7 Key Takeaways from Nvidia's Latest Q2 2025 Earnings

Without selling a single chip to China.

Dear Investor,

Zee here. When the world's most valuable chipmaker reports earnings, the entire tech ecosystem listens. Nvidia just delivered their Q2 fiscal 2026 results, and while the headlines focus on whether growth is "slowing", the smart money sees something different entirely.

For this week’s Kintsugi Stock Saturday, we unpack 7 critical insights from Nvidia's latest earnings that reveal why this AI juggernaut remains unstoppable.

1. Revenue Beat Expectations Despite "Deceleration" Narrative

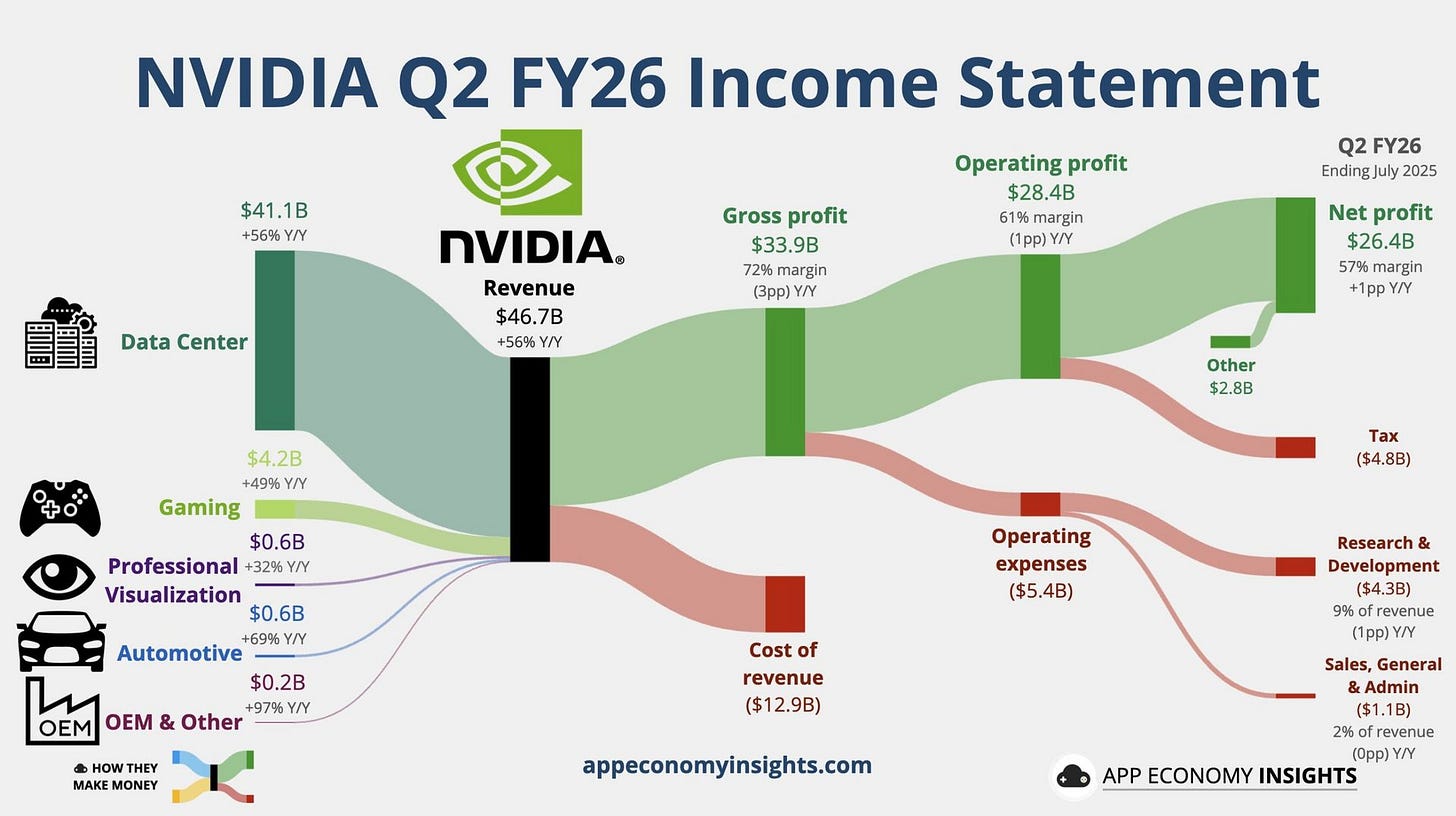

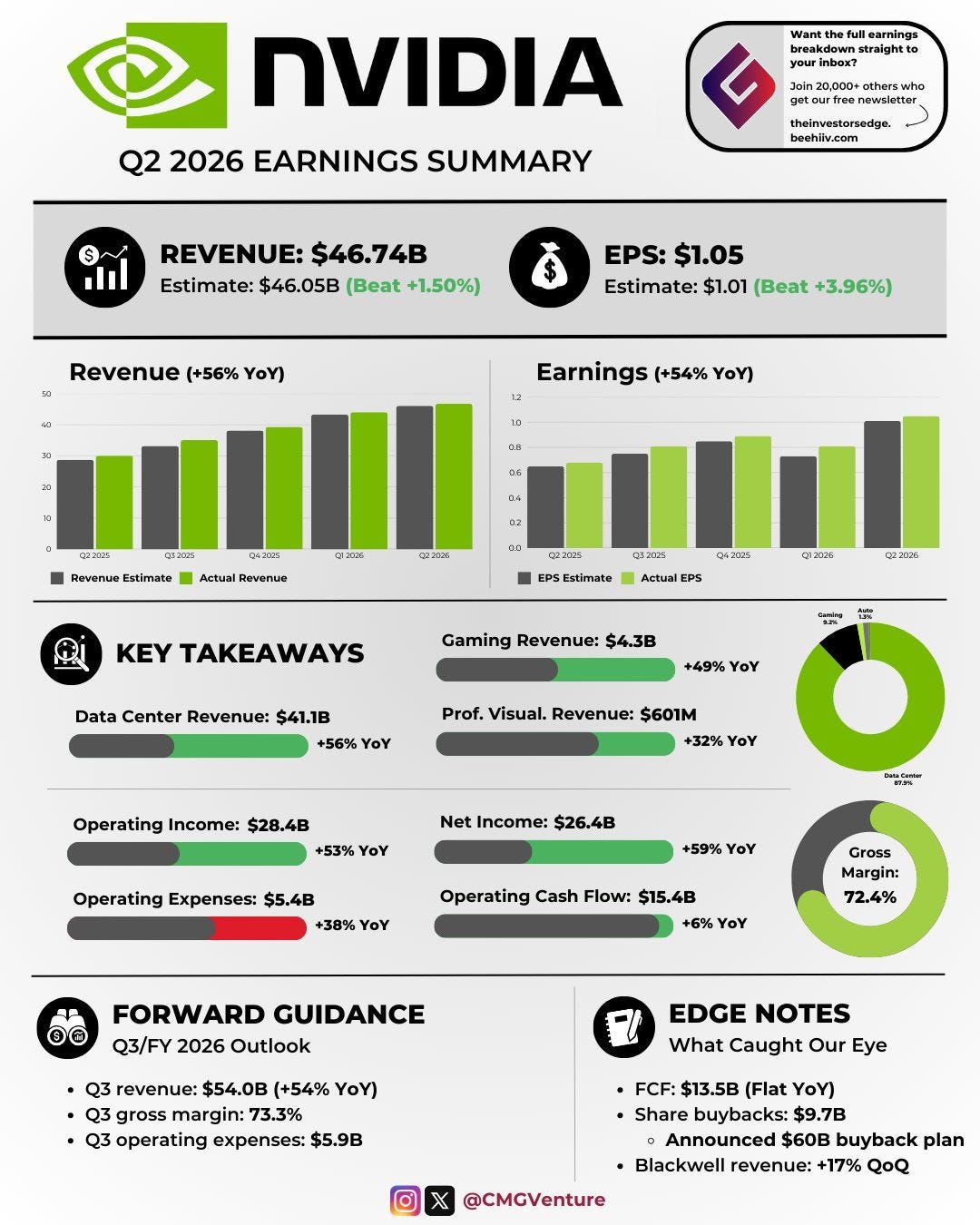

