7 Key Takeaways from Snowflake's Latest Q4 2025 Earnings Report

Was Warren Buffett wrong about selling Snowflake?

Dear Investor,

Zee here. In the second quarter of 2024, Berkshire Hathaway sold its entire stake in Snowflake, which had consisted of approximately 6.1 million shares. This move effectively eliminated the position from the portfolio by June 30, 2024. Was it High Valuation & Limited Margin of Safety or Profitability Concerns?

Snowflake (NYSE: SNOW) just reported its fiscal Q4 2025 results, and the numbers tell a compelling story of a company that's successfully navigating the transition from high-growth startup to profitable enterprise.

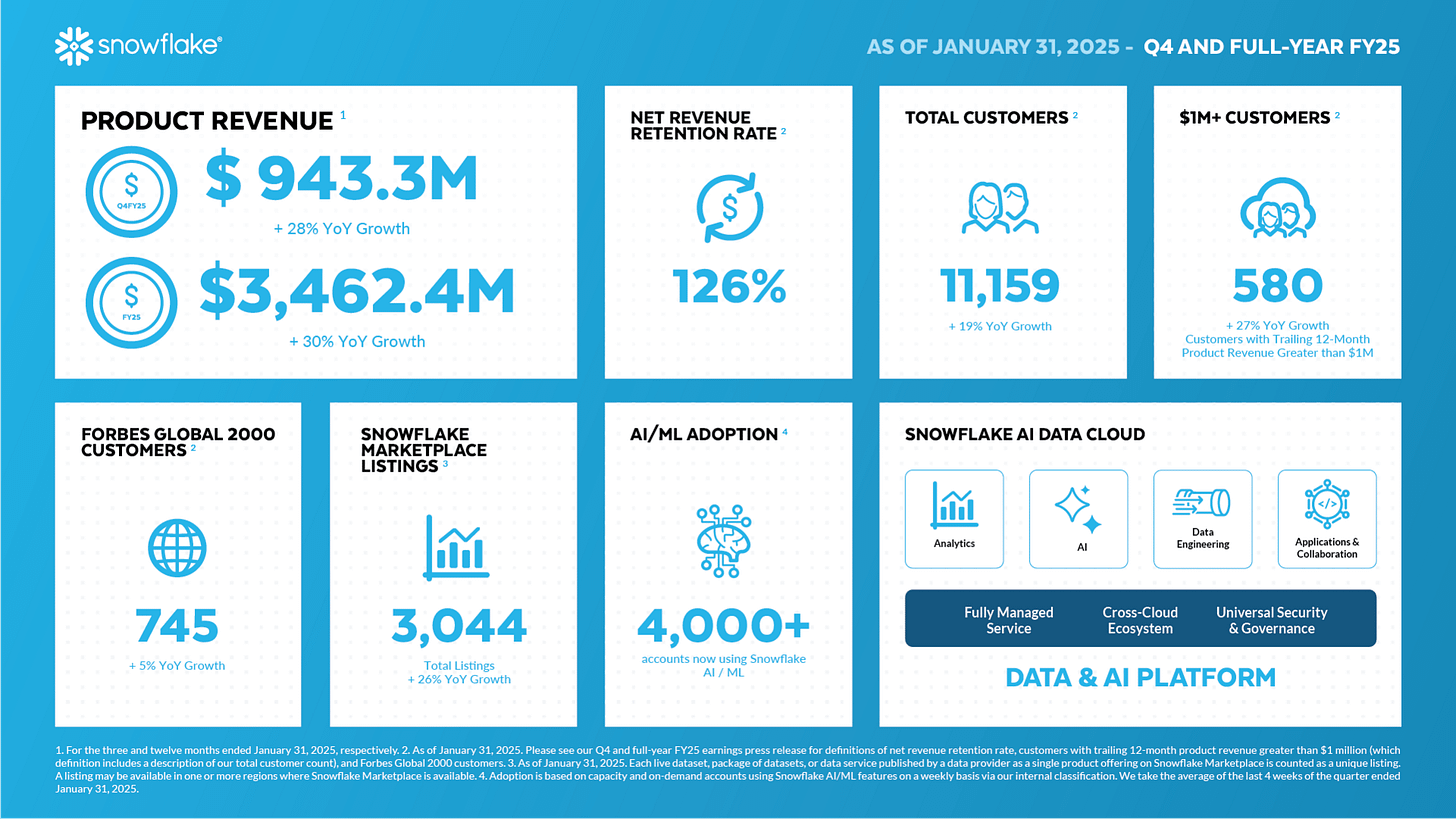

Product revenue of $943.3 million representing 28% year-over-year growth and improved profitability metrics, was Warren Buffett wrong about selling Snowflake?

Let's dive into the seven most important takeaways from this earnings report.

1. Strong Revenue Growth Despite Macro Headwinds

Revenue for the quarter was $986.8 million, representing 27% year-over-year growth, with the core product revenue growing even faster at 28%. This performance is particularly impressive given the current economic environment where many SaaS companies are facing growth headwinds.

