CrowdStrike Holdings Inc. (US: CRWD) Stock Analysis

Updated November 2025

Company Profile

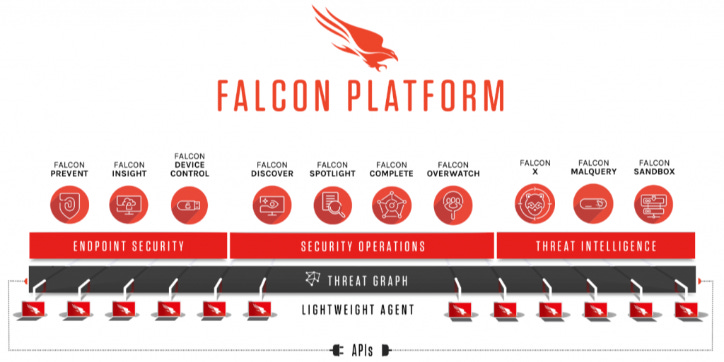

CrowdStrike Holdings Inc. is an American multinational cybersecurity technology company founded in 2011 and headquartered in Austin, Texas. The company went public in 2019 and has established itself as a leader in cloud-native endpoint security solutions. CrowdStrike provides cybersecurity services through its proprietary Falcon platform, which leverages artificial intelligence and machine learning to detect, prevent, and respond to cyber threats in real-time.

The company operates through a Software-as-a-Service (SaaS) model, offering endpoint detection and response (EDR), managed threat hunting, and cyberattack response services. CrowdStrike serves customers across various sectors including enterprise, government, and small-to-medium businesses, with over 29,000 subscription customers globally as of January 2025.

CrowdStrike’s Falcon platform is built on a single lightweight agent architecture that provides comprehensive cybersecurity coverage including endpoint protection, threat intelligence, managed hunting services, and incident response capabilities. The platform’s cloud-native design allows for rapid deployment, real-time updates, and scalable protection across diverse IT environments.

Business Segments

Endpoint Protection:

Falcon Prevent (Next-Generation Antivirus)

Falcon Device Control

Falcon Firewall Management

Threat Intelligence & Hunting:

Falcon Intelligence

Falcon OverWatch (Managed Hunting)