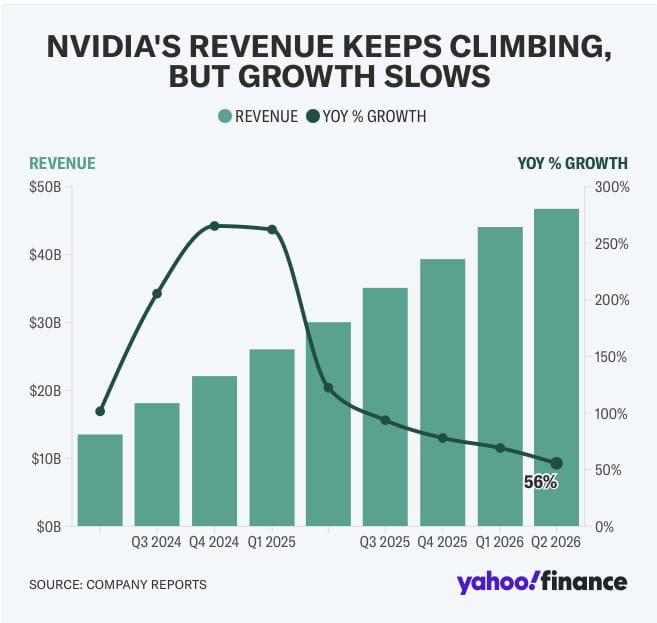

Nvidia reported fiscal 2026 second-quarter revenue of $46.7 billion, up 6% quarter over quarter and 56% year over year, and earnings of $1.05 per share, up 30% sequentially and 54% annually. Wall Street forecast revenue growth of 53% to $46 billion and EPS of $1.01.

Let's put this in perspective: Nvidia beat both revenue and earnings expectations while delivering 56% year-over-year growth on a $46.7 billion base. Most companies would kill for 10% growth on this scale. The "deceleration" narrative misses the mathematical reality that maintaining high growth rates becomes exponentially harder as the revenue base expands.

