Confessions of Fund Manager Part 2

Smart Money: is it really smart?

On 28 Oct, we’ll be conducting a live webinar on “How to Invest in 2026, and Our Outlook for the Year Ahead.”. We’ll also break down a stock that’s recently dropped but may be setting up for a turnaround.

Dear Investor.

Zee here. You’ve heard it a thousand times: “Follow the smart money.” The institutional investors, the hedge fund titans, the venture capital legends who seem to predict every market move before it happens. They’re operating with insider knowledge, sophisticated algorithms, and armies of analysts, so surely they must know something we don’t, right?

Not true.

Truth: Smart money makes plenty of dumb moves.

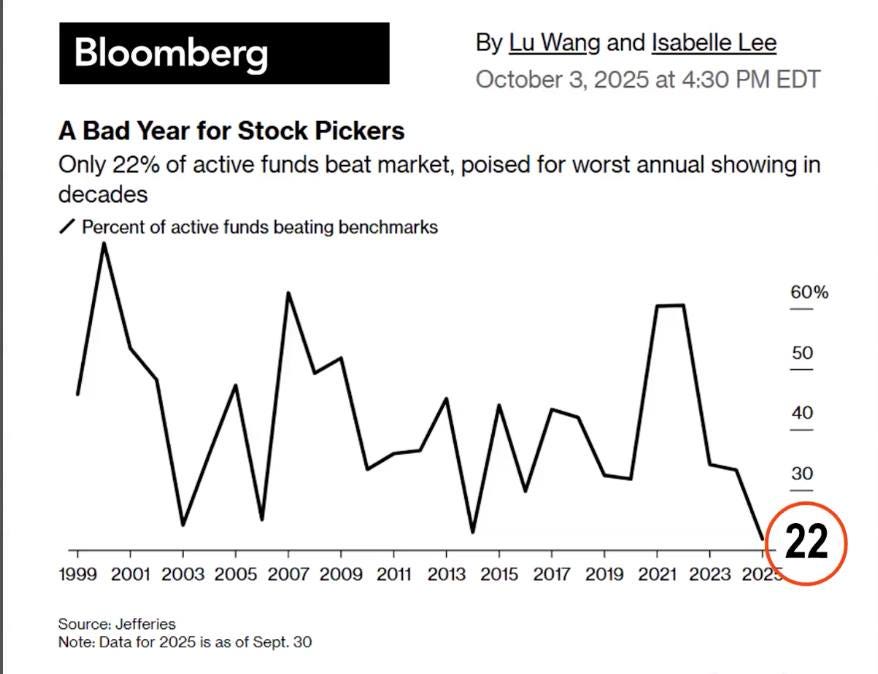

This year only 22% of active funds beat the S&P500, one of the worst results.

In this 2nd part series finale, I am pulling back the curtain on one of investing’s most persistent myths by sharing how Warren Buffet proved this.

