7 Key Takeaways from UnitedHealth Group's Q2 2025 Earnings

Why Smart Money is Buying the Dip

Dear Investor,

UnitedHealth Group’s Q2 2025 earnings weren’t just about health insurance, they offered a glimpse into the pulse of the U.S. healthcare system and parts of the wider economy. As the country’s largest health insurer, UNH sits at the crossroads of patient care, insurance costs, and government policy, making its quarterly performance a bellwether far beyond Wall Street.

From rising medical utilization to shifting consumer behavior and evolving cost trends, this quarter’s results reveal more than numbers on a balance sheet.

For this week’s Kintsugi Stock Saturday, we unpack the 7 key takeaways that explain what UnitedHealth’s performance means for patients, providers, policymakers and the future of healthcare in America.

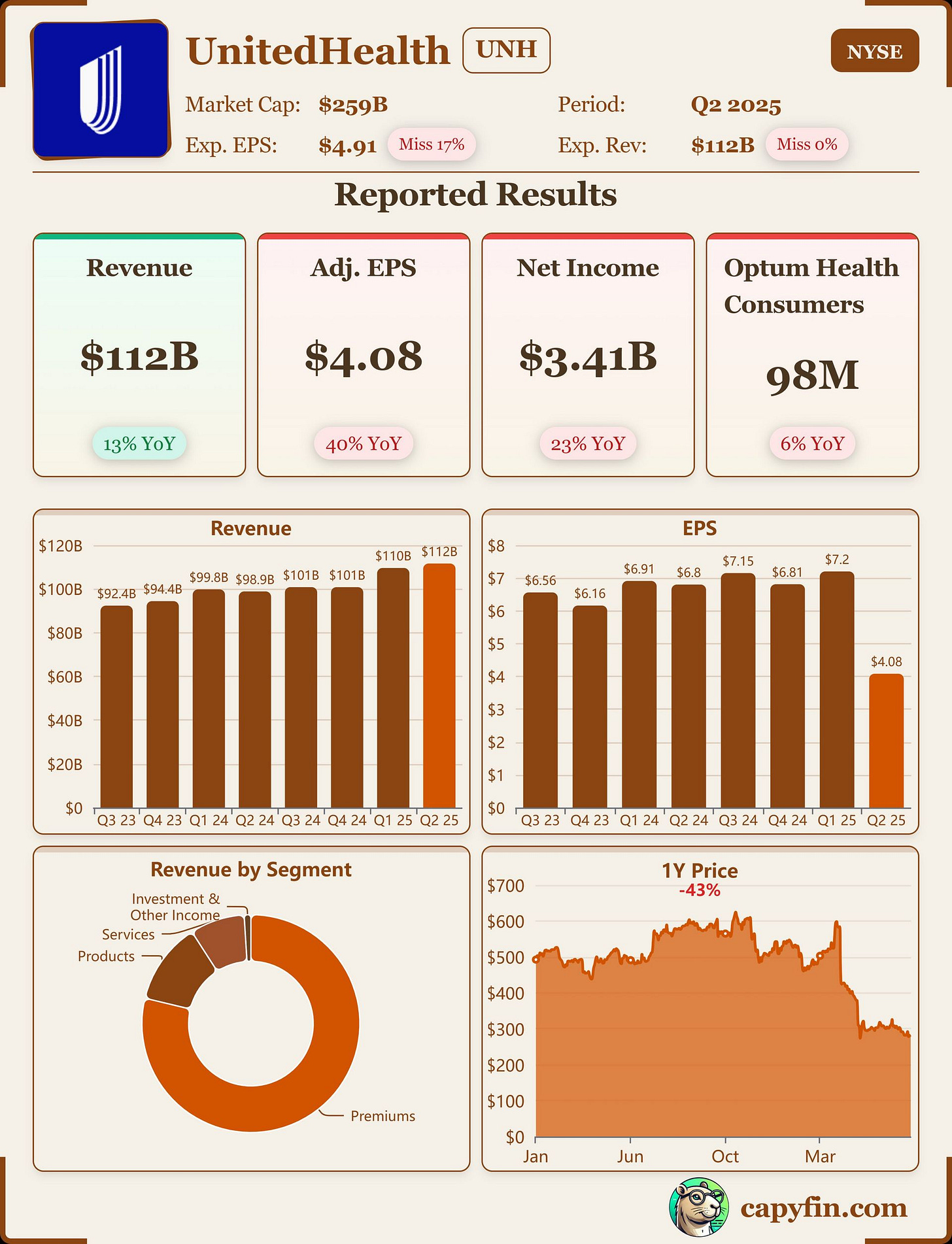

1. The Earnings Miss That Wasn't Really a Miss

UnitedHealth Group (UNH) reported Q2 adjusted EPS of $4.08 versus the $4.48 Wall Street expected, an 8.9% miss that sent shares down 3%+ in premarket trading. But context matters: this "disappointment" still represents solid profitability on massive scale, and the company's guidance reset provides a more realistic foundation for future beats.

The market's obsession with quarterly estimates often misses the bigger picture. UNH's earnings power remains intact, just temporarily pressured by the same medical cost headwinds affecting the entire industry.

2. Revenue Growth Momentum Continues Despite Headwinds

Revenue hit $111.62 billion, slightly beating the $111.52 billion consensus and representing robust 13% year-over-year growth. This demonstrates UNH's ability to expand its business even while managing elevated medical costs.

For perspective, UNH's trailing 12 months revenue of $422.818B represents a 9.7% increase year-over-year, showing consistent growth momentum that most companies can only dream of achieving.

3. Medical Care Ratio Spike Signals Industry-Wide Challenge

The most concerning metric was UNH's medical care ratio jumping to 89.4% in Q2 from 85.1% in the prior year period. This measures medical expenses relative to premiums collected, higher ratios mean lower profitability.

However, this isn't a UNH-specific problem. The broader health insurance industry is grappling with higher medical costs in Medicare Advantage plans as more seniors return to hospitals for procedures delayed during COVID-19. UNH's scale and Optum integration actually position them better than smaller competitors to manage these cyclical pressures.