2. Blackwell Is Already Generating Serious Revenue

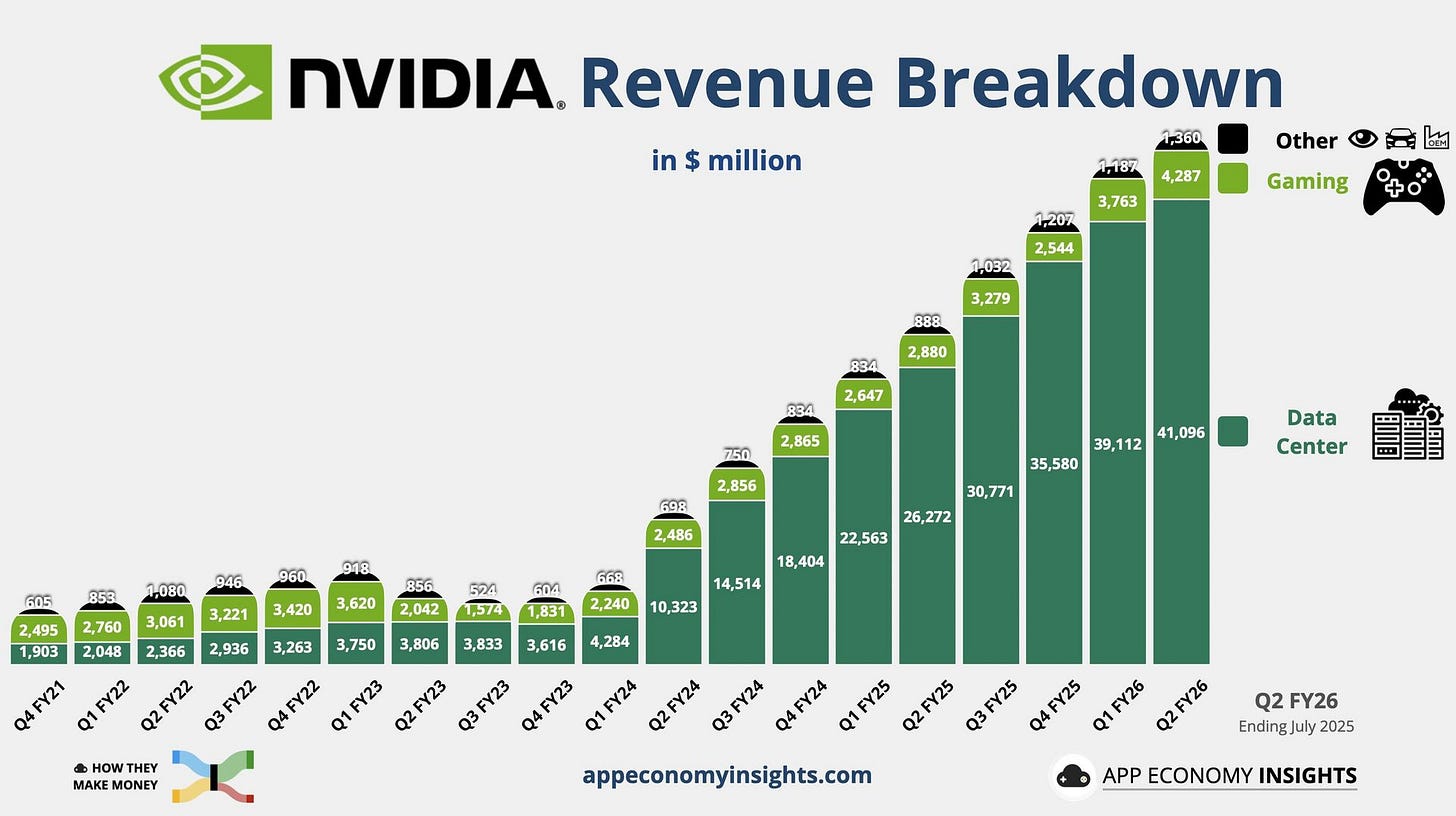

NVIDIA's Blackwell Data Center revenue grew 17% sequentially.

This is perhaps the most overlooked detail in the entire earnings report. Blackwell, Nvidia's next-generation AI chip architecture, isn't just a future promise, it's already generating billions in revenue and growing at a 17% quarterly pace. This suggests the transition to more advanced AI infrastructure is happening faster than anticipated.

3. Growth Trajectory Remains Above 50%

Nvidia said sales growth this quarter will remain above 50%, signaling to Wall Street that demand for AI infrastructure shows no sign of fading.

While competitors struggle to achieve double-digit growth, Nvidia is guiding for continued 50%+ growth rates. This isn't just impressive, it is unprecedented for a company operating at this scale. The guidance suggests management sees sustained AI infrastructure demand well into the future.

4. China Headwinds Are Real But Manageable

NVIDIA confirmed that zero sales of its H20 AI chips were made to China-based customers during the second quarter. Instead, the company realized $180 million in revenue from previously reserved H20 inventory sold to a non-Chinese customer.

In its Q3 revenue guidance (~$54 billion), NVIDIA did not incorporate any H20 sales to China, signaling continued uncertainty around access to that market. CFO Colette Kress noted that if geopolitical conditions improve and necessary orders are in place, NVIDIA could potentially generate $2–$5 billion in H20 chip revenue from China in Q3.

The absence of China sales stems from a mix of U.S. export licensing restrictions and Chinese government resistance, which limited the flow of H20 chips to Chinese buyers despite licensed export permissions. While NVIDIA had agreed to remit 15% of H20 revenue from China to the U.S. government as part of licensing conditions, concerns over chip security and upgraded specifications led China to discourage domestic firms from purchasing them.

