7 Things Every Investor Should Know about Fortinet

This stock dropped 26% in 1 day.

Dear Investor,

Zee here. On 7th August 2025, Fortinet (NASDAQ: FTNT) experienced a massive 26% single-day stock collapse on falling to $71.67, despite beating Q2 2025 earnings expectations.

The primary reason for the dramatic decline was investors had expected stronger future growth from hardware refresh cycles, but the company’s disclosure suggested this revenue driver was being exhausted faster than anticipated, and suggested fewer future upgrade opportunities.

This created concerns about future growth prospects despite the company’s otherwise solid financial performance in Q2 2025.

What does Fortinet do?

Fortinet is a cybersecurity company that helps protect businesses from hackers and cyber threats.

If a company’s computer network is like a building, Fortinet provides the locks, security cameras, alarm systems, and security guards to keep the bad guys out and protect valuable information inside.

The company essentially makes the digital equivalent of security systems that businesses need to stay safe online.

Main Products:

Firewalls - These are like digital security gates that control what internet traffic can enter or leave a company’s network

Security Software - Programs that detect and block viruses, malware, and cyber attacks

Network Security - They monitor and protect all the connections between computers, servers, and devices in a business

How They Make Money:

They sell physical security devices (hardware) like firewall boxes that companies install

They sell software licenses and subscriptions for security programs

They provide ongoing security services and support

Who Uses Them: Primarily businesses, government agencies, and organizations that need to protect their computer networks, data, and digital operations from cyber criminals.

The stock has been talked about rather often recently, lets unpack more…

1. Record-Breaking Financial Performance That Actually Matters

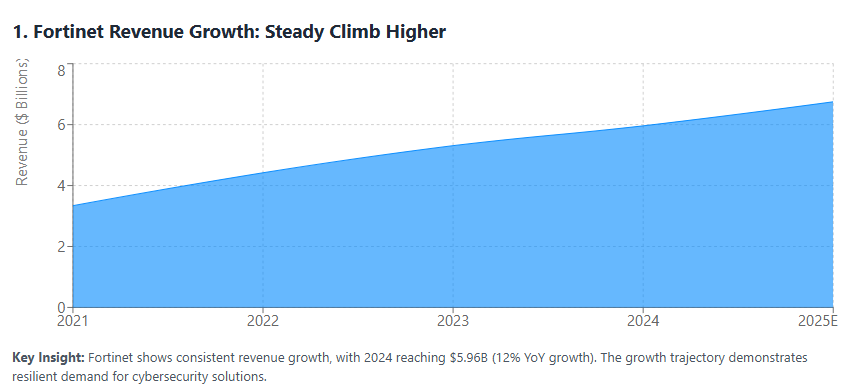

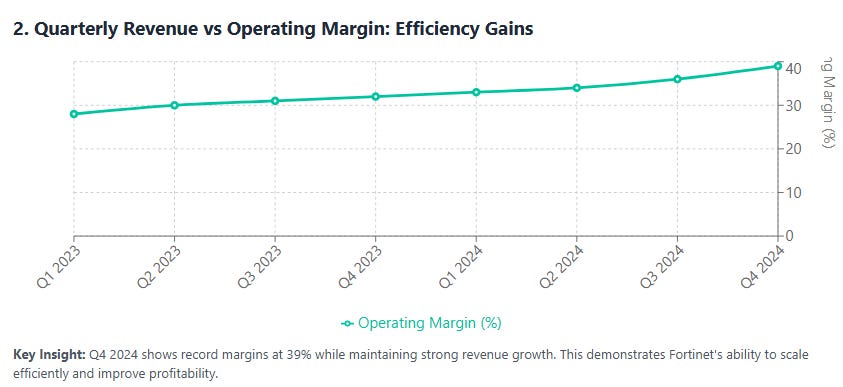

Fortinet just delivered numbers that would make any CFO smile. Fourth quarter 2024 revenue hit $1.66 billion, jumping 17% year over year, while their operating margins reached record levels at 35% for GAAP and 39% for non-GAAP metrics.

But here’s what’s really interesting: total revenue grew 12% for the full year 2024, showing consistent growth even in a challenging economic environment. This isn’t just about top-line growth, the company is getting more efficient at turning revenue into profit, which is exactly what you want to see from a maturing tech company.

