August is seasonally a down month (Packed with Opportunities)

August weakness: Use it as an opportunity, not panic.

Dear Investors,

Zee Here. As an Investor for more than 20 years, I’ve learned something over the years sometimes, the best opportunities show up when things feel the most uncertain.

August tends to be one of those months. It’s often volatile, unpredictable, and packed with scary headlines. But if you take a step back, it’s also a time when patient investors can find some of the best entry points into quality index funds like SPY and QQQ. In this 3rd piece, I want to walk you through why August matters, how to prepare, and what I’d be doing if I were you.

Lets go!

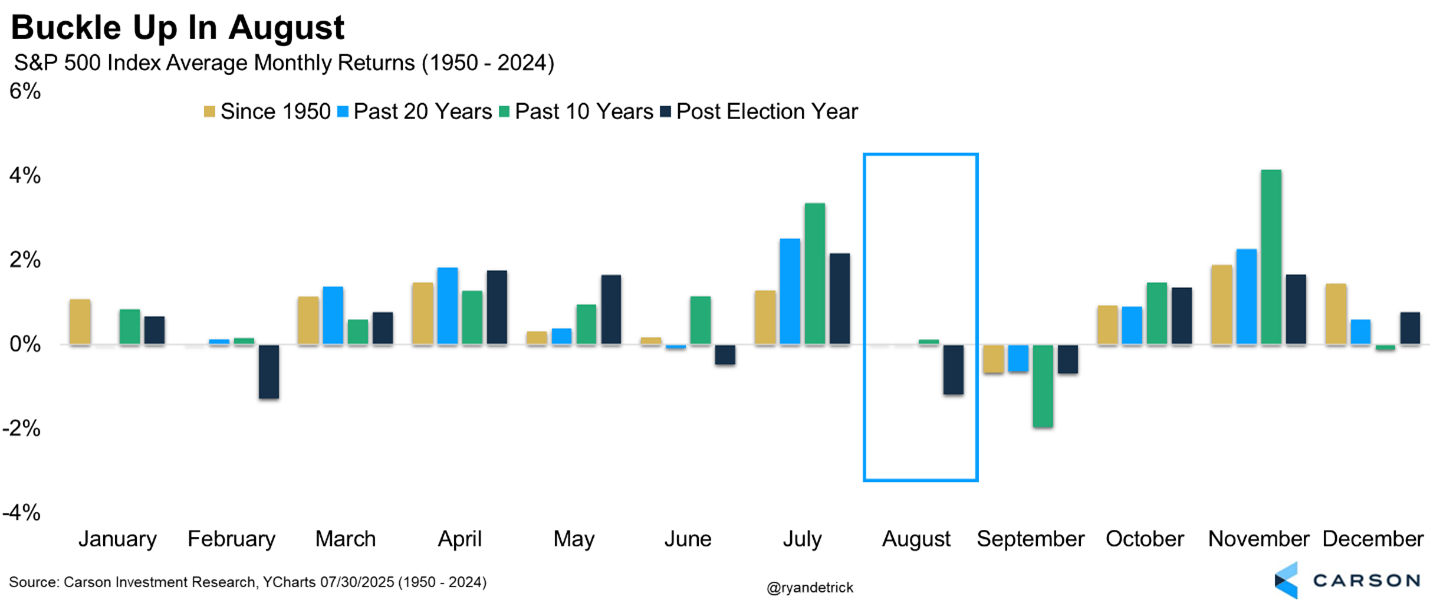

If the stock market had a personality, August to September traditionally would be a down market. We’ve seen it happen too many times to ignore.