The H20 chip was designed primarily for the China market, so resuming its sales represents meaningful upside if access is restored.

5. Data Center Dominance Continues

The numbers tell the story of Nvidia's data center supremacy. With Blackwell revenue already contributing meaningfully and growing sequentially, Nvidia isn't just riding the current AI wave, they're building the infrastructure for the next phase of AI development. This positions them perfectly as enterprises move from experimentation to full-scale AI deployment.

6. Margin Expansion Despite Scale

Achieving 54% annual earnings per share growth while revenue grew 56% indicates that Nvidia is maintaining pricing power and operational efficiency even at massive scale. This suggests their competitive moats remain intact and their premium positioning in AI chips continues to command premium pricing.

7. The Market Is Missing the Long-Term Picture

Here's what the sell-off reveals: the market is focusing on quarter-to-quarter fluctuations rather than the fundamental transformation Nvidia is enabling. A company doesn't accidentally deliver 50%+ growth guidance for multiple consecutive quarters while launching next-generation products that are already generating revenue.

The Bottom Line

While headlines debate whether Nvidia's growth is "slowing," the underlying metrics tell a different story. This is a company that:

Consistently beats expectations across revenue and earnings

Maintains 50%+ growth rates at unprecedented scale

Successfully transitions customers to next-generation products

Demonstrates pricing power and operational efficiency

Continues expanding in the fastest-growing segment of technology

The temporary stock decline after earnings creates an opportunity rather than a cause for concern. When a company delivers results this strong while guiding for continued exceptional growth, temporary market reactions often represent buying opportunities for patient investors.