4. Guidance Reset Creates Realistic Expectations

UNH's 2025 guidance of at least $16 per share in adjusted earnings and revenue of $445.5-448 billion fell well short of Wall Street's $20.91 EPS expectation. While initially disappointing, this reset eliminates the overhang of unrealistic expectations that have plagued the stock.

Conservative guidance from management teams often signals they're prioritizing deliverable results over Wall Street cheerleading. For UNH, this approach could set up a series of quarterly beats once medical costs normalize.

5. New Leadership Under Fire Gets First Real Test

This marked UNH's first earnings report under new CEO Stephen Hemsley, who is tasked with restoring investor confidence after a tumultuous period including the murder of former UnitedHealthcare CEO Brian Thompson and various regulatory investigations.

Hemsley's transparent approach to resetting guidance and acknowledging challenges suggests a leadership team focused on operational execution rather than financial engineering. This could prove crucial for long-term value creation.

6. The Optum Wild Card Remains Underappreciated

While the earnings report focused heavily on insurance challenges, UNH's Optum healthcare services division continues growing rapidly with higher margins than the traditional insurance business. This integrated model, owning both the payment system and healthcare infrastructure, provides unique competitive advantages during industry disruption.

The market's fixation on insurance metrics may be missing Optum's emerging value as the "operating system" for American healthcare.

7. Smart Money Sees Opportunity in the Chaos

Despite the earnings disappointment, legendary investors continue accumulating UNH shares. Warren Buffett's Berkshire Hathaway recently disclosed a massive $1.6 billion position, while other sophisticated smart investors like Michael Burry are buying call options.

Here are a list of them:

Warren Buffett: 5.03 million shares ($1.6B+ position)

Dodge & Cox: 4.73 million shares (one of the most respected value shops)

David Tepper: 2.27 million shares (the hedge fund king)

Renaissance Technologies: 1.35 million shares (the quant legends)

Michael Burry: Buying call options (the "Big Short" guy)

Saudi Arabia's PIF: Also buying call options (sovereign wealth fund)

UNH shares are down more than 44% for the year, creating what could be a generational buying opportunity in a business that generates $25+ billion in annual free cash flow.