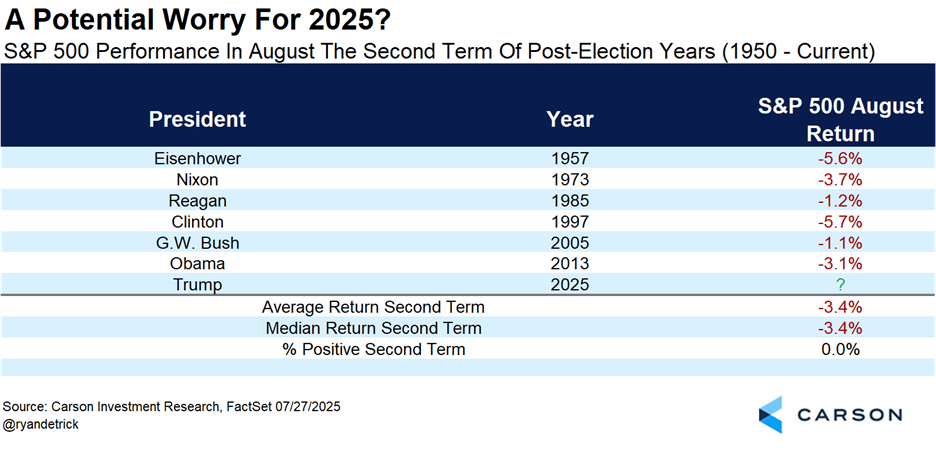

In fact, it’s almost tradition at this point. August hasn’t been higher under a second term President in a post-election year back to when Eisenhower was in office, down six times in a row.

Remember Last August?

Stocks fell more than 1% on just the first Thursday and Friday. Then, as if that wasn’t enough, Sunday night delivered a nasty surprise, Japan’s market tanked (its worst day since 1987’s crash), and US futures followed suit, dropping sharply.

By Monday, the VIX (Wall Street’s fear gauge) spiked to 50. That’s not a typo—50. Stocks dropped 3% in a single day. That’s one of the worst days we’ve had in years.

And yet, here's the twist: stocks actually ended the month higher.

If you lived through that week, you probably remember the gut-wrenching fear. But you also remember the snapback recovery. That’s August in a nutshell—volatility with a chance of redemption.

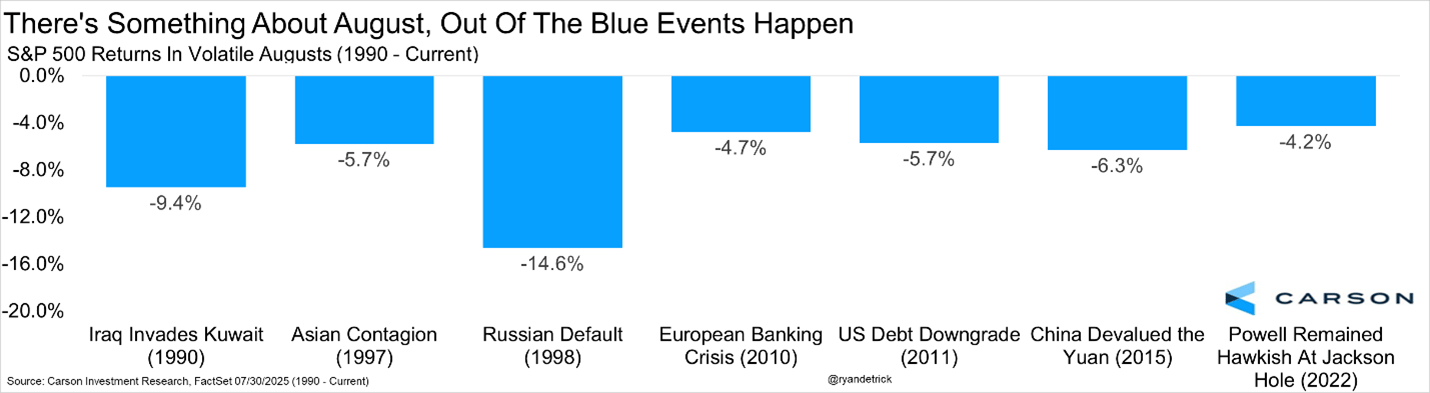

The August Effect: It’s Not Just in Your Head

Since 1990, August has developed a reputation for being a little dramatic.