Falcon Intelligence Premium

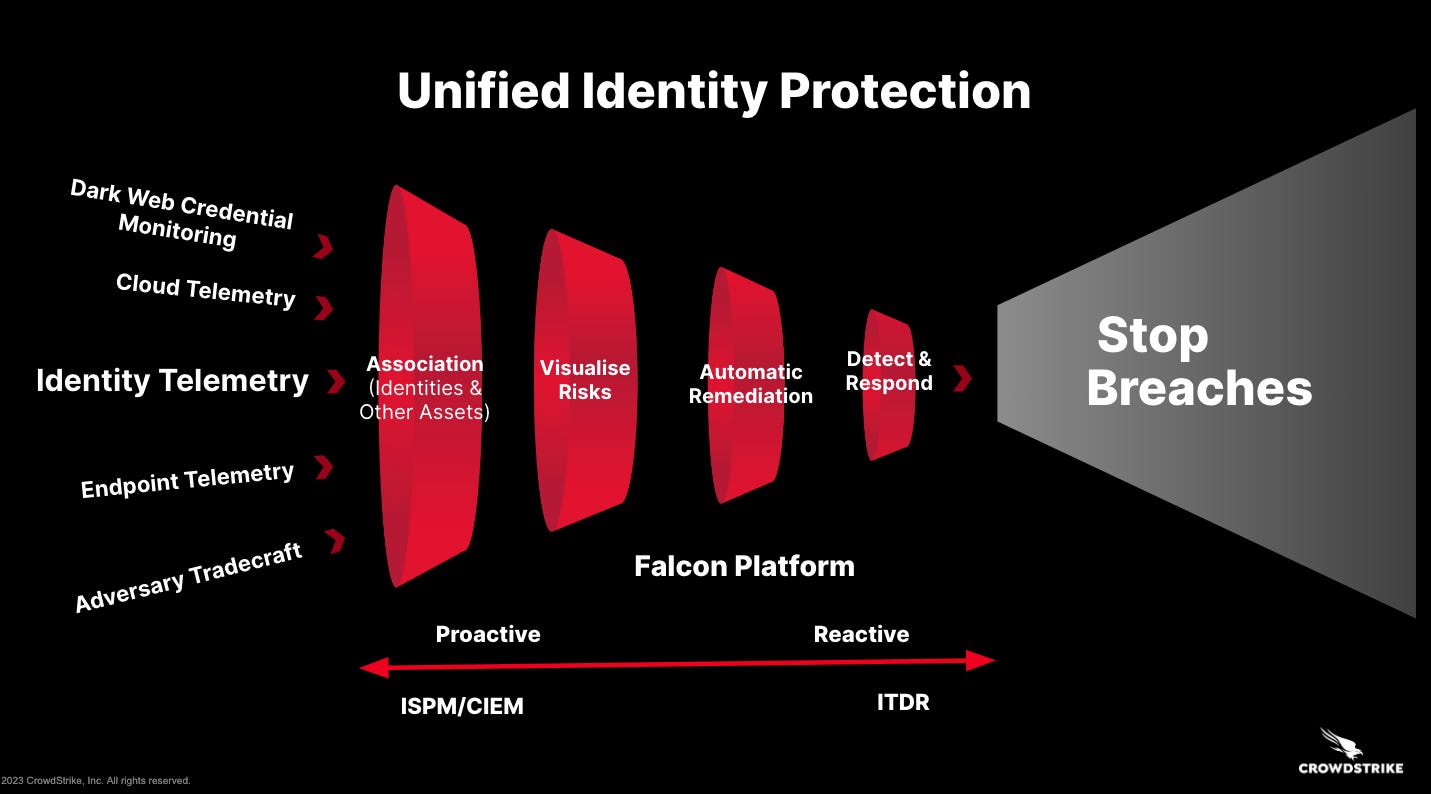

Identity Protection:

Falcon Identity Threat Detection

Falcon Identity Protection for Microsoft Entra ID

Cloud Security:

Falcon Cloud Security

Falcon Horizon (Cloud Security Posture Management)

Falcon Container Security

Data Protection & Compliance:

