BREAKING🚨: How will U.S. government shutdown affect your portfolio?

Wall Street vs. Washington: Who Really Wins?

Dear Investor.

Its official: The US Government has shutdown on 1st October 2025.

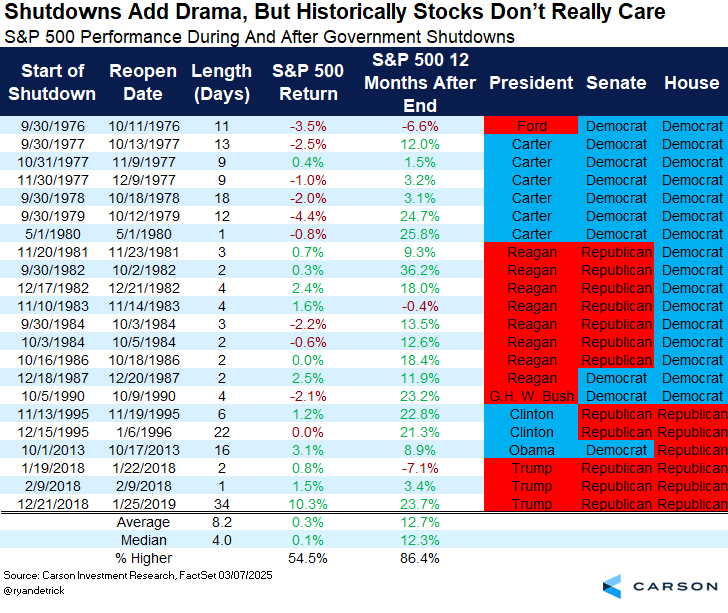

But history tells a very different story. In fact, the S&P 500 has risen 12.7% on average in the 12 months after a shutdown.

Lets unpack.

First Why the shutdown?

(i) The U.S. government needs Congress to agree on a budget each year to pay for things like health care, defense, and federal workers.

(ii) Congress couldn’t agree on the new budget before the deadline.

(iii) Republicans and Democrats were stuck on issues like:

whether to cut or extend health care subsidies,

how much to spend on foreign aid, and other funding priorities.

(iv) Since no deal was reached, the money stopped flowing, and many parts of the government had to shut down until they can agree.

In short, They couldn’t agree on how to spend the money, so the government ran out of legal authority to pay for itself and had to shut down.

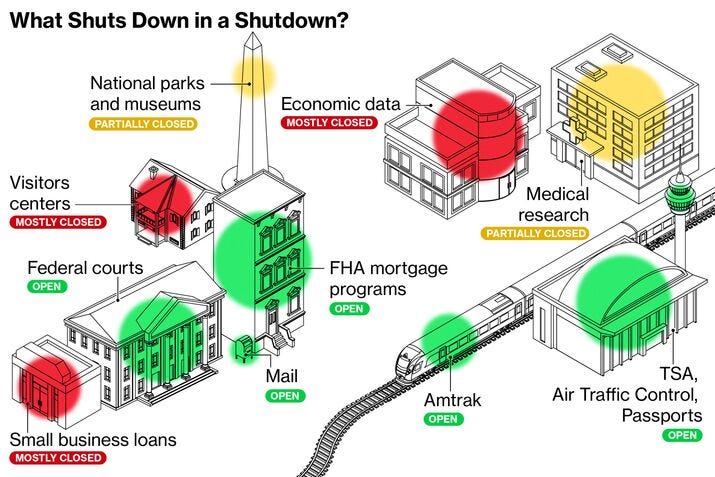

Here’s what will happen in a shut down:

Important services (like police, military, and hospitals) will keep running, but many other government services will stop. Federal workers may face late or missed paychecks.

No official economic updates will be released. Reports like inflation (CPI), jobs numbers, and unemployment data will be paused. This makes it harder for the Federal Reserve to know how the economy is doing.

Millions of government employees and contractors won’t get paid during the shutdown.

The economy takes a hit: Every week the government stays shut, U.S. economic growth is expected to shrink by about 0.1% for that quarter.

How does the shutdown affects the stock markets?

The table below shows that during past 22 government shutdowns, stocks usually moved only a little at the time. But a year later, in 19 out of 22 cases, the market was higher, on average about 13% up.

Of course, every situation is different, and we’re not saying you should invest based on what the government does.

The key takeaway is: don’t stress too much about your investments just because of political gridlock in Washington.

Fundstrat’s data science team compiled how past government shutdowns impact markets. Below you would find a full chronological list since 1976, with S&P 500 index returns before and after the government shutdown:

On average, shutdowns last about 9 days. They cause big news headlines and make other countries question how the U.S. runs things, but they usually don’t have much effect on the stock market before, during, or after.

Bottom line

While shutdowns create headline risk and leave foreign governments perplexed over U.S. policy-making practices and procedures, the shutdowns themselves have little impact on markets.

Sidenote: Next Tuesday (7th Oct), at 830pm (GMT+8), We’re breaking down a stock that we’re studying as an opportunity live on Zoom, using the same methods we apply in our own investing.

We’ll also he sharing more about our investing course that has helped over 2000+ students (to date) achieve their goals. No fluff, just clear insights you can use.

Sign up for free here

Disclaimer: All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.