Big headlines. Big moves. Most of them? Not good.

And historically, August is the third worst month for the stock market going back to 1950. In post-election years, it’s even worse—only February tends to be uglier.

We’re not saying this bull market is over. In fact, we’re still optimistic for the rest of the year. But we are saying: August is rarely quiet.

So, Should You Panic?

Short answer: No.

Long answer: Also no. But you should have a plan.

August volatility isn’t a signal to retreat. It’s a signal to prepare. If the market dips, especially if driven by fear or headlines (not fundamentals), it could be a buying opportunity—especially if you're looking at long-term investments.

Let’s be honest. You don’t get discounts in calm, euphoric markets. You get them when everyone else is looking for the exit.

Why This August Might Be a Good Time to Invest (Yes, Really)

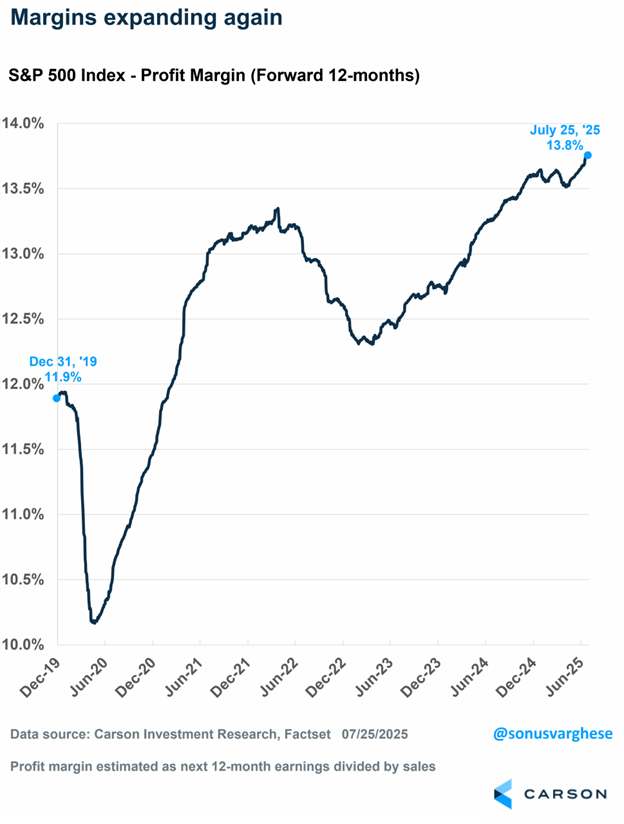

Here’s the good news that often gets buried beneath scary headlines: Earnings are strong. Profit margins are rising.

Out of the roughly 370 companies in the S&P 500 that have already reported this reporting season, more than 81% have beaten expectations, according to FactSet.

Earnings are hitting record levels and profit margins are hitting new cycle highs.

If August delivers a dip, especially in the indexes like the S&P 500 (eg. SPY) or the Nasdaq 100 (eg. QQQ), that could be your last moment in 2025 to step in.

Both indexes have had tremendous runs, especially QQQ, which has outpaced SPY in many recent bull cycles. But both can also be volatile, particularly during uncertain months like August. If prices dip due to fear (not failing fundamentals), it’s like buying a high-quality company at a discount.

As Warren Buffett said: “Be fearful when others are greedy, and greedy when others are fearful.”

If August fear gives you even a 3 to 5% discount on SPY or QQQ, that could compound beautifully over the next 3 to 5 years.

The Bottom Line

August has a track record of being chaotic, but chaos isn’t always a bad thing. Sometimes it shakes out the weak hands. Sometimes it offers the long-term investor a golden opportunity to rebalance, reinvest, or even double down.

This isn’t the time to panic. It’s the time to stay calm, stay focused, and stick to your trade plan.

P.S. Need a trade plan, check out our affordable programs here to kick start, a potentially last moment in 2025 to invest cheap.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.