For the full fiscal year 2025, product revenue reached $3,462.4 million, representing 30% year-over-year growth. This demonstrates Snowflake's ability to maintain robust growth rates even as it scales to multi-billion dollar revenue levels.

The consistency of this growth, combined with the company's consumption-based model, suggests strong underlying demand for Snowflake's data cloud platform.

2. Customer Expansion Continues at Scale

The customer metrics reveal a business that's not just growing but expanding its footprint among high-value clients. The company now has 580 customers with trailing 12-month product revenue greater than $1 million and 745 Forbes Global 2000 customers, representing 27% and 5% year-over-year growth, respectively.

What's particularly noteworthy is that these aren't just new customer acquisitions – the net revenue retention rate was 126% as of January 31, 2025. This metric indicates that existing customers are not only staying but are increasing their consumption of Snowflake's platform, a strong indicator of product stickiness and value creation.

3. Path to Profitability Becoming Clearer

While Snowflake reported a GAAP operating loss, the non-GAAP metrics show significant progress toward profitability. Non-GAAP operating income was $92.8 million with a 9% operating margin for Q4, and non-GAAP operating income was $231.7 million with a 6% operating margin for the full year.

This improvement in profitability metrics, combined with strong free cash flow generation, demonstrates management's ability to balance growth investments with financial discipline – a crucial factor for long-term sustainability.

4. Massive Cash Generation and Strong Balance Sheet

Snowflake's cash generation capabilities are impressive. Net cash provided by operating activities was $432.7 million (44% of revenue) for Q4 and $959.8 million (26% of revenue) for the full year. The company also generated free cash flow of $415.4 million (42% margin) for Q4 and $884.1 million (24% margin) for the full year.

With cash and short-term investments totaling over $4.6 billion, Snowflake has a fortress balance sheet that provides significant strategic flexibility for investments, acquisitions, or weathering any potential economic downturns.

5. Raised Full-Year Fiscal 2026 Guidance Shows Confidence

Management's outlook for fiscal 2026 reflects continued confidence in the business trajectory. The company guided for full-year fiscal 2026 product revenue of $4,280 million, representing 24% year-over-year growth.

While this represents a slight deceleration from the 30% growth achieved in fiscal 2025, it's important to note that this is off a much larger base. The guidance also shows non-GAAP operating margin of 8% and adjusted free cash flow margin of 25%, indicating that profitability improvements will continue alongside revenue growth.

6. Record Remaining Performance Obligations Signal Future Growth

One of the most encouraging metrics from the report is the substantial increase in contracted but not yet recognized revenue. Remaining performance obligations were $6.9 billion, representing 33% year-over-year growth.

This metric provides visibility into future revenue and suggests that Snowflake's customers are committing to longer-term contracts and larger consumption commitments. The 33% growth in RPO, which is faster than current revenue growth, indicates accelerating business momentum.

7. AI Data Cloud Positioning for the Next Phase

CEO Sridhar Ramaswamy emphasized the company's positioning in the AI revolution, stating that "Today, Snowflake is the most consequential data and AI company in the world. More than 11,000 customers are already betting their business on our easy-to-use, efficient, and trusted platform."

The company's focus on being the infrastructure layer for enterprise AI workloads positions it well for the next wave of technology adoption. As companies increasingly look to implement AI solutions, Snowflake's data cloud platform becomes even more valuable as the foundation for these initiatives.

Bottom Line

While the results are strong, investors should keep an eye on potential headwinds:

Consumption Variability: The consumption-based model can lead to quarterly volatility

Competitive Pressure: Cloud providers like AWS, Microsoft, and Google continue to invest heavily in data analytics

Economic Sensitivity: Enterprise IT spending could slow in a recession

Snowflake's latest earnings report reinforces several key investment themes:

Growth at Scale: The ability to maintain 28% product revenue growth at a $3.5+ billion annual run rate is exceptional in the current environment.

Improving Unit Economics: The progression toward higher operating margins and strong free cash flow generation shows a maturing business model.

Market Leadership: With over 11,000 customers and strong net revenue retention, Snowflake has established clear competitive moats.

AI Tailwinds: The company is well-positioned to benefit from the enterprise AI adoption cycle.

IMPORTANT DISCLAIMER: By reading this document, you agree that any information, commentary, recommendations or statements of opinion provided here are for general information and education purposes only.

The information contained in this publication are obtained from, or based upon publicly available sources that we believe to reliable, but we make no warranty as to their accuracy or usefulness of the information provided, and accepts no liability for losses incurred by readers using our case studies.

It is not intended to be financial advice, personalized investment advice or a solicitation for the purchase or sale of securities. Before purchasing any discussed securities, please be sure actions are in line with your investment objectives, financial situation and particular needs. Please do your own research and speak with a licensed advisor before making any investment decisions.

International investors may be subject to additional risks arising from currency fluctuations and/or local taxes or restrictions.

Please remember that investments can go up and down, including the possibility that a stock could lose all of its value. Past performance is not indicative of future results.