Think of it this way: Fortinet is like that reliable friend who keeps getting promotions at work. They’re not just growing bigger, they’re growing smarter.

2. AI Integration That’s More Than Just Buzzwords

While every tech company seems to be throwing around AI buzzwords these days, Fortinet is actually doing something meaningful with it. In November 2024, the company expanded its generative AI capabilities with new additions that help accelerate threat coverage analysis and streamline security investigations.

Their FortiAI platform is embedded within their security fabric to proactively defend against emerging threats, enabling rapid detection and response while automating security operations. This isn’t just about adding AI features for marketing purposes—it’s about making their core cybersecurity products genuinely better at stopping bad guys.

In a world where cyber threats are getting more sophisticated by the day, having AI that can think faster than hackers is like having a security guard who never sleeps and gets smarter every day.

3. SASE Growth That’s Changing the Game

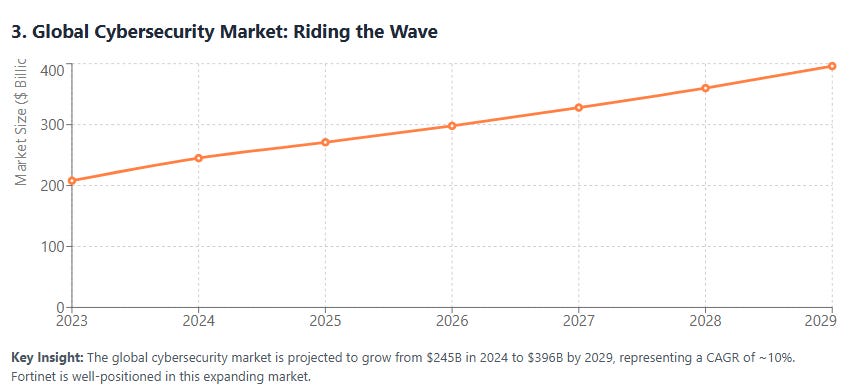

Here’s where things get really interesting for long-term investors. Fortinet’s Unified SASE (Secure Access Service Edge) Annual Recurring Revenue grew 28%, which is a fancy way of saying their cloud-based security services are taking off like a rocket.

SASE represents the future of cybersecurity instead of having separate tools for network security and remote access, companies get everything in one cloud-based package. As more businesses embrace remote work and cloud computing, this market is expected to explode over the next few years.

4. Trust Recognition That Money Can’t Buy

Sometimes the most valuable developments aren’t on a balance sheet. Fortinet was recognized as No. 7 on Forbes’ Most Trusted Companies in America 2025 list making them the most trusted U.S.-based cybersecurity company.

In an industry where trust is everything, this kind of recognition is pure gold. It’s like being voted the most trusted mechanic in town, once you have that reputation, customers keep coming back and telling their friends.

5. Legal developments to monitor

There’s an ongoing class action lawsuit against Fortinet, with investors. The specific allegations are that Fortinet and some of its executives made misleading statements about how profitable a planned “upgrade/ refresh cycle” for its FortiGate firewall products would be, and hid facts about how many units could actually be upgraded.

On August 6, 2025, Fortinet disclosed in its quarterly results that it was already 40–50% through the upgrade cycle, admitted uncertainty about how many units could be upgraded, and revealed that the refresh might not have as large an impact as earlier statements indicated.

After those disclosures, the company’s stock price dropped, which is a key part of the lawsuit’s claim: that investors lost money because they relied on misleading statements.

While legal issues can be concerning, they’re also common for large publicly traded companies. The key is monitoring whether these issues affect the company’s core business operations or are more about stock price volatility and investor expectations.