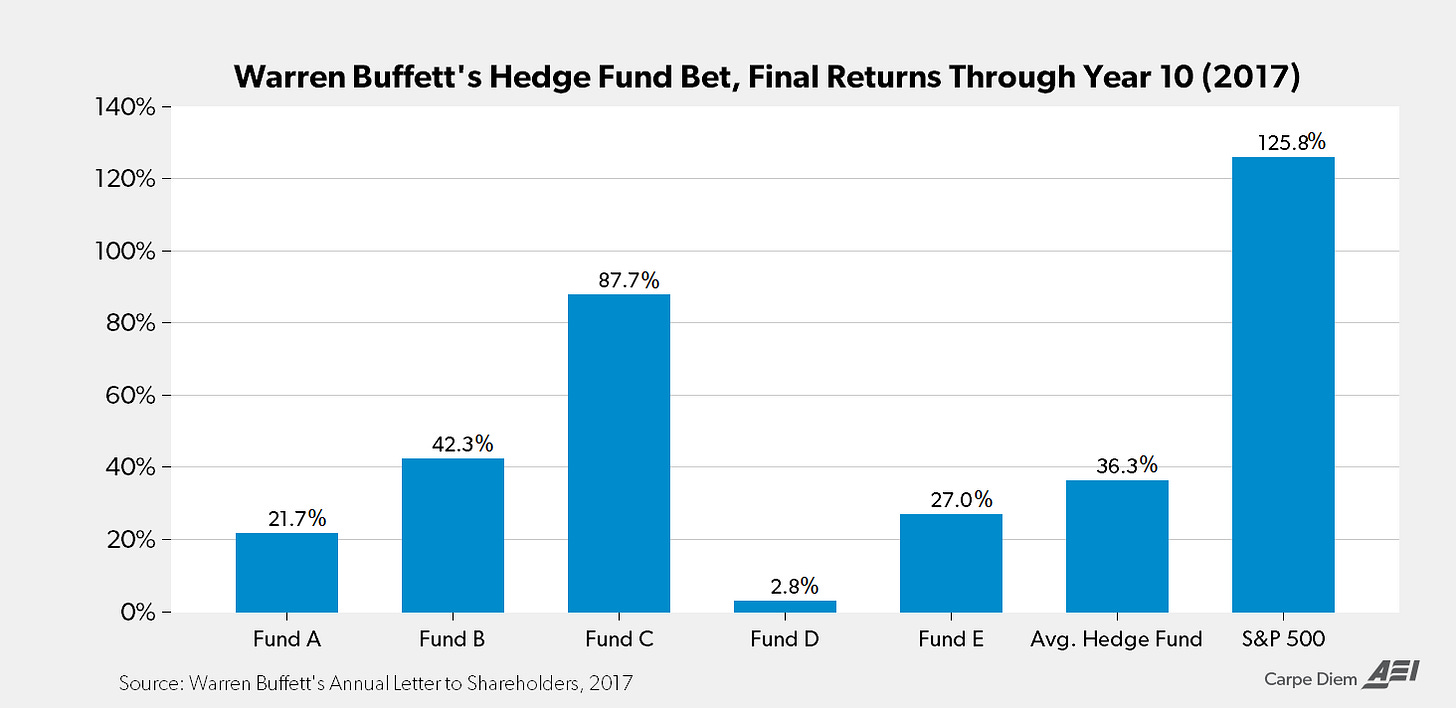

The Warren Buffett Challenge: The Bet of the Decade

In 2008, Warren Buffett, one of history’s greatest investors, and our “North Star Investor” made a bold public wager that shows exactly why this matters.

The Setup

Buffett bet $1 million that a simple S&P 500 index fund would outperform a collection of hedge funds over 10 years.

Protégé Partners, a fund of hedge funds, took the other side, selecting five hedge funds they believed would win.

The Stakes

The winner’s charity would receive $1 million USD. But more importantly, this would settle the debate: Can active management justify its high fees?

The Rules

Buffett’s pick: Vanguard S&P 500 Index Fund

Protégé’s picks: Five hedge funds (names kept confidential)