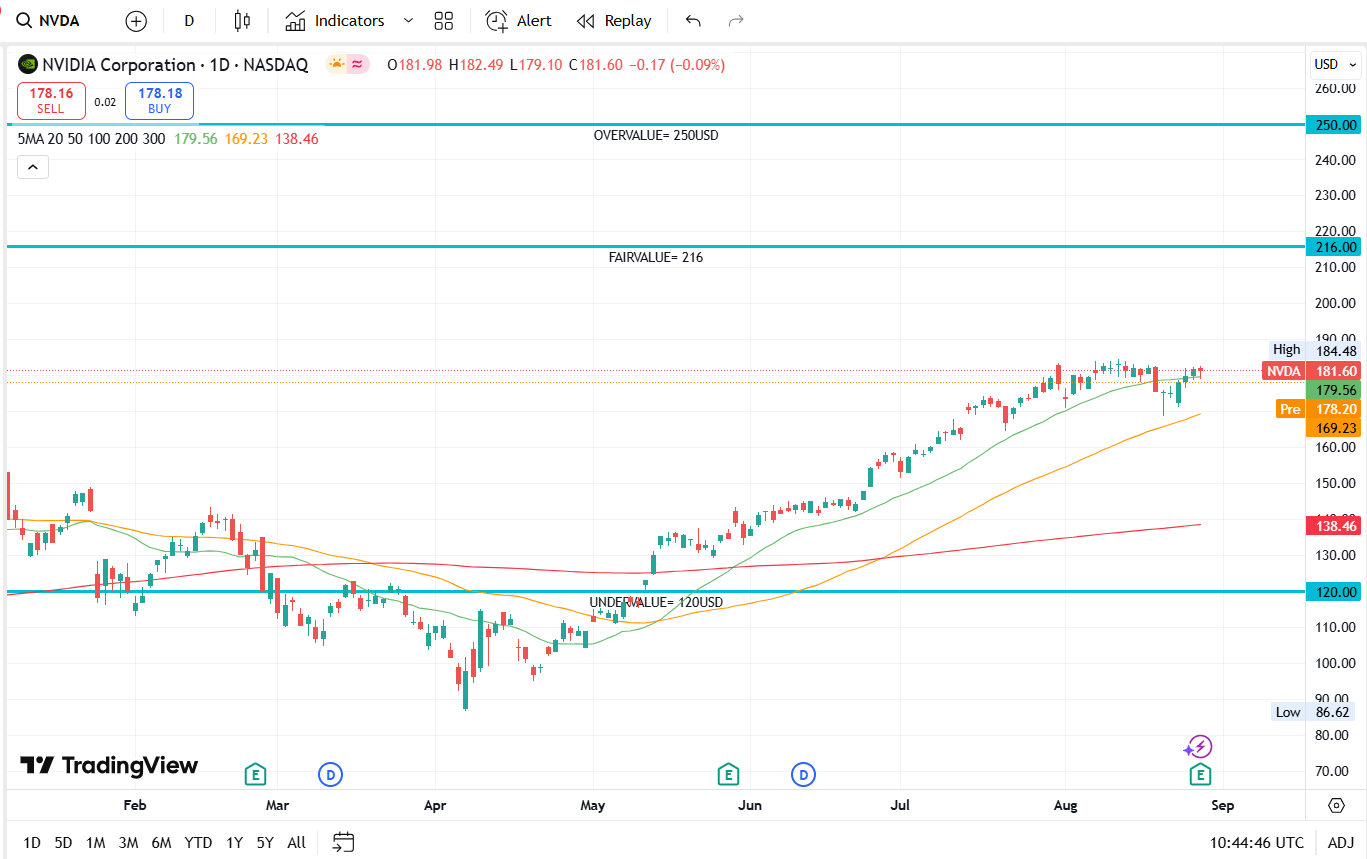

Kintsugi Analyst’s valuation of NVDA

Nvidia isn't just riding the AI wave, they're creating it. And based on these earnings, that wave is far from cresting.

P.S. Like what you read? Subscribe to read Nvidia Full Stock Analysis here, includes valuation and fundamental analysis.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.