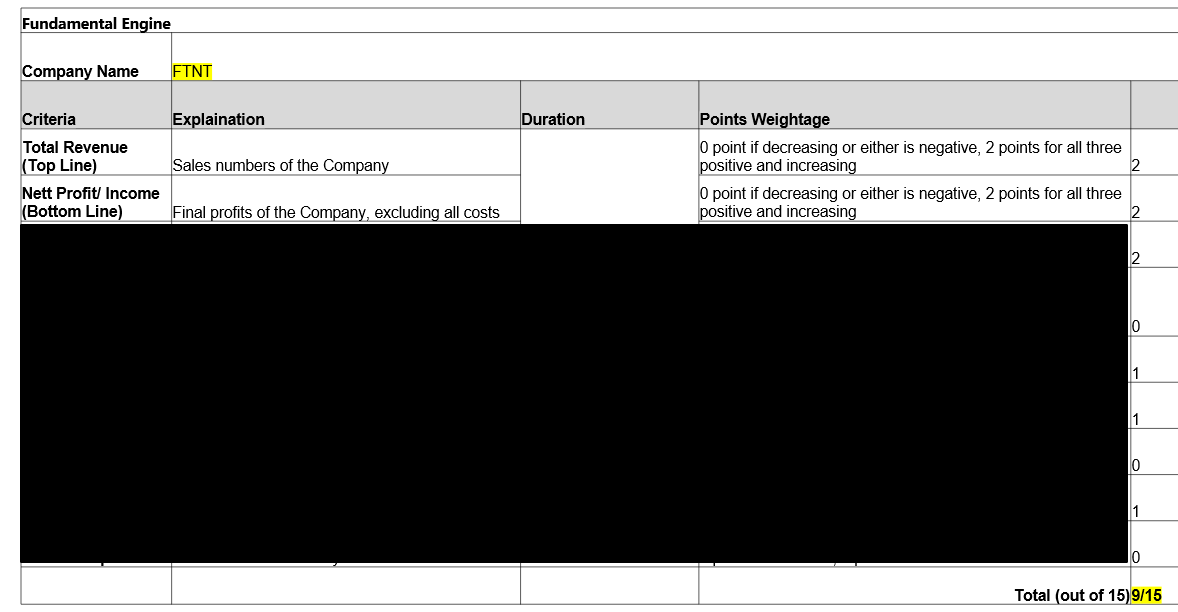

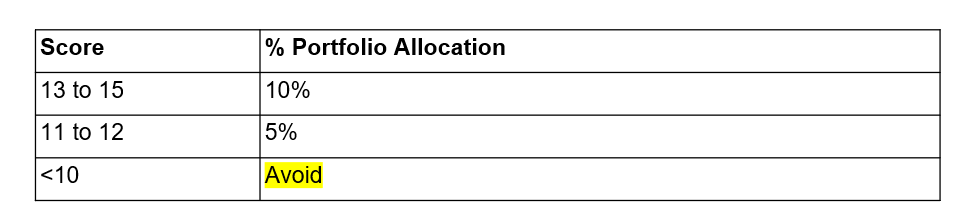

6. Fundamental Analysis

Based on our Fundamental Engine-15 test, we deduce that:

7. Valuation

Bottom line

Given the mix of strengths and risks, here is my take:

Moderate risk / moderate reward: Possible upside if Fortinet can convincingly articulate its next growth driver beyond hardware refreshes (e.g. growth in services, software, cloud security, AI tools). But the danger is that investors may expect too much on the hardware side and get disappointed.

Catalysts to watch:

How fast service/subscription revenue grows?

Billings (a forward indicator) and guidance in upcoming quarters.

New product launches or expansions (e.g. in SASE, zero trust, AI security).

Macro & IT spending environment: if enterprises tighten budgets, security might get delayed or cut.

Competitive moves and technology disruption (e.g. new entrants, shifts in cloud-native security).

NOTE: We teach our fundamental analysis and valuation methods in our classes. Find out more here.

IMPORTANT DISCLAIMER: By reading this document, you agree that any information, commentary, recommendations or statements of opinion provided here are for general information and education purposes only.

The information contained in this publication are obtained from, or based upon publicly available sources that we believe to reliable, but we make no warranty as to their accuracy or usefulness of the information provided, and accepts no liability for losses incurred by readers using our case studies.

It is not intended to be financial advice, personalized investment advice or a solicitation for the purchase or sale of securities. Before purchasing any discussed securities, please be sure actions are in line with your investment objectives, financial situation and particular needs. Please do your own research and speak with a licensed advisor before making any investment decisions.

International investors may be subject to additional risks arising from currency fluctuations and/or local taxes or restrictions.

Please remember that investments can go up and down, including the possibility that a stock could lose all of its value. Past performance is not indicative of future results.