Timeline: January 1, 2008 to December 31, 2017

The Results

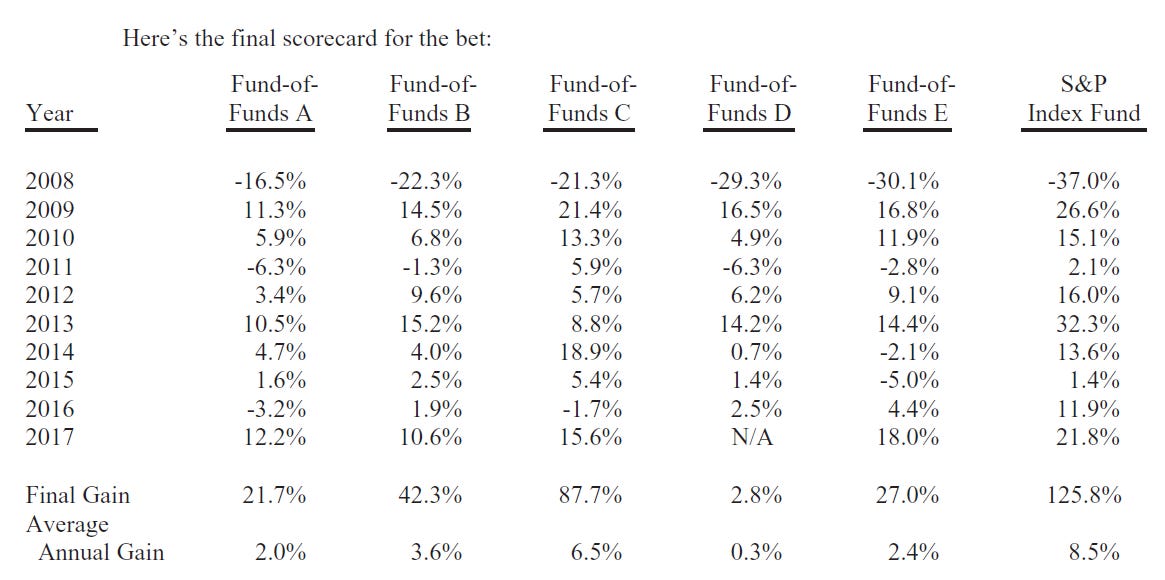

It wasn’t even close:

Index Fund (Buffett): 125.8% total return (7.1% annually)

Hedge Funds (Protégé): 36.3% average return (2.9% annually)

The index fund more than tripled the hedge fund returns!

What Happened?

The hedge funds had smart managers, sophisticated strategies, and exclusive access to deals. But they couldn’t overcome:

High management fees (2% of assets annually)

Performance fees (20% of profits)

Trading costs

The difficulty of consistently beating the market

As Buffett explained: “When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.”

The Real-World Lesson

The data backs up Buffett’s point. Studies consistently show:

Over 15 years, about 90% of actively managed funds fail to beat their benchmark index

The few that do beat the market rarely do so consistently

Past performance doesn’t predict future success

So, Which Should You Choose?

Index Funds

Think of an index fund as buying a slice of the entire market. It automatically tracks a market index (like the S&P 500) by owning all the companies in that index. No fund manager is picking stocks, it’s completely automated.

Key Features:

Low fees (typically 0.03% to 0.20% per year)

Follows the market, no attempts to beat it

Minimal trading, which means lower costs

Transparent, you always know what you own

Managed Funds (Unit Trusts)

These funds employ professional managers who actively pick stocks they believe will outperform the market. You’re paying for their expertise, research team, and trading activity.

Key Features:

Higher fees (typically 1% to 2.5% per year, plus performance fees)

Aim to beat the market through stock selection

Active trading based on manager decisions

Less transparent—holdings may change frequently

Why Fees Matter More Than You Think

Let’s say you invest $100,000 over 30 years with an average 8% annual return:

Index fund (0.10% fee): Your investment grows to $986,000

Managed fund (2% fee): Your investment grows to $574,000

That’s a difference of over $400,000, just from fees! Even if the managed fund delivers the same returns before fees, you keep far less of the profits.

Consider an Index Fund if:

You want low costs and simplicity

You’re investing for the long term (10+ years)

You believe markets are generally efficient

You want to match market returns (which are quite good!)

Consider a Managed Fund if:

You have access to truly exceptional managers with proven long-term records

You’re investing in less efficient markets (small caps, emerging markets)

You understand you’re betting against the odds

You can afford the higher fees without stress

The Bottom Line

Warren Buffett’s advice for most investors is simple: “Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund.”

You don’t need to beat the market to build wealth. You just need to stay in the market, keep costs low, and let compound growth work its magic.

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns. How we invest may not suit your investment goals and risk management profile.