The Bottom Line

UNH's latest earnings reflect temporary industry headwinds rather than permanent business impairment. Medical cost pressures are cyclical, regulatory scrutiny is manageable for a company of UNH's scale, and the core business model remains one of the most robust in American healthcare.

The question isn't whether UNH will recover, businesses this dominant typically do. The question is whether you'll have the patience to buy while headlines remain negative and the smart money quietly accumulates.

For long-term investors, UNH's current challenges may represent exactly the kind of high-quality opportunity that creates lasting wealth: a proven winner made temporarily cheap by temporary problems.

P.S. Like what you read? Read on for the Full Stock Analysis.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.

UnitedHealth Group Inc. (NYSE: UNH)

Updated August 2025

Company Profile

UnitedHealth Group Incorporated is an American multinational managed healthcare and insurance company based in Minnetonka, Minnesota. Founded in 1977 by Richard T. Burke, UnitedHealth Group has grown to become the largest healthcare company in the United States by revenue and the world's largest health insurer by market capitalization.

The company operates through two primary business platforms: UnitedHealthcare, which provides health care coverage and benefits services, and Optum, which provides information and technology-enabled health services. UnitedHealth Group serves over 150 million people globally across all 50 U.S. states and internationally.

For the second quarter of 2025, UnitedHealth Group reported revenues of $111.6 billion, representing a 12.9% increase year-over-year. The company has re-established its full-year 2025 outlook after suspending guidance in May, projecting revenues between $445.5 billion and $448.0 billion.

The company serves individuals, employers, government programs, and healthcare providers through a diversified portfolio of products and services spanning health insurance, healthcare delivery, pharmacy benefits management, data analytics, and technology solutions.

Business Segments

UnitedHealthcare:

Commercial Health Insurance

Medicare Advantage

Medicaid Plans

International Operations

Optum:

OptumHealth (Healthcare Delivery)

OptumInsight (Data Analytics & Technology)

OptumRx (Pharmacy Benefits Management)

Business Segments & Revenue

Segment

Revenue (Q2 2025)

Revenue (Q2 2024)

YoY Growth

Primary Services

UnitedHealthcare

$65.0B

$58.0B

12%

Health Insurance Plans

Optum

$46.6B

$40.8B

14%

Healthcare Services & Technology

Total

$111.6B

$98.8B

12.9%

Integrated Healthcare Solutions

All revenues are in billions USD

The revenue breakdown shows strong growth across both major segments, with Optum continuing to drive significant expansion through its diversified healthcare services portfolio. UnitedHealthcare maintains its position as the core revenue generator while Optum represents the growth engine for future expansion.

How have the individual segments been performing throughout the years?

Segment

2025 (H1)

2024

2023

2022

YoY Growth (2025)

Total Revenue

$223.2B

$400.3B

$371.6B

$324.2B

9.7%

UnitedHealthcare

$130B

$281.4B

$249.8B

$223.1B

~12%

Optum

$93B

$118.9B

$121.8B

$101.1B

~14%

All revenues are in billions USD

The historical data shows consistent revenue growth across both segments. UnitedHealthcare has demonstrated steady expansion in its core insurance business, while Optum has emerged as a significant growth driver, representing nearly 42% of total company revenue in the first half of 2025.

Is UNH still a strong company?

UnitedHealth Group has demonstrated resilience and market leadership in the healthcare sector through:

Market Leadership: Largest health insurer in the U.S. with over 50 million members

Diversified Business Model: Balanced portfolio across insurance and healthcare services

Integrated Care Delivery: Vertically integrated model through Optum's care delivery platforms

Strong Membership Growth: Consistent expansion across commercial and government programs

Technology Investment: Significant investments in healthcare technology and data analytics

Despite facing challenges in 2025, including the suspension and subsequent re-establishment of guidance, UnitedHealth Group has maintained its position as a dominant force in healthcare. The company experienced operational challenges in the first half of 2025 related to higher care trends but has outlined a "rigorous path back to being a high-performing company."