Falcon Data Protection

Falcon Exposure Management

Falcon Next-Gen SIEM

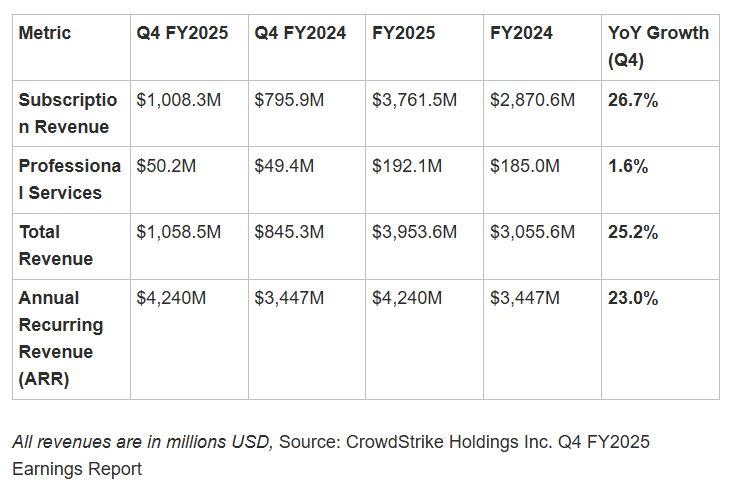

Business Segments & Revenue

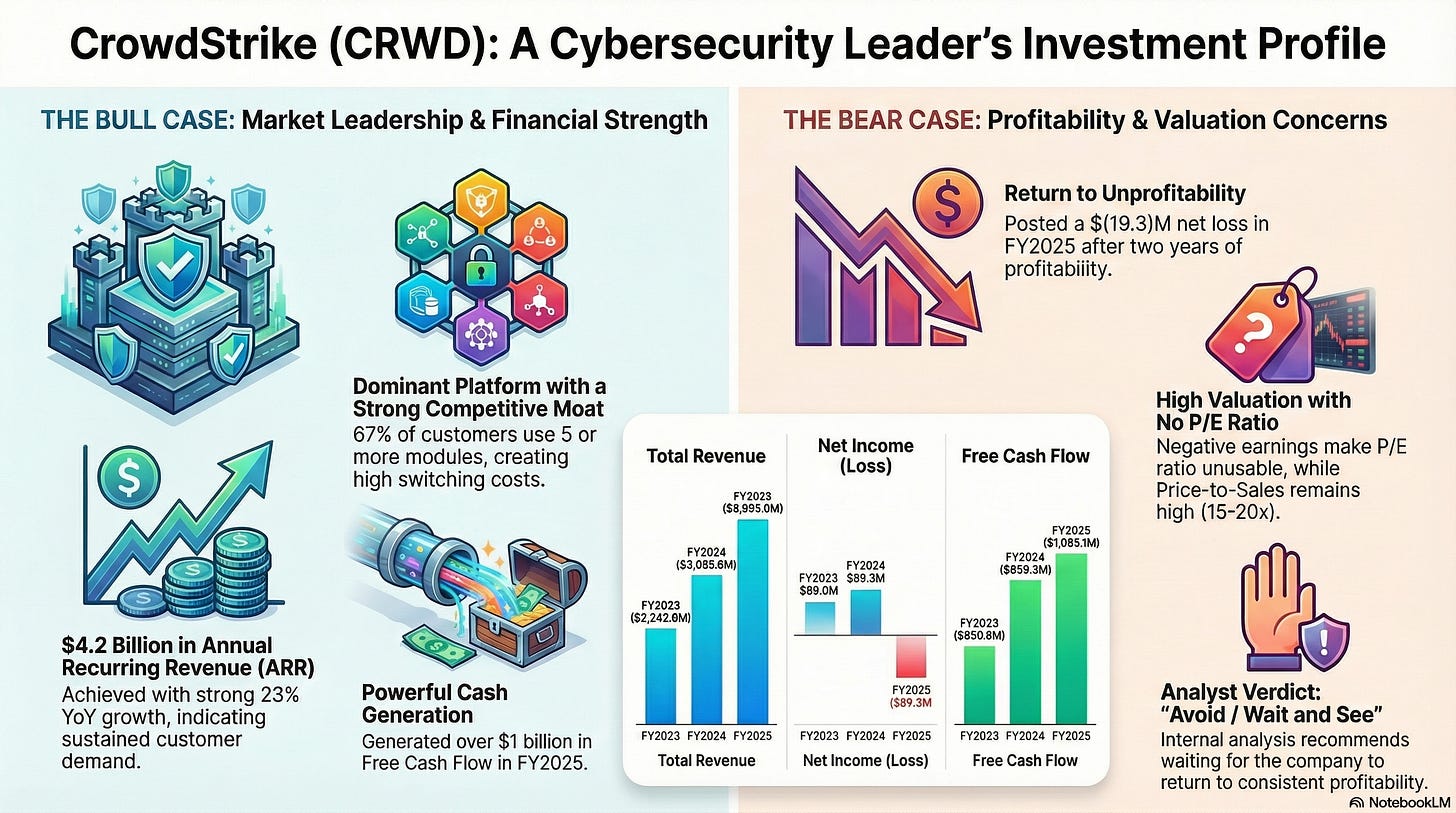

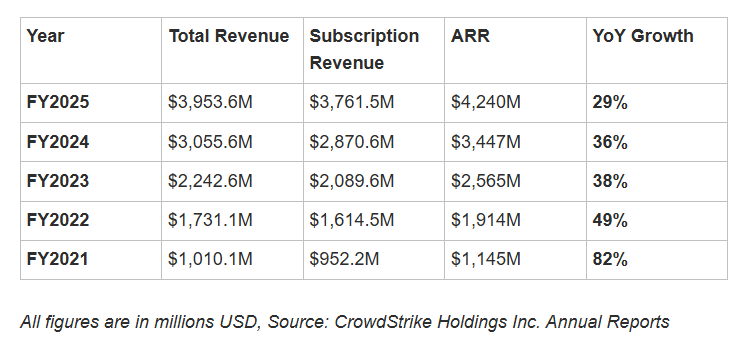

The table shows strong growth across all revenue segments, with subscription revenue representing approximately 95% of total revenue. The company achieved a significant milestone of surpassing $4 billion in ARR, making it the fastest pure-play cybersecurity company to reach this threshold. Professional services revenue showed modest growth as the company continues to focus on its high-margin subscription model.

Historical Revenue Performance

CrowdStrike has demonstrated consistent high-growth trajectory over the past five years, with revenue growing from approximately $1 billion in FY2021 to nearly $4 billion in FY2025. While growth rates have moderated from the extreme highs of earlier years, the company continues to maintain strong double-digit growth well above industry averages.

Financial Performance Highlights

FY2025 Key Metrics:

Gross Margin (Subscription): 78% (GAAP), 80% (Non-GAAP)

Operating Cash Flow: $1.38 billion (+18% YoY)

Free Cash Flow: $1.07 billion (+14% YoY)

Free Cash Flow Margin: 27%

Non-GAAP Operating Margin: 21%

Customer Metrics:

Total Customers: 29,000+ subscription customers

Dollar-Based Gross Retention Rate: 95%+

Module Adoption: 67% of customers use 5+ modules

Is CrowdStrike Still a Strong Company?

CrowdStrike maintains its position as a cybersecurity leader for several key reasons:

Competitive Advantages:

Platform Approach: Single-agent architecture providing comprehensive security coverage

AI/ML Innovation: Leading-edge artificial intelligence and machine learning capabilities

Cloud-Native Design: Built for modern IT environments and rapid deployment

Strong Customer Loyalty: Industry-leading retention rates and expanding module adoption

Market Position: The company has successfully navigated challenges including the July 2024 system outage that affected global operations. Despite this incident, CrowdStrike demonstrated resilience by maintaining customer relationships and continuing to grow its business. The company’s quick response, transparency, and remediation efforts helped preserve trust with enterprise customers.

Operational Excellence: CrowdStrike achieved record financial performance in FY2025 with exceptional cash flow generation, demonstrating the strength of its subscription model. The company’s ability to maintain high gross margins (80% non-GAAP subscription gross margin) while scaling operations shows operational efficiency and pricing power.

Financial Efficiency Analysis

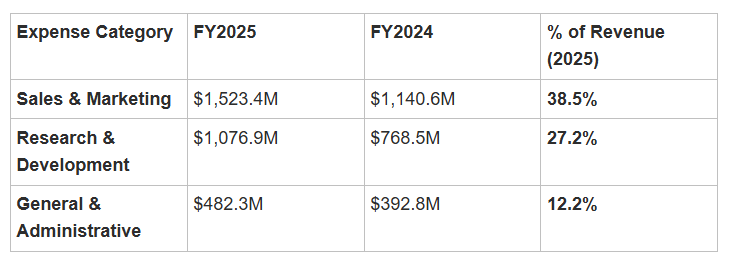

CrowdStrike Expense Ratios:

Sales & Marketing: 32% (Non-GAAP)

Research & Development: 19% (Non-GAAP)

General & Administrative: 6% (Non-GAAP)

CrowdStrike maintains disciplined expense management while continuing to invest heavily in growth. The company’s sales and marketing efficiency, measured by the “Magic Number” (revenue growth per dollar of sales spend), demonstrates strong return on marketing investments.

Strongest Competitive Moat

Multi-Module Platform Strategy: CrowdStrike’s primary competitive advantage lies in its unified platform approach, where customers increasingly adopt multiple security modules. With 67% of customers using 5 or more modules, the platform creates strong switching costs and increases customer lifetime value.

Data Network Effects: The Falcon platform benefits from network effects, where each new customer and endpoint adds to the collective threat intelligence, making the platform more effective for all users. This creates a virtuous cycle of improvement and customer value.

Technology Leadership: The company’s investment in AI/ML capabilities, including the recent launch of Charlotte AI Detection Triage, maintains its technological edge in an increasingly competitive market.

Geographic Revenue Distribution

CrowdStrike generates revenue globally with strong presence in North America, Europe, and Asia-Pacific regions. The company has been expanding internationally, with particular focus on European and Asian markets as cybersecurity awareness and regulatory requirements increase globally.

Financial Position

Balance Sheet Strength:

Current Ratio: 1.77 (strong liquidity position)

Debt-to-Equity: 0.22 (conservative debt levels)

Total Cash: $4.3+ billion (strong financial position)

CrowdStrike maintains an exceptionally strong balance sheet with over $4.3 billion in cash and minimal debt. This financial strength provides significant flexibility for investments, acquisitions, and weather potential economic downturns.

Growth Opportunities

Expanding Cybersecurity Market: The global cybersecurity market is projected to grow at approximately 12-15% CAGR through 2030, driven