one software update can ground airlines, shut down hospitals, and freeze banking systems, it proves how deeply integrated and essential these platforms have become. That integration creates switching costs that go far beyond simple contract terms.

But sometimes the market's worst fears create the best opportunities.

CrowdStrike just reported their Q2 FY 2026 earnings, and the results tell a remarkable story of resilience, customer loyalty, and why dominant platforms survive even catastrophic mistakes.

Here are seven critical insights that reveal why CrowdStrike's darkest hour might actually validate their long-term investment thesis.

1. Record Performance Despite the July Catastrophe

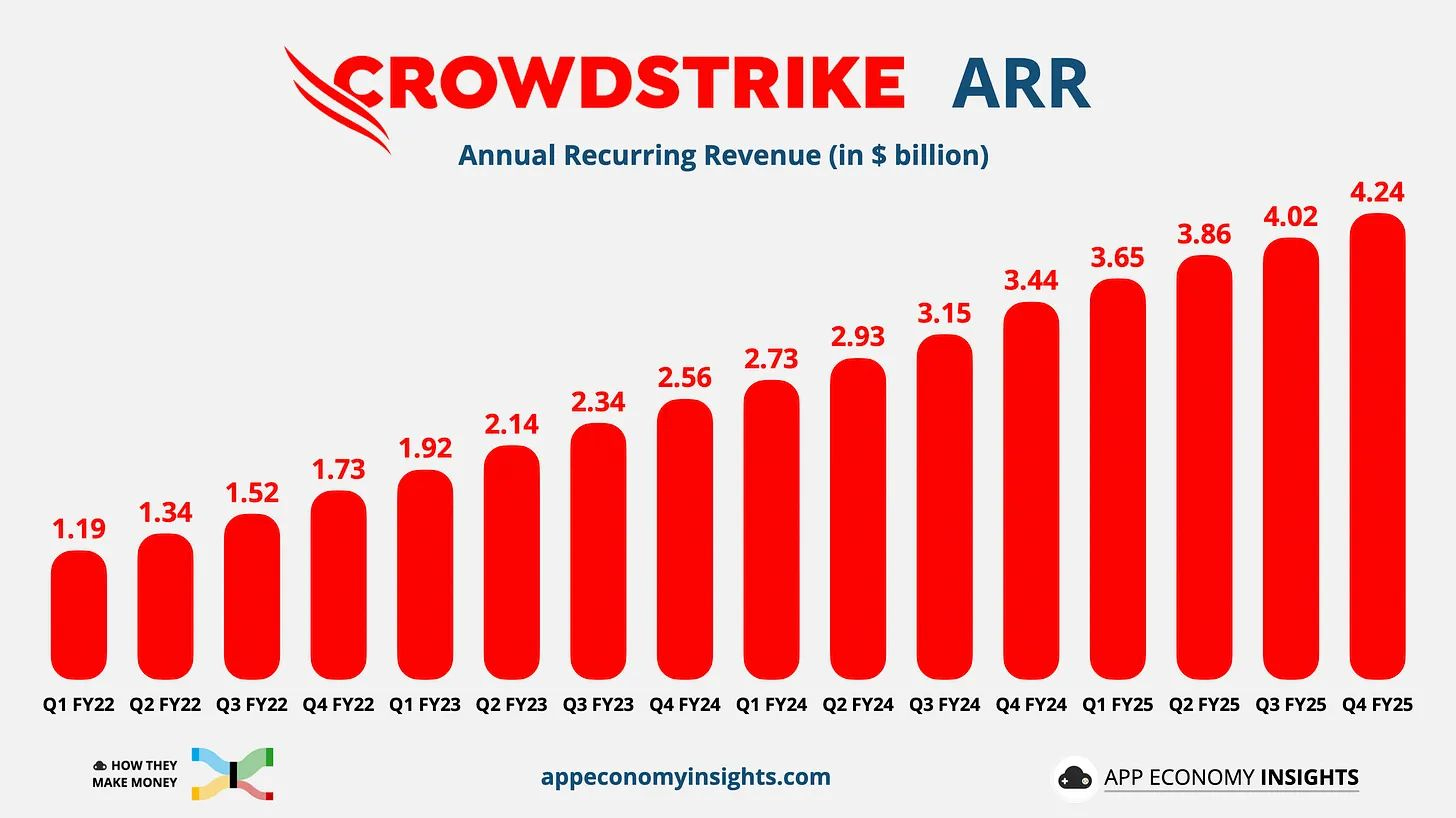

CrowdStrike achieved record Q2 net new ARR (Annual Recurring Revenue) of $221 million with ending ARR growing 20% year-over-year to reach $4.66 billion, while delivering record Q2 cash flow from operations of $333 million and record Q2 free cash flow of $284 million.

Let's put this in perspective: 3 months after causing a worldwide IT outage with financial damage estimated at least $10 billion, CrowdStrike is posting record financial metrics. This isn't just remarkable, it's unprecedented in enterprise software. Most companies would be fighting for survival; CrowdStrike is setting records.