Efficiency of UNH

Metric

Q2 2025

Q2 2024

H1 2025

Medical Care Ratio

84-85%

82%

84%

Operating Cost Ratio

15-16%

14%

15%

Operating Margins

85-87%

86%

86%

Estimated based on available data

UNH Efficiency Metrics:

Medical Care Ratio: Increased to approximately 84-85% due to higher care utilization trends

Operating Cost Management: Maintained disciplined cost structure despite revenue growth

Administrative Efficiency: Continued focus on operational excellence and technology integration

The company has experienced some margin pressure in 2025 due to higher medical costs and care trends, but maintains strong operational fundamentals and has outlined plans to return to historical performance levels.

Strongest Moat of UNH

UnitedHealth Group maintains significant competitive advantages through:

Scale and Network Effects - Largest membership base providing negotiating leverage with providers

Vertical Integration - Integrated model spanning insurance, care delivery, and technology

Data and Analytics Capabilities - Extensive healthcare data assets through Optum platforms

Provider Network - Comprehensive network of healthcare providers and facilities

Technology Infrastructure - Advanced healthcare technology platforms and digital health solutions

Regulatory Expertise - Deep experience navigating complex healthcare regulations

Capital Allocation - Strong balance sheet enabling strategic investments and acquisitions

Revenue Distribution by Geography (2025)

United States: ~95% (Primary market focus)

International: ~5% (Brazil, Europe, and other markets)

UnitedHealth Group's revenue is primarily concentrated in the U.S. healthcare market, with limited but growing international exposure through select markets and partnerships.

General Finances of UNH

Metric

Q2 2025

Q2 2024

H1 2025

H1 2024

Revenue

$111.6B

$98.8B

$223.2B

$198.6B

Net Earnings

$3.74/share

$6.80/share

$10.18/share

$12.78/share

Adjusted Earnings

$4.08/share

$6.80/share

$11.52/share

$13.15/share

Cash Flow from Operations

$8.0B

$6.5B

$15.0B

$13.2B

Financial Health Indicators:

Ratio

2025

2024

Debt-to-Equity

~0.35

~0.33

Cash and Investments

~$35B

~$32B

UnitedHealth Group maintains a solid financial foundation with strong cash generation capabilities, though earnings per share declined in Q2 2025 due to higher medical costs and operational challenges.

Possible Growth Opportunities

Medicare Advantage Expansion The aging U.S. population presents significant opportunities for Medicare Advantage growth, with UnitedHealth Group well-positioned to capture market share through its comprehensive offerings.

Value-Based Care Continued expansion of value-based care arrangements through Optum's provider networks and technology platforms, enabling improved outcomes and cost management.

Digital Health Innovation Growing investments in digital health technologies, including telehealth, remote monitoring, and AI-powered healthcare solutions.

International Expansion Selective expansion in international markets, particularly in emerging economies with growing healthcare needs.

Healthcare Technology Continued development of healthcare technology solutions through Optum, including data analytics, workflow optimization, and care management platforms.

Pharmacy Integration Further integration of OptumRx with care delivery platforms to create comprehensive pharmacy and medical management solutions.

Risks

Regulatory and Political Environment

Healthcare Policy Changes: Potential changes in healthcare legislation affecting Medicare Advantage and ACA markets

Government Relations: Ongoing Department of Justice investigations into Medicare billing practices

Rate Regulation: Regulatory scrutiny of premium rates and medical loss ratios

Key Risk Factors:

Medical Cost Inflation affecting profitability across insurance segments

Competition from new entrants in health insurance and healthcare services markets

Cyber Security Risks given extensive healthcare data holdings

Provider Relations and potential conflicts with healthcare systems

Economic Recession Impact on employer-sponsored health plans

Technology Integration Challenges across acquisitions and platforms

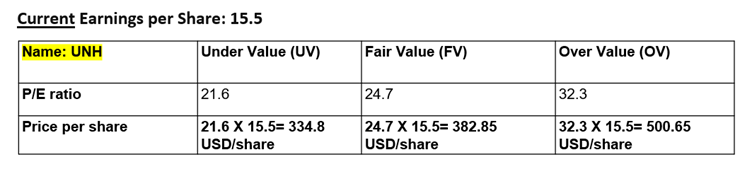

Valuation

Current Metrics (as of August 2025):