2. The $4 Billion ARR Milestone No One Expected

CrowdStrike reached $4 billion in ending ARR in the quarter, becoming the fastest and only pure play cybersecurity software company to reach this milestone.

This achievement is particularly stunning given the timing. Reaching $4 billion in ARR just months after a global outage demonstrates that CrowdStrike's platform isn't just sticky, it's irreplaceable. When customers stay with you after you've caused their worst nightmare, that's not just customer loyalty; that's platform dependency.

3. Customer Commitment Packages Turned Crisis Into Opportunity

The company saw "incredible success with customer commitment packages as customers embraced the program and chose to deepen their relationship with CrowdStrike".

This is perhaps the most counterintuitive outcome: CrowdStrike turned their crisis into deeper customer relationships. Instead of fleeing, enterprise customers signed commitment packages, essentially doubling down on their CrowdStrike investment. This behavior suggests that switching costs in cybersecurity are even higher than previously understood.

4. Minimal Financial Impact from Maximum Reputational Damage

The customer commitment program impacted revenue by about $11 million in the quarter, with expected impact of $10-15 million through fiscal year end.

The July outage created global headlines and political scrutiny, yet the actual financial impact represents less than 1% of quarterly revenue. Total revenue was $1,010.2 million, a 29% increase compared to $786.0 million in the prior year quarter. This disconnect between perception and financial reality creates a classic value opportunity.

5. Earnings Beat Demonstrates Operational Excellence

CrowdStrike reported non-GAAP earnings of 93 cents per share, surpassing the consensus estimate by 14.8% and beating management's guidance of 80 to 81 cents.

Even while managing a global crisis, investing in customer relationships, and facing regulatory scrutiny, CrowdStrike beat both street expectations and their own guidance. This operational discipline during extreme stress demonstrates management quality that most investors underestimate.

6. The Competitive Moat Validated Under Extreme Stress

The July outage created the ultimate stress test for CrowdStrike's competitive position. When your product causes global disruption, competitors should be circling like vultures, customers should be evaluating alternatives, and market share should be hemorrhaging.

Instead, we see record ARR growth, customer commitment packages, and minimal churn. This validates that CrowdStrike operates in a market with extreme switching costs and limited viable alternatives. The cybersecurity landscape isn't just winner-take-most, it's becoming winner-take-nearly-all.

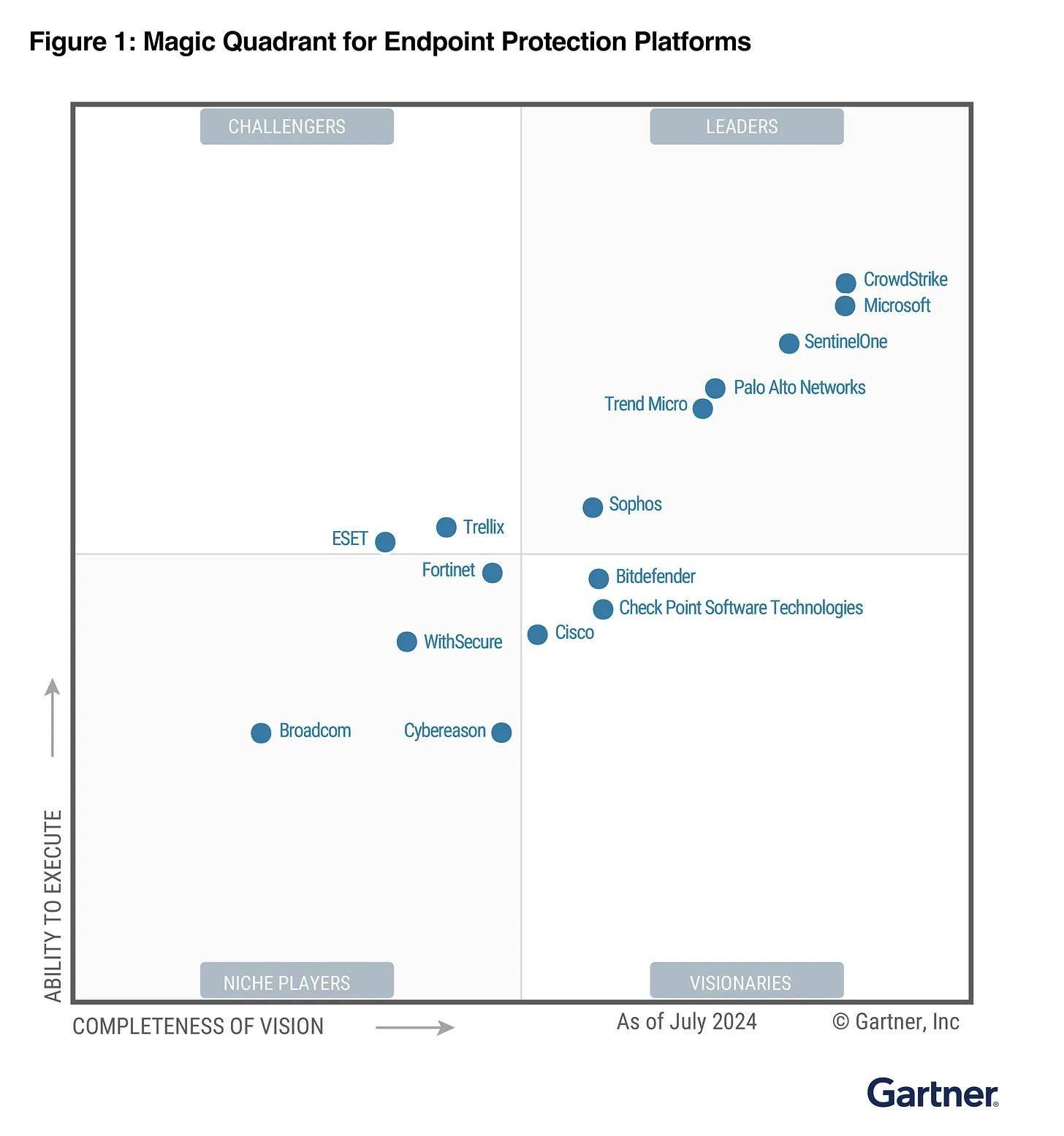

Gartner’s Magic Quadrant: In July 2024, CrowdStrike was named the leader in Endpoint Protection Platforms, outranking Microsoft and all competitors in execution and vision.

7. The Acquisitions continues…

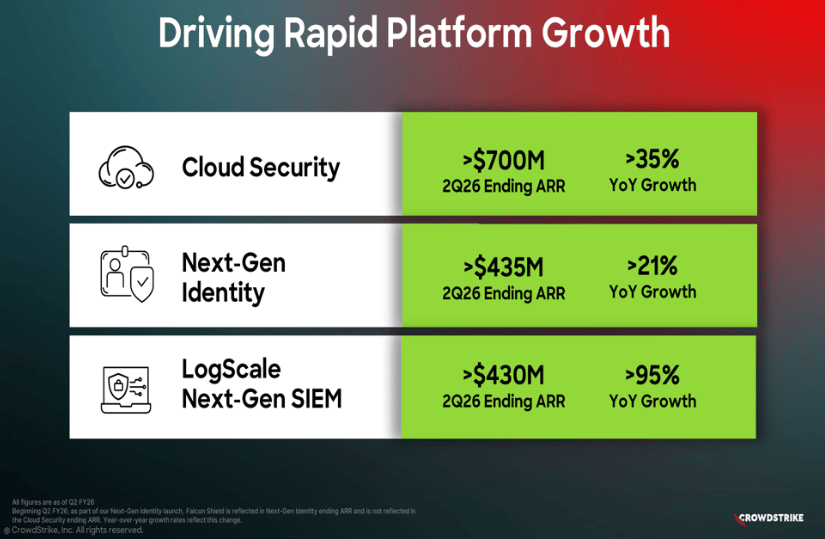

CrowdStrike continues to pursue an active acquisition strategy, using M&A to strengthen and broaden its multi-module platform, similar to the playbooks of Microsoft and Salesforce. By integrating new capabilities into its cloud and AI-driven cybersecurity suite, the company boosts adoption across its modules and maintains a competitive edge over traditional security vendors.

Recent (2025) Acquisitions:

Onum: Data observability startup providing real-time telemetry pipeline management to enhance CrowdStrike's Falcon Next-Gen SIEM capabilities. ($290M)

2024 Acquisitions:

Adaptive Shield: SaaS Security Posture Management (SSPM).

Flow Security: Cloud security startup providing Data Security Posture Management (DSPM) solutions. ($200M)

2023 Acquisition:

Bionic: application security posture management ($350M)

Earlier Notable Acquisitions:

Reposify (2022): Threat detection for IoT devices.

Humio (2021): High-speed log management & observability ($400M).

SecureCircle (2021): Cloud-based data security solution.

Preempt Security (2020): Zero-trust and real-time access control ($96M).

Payload Security (2017): Automated malware analysis sandbox.

Onum acquisition in August 2025 will help boost Next-Gen SIEM, which is growing at >95% YoY Growth.

The Bottom Line

CrowdStrike's latest earnings don't just show recovery, they show dominance validated under extreme stress. This is a company that:

Posted record financial metrics months after causing global disruption

Converted crisis into deeper customer relationships through commitment packages

Demonstrated minimal financial impact from maximum reputational damage

Beat earnings expectations while managing unprecedented challenges

Proved that their platform isn't valuable and irreplaceable

The July outage created the ultimate stress test for CrowdStrike's business model, competitive position, and customer loyalty. They didn't just survive, they thrived.

When your worst-case scenario validates your investment thesis rather than destroying it, temporary market weakness often represents long-term opportunity.

The cybersecurity market isn't just growing, it's consolidating around platforms that can operate at global scale with acceptable risk. CrowdStrike proved they can do both, even when everything goes wrong.

P.S. Like what you read? Subscribe to read our Full Stock Analysis here, includes valuation and fundamental analysis.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.