P/E Ratio: ~20-22x (based on forward earnings)

Price-to-Book: ~3.2x

Market Capitalization: ~$480 billion

Historical Context:

Stock has experienced volatility in 2025 due to operational challenges and guidance revisions

Trading at discount to historical multiples due to near-term headwinds

Valuation reflects concerns about medical cost trends and margin pressure

Investment Outlook

UnitedHealth Group represents a defensive healthcare play with long-term growth potential despite near-term challenges. The company's market leadership, diversified business model, and integrated care delivery platform provide competitive advantages in the evolving healthcare landscape.

However, investors should consider the current operational challenges, including elevated medical costs and the recent suspension of guidance, which indicate near-term headwinds. The company's commitment to returning to historical performance levels and earnings growth in 2026 suggests management confidence in addressing current issues.

Key Investment Considerations:

Market Leadership: Dominant position in U.S. health insurance with defensive characteristics

Diversification: Balanced revenue streams across insurance and healthcare services

Long-term Demographics: Favorable trends from aging population and healthcare digitization

Near-term Headwinds: Medical cost inflation and operational challenges requiring monitoring

Valuation Opportunity: Trading at discount due to temporary factors

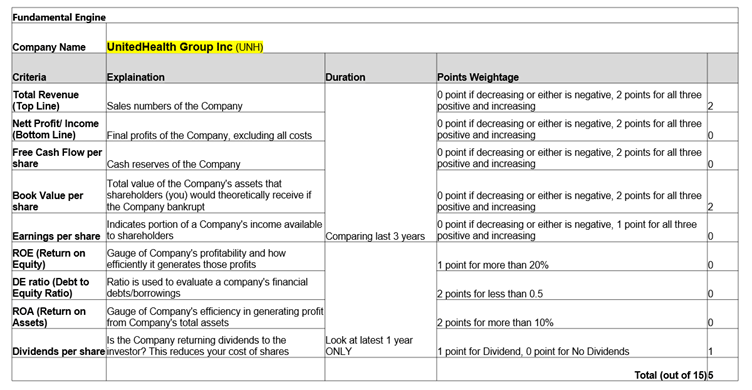

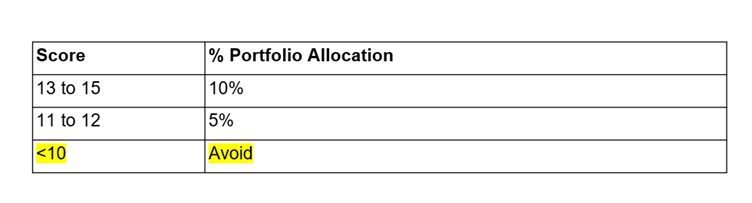

Kintsugi Analysis

(I) Fundamental Analysis Score: 5/15

(II) Portfolio Allocation

Avoid, Add to watchlist and wait for recovery

(III) Valuation

NOTE: We teach our fundamental analysis and valuation methods in our classes. Find out more here.

IMPORTANT DISCLAIMER: By reading this document, you agree that any information, commentary, recommendations or statements of opinion provided here are for general information and education purposes only.

The information contained in this publication are obtained from, or based upon publicly available sources that we believe to reliable, but we make no warranty as to their accuracy or usefulness of the information provided, and accepts no liability for losses incurred by readers using our case studies.

It is not intended to be financial advice, personalized investment advice or a solicitation for the purchase or sale of securities. Before purchasing any discussed securities, please be sure actions are in line with your investment objectives, financial situation and particular needs. Please do your own research and speak with a licensed advisor before making any investment decisions.

International investors may be subject to additional risks arising from currency fluctuations and/or local taxes or restrictions.

Please remember that investments can go up and down, including the possibility that a stock could lose all of its value. Past performance is not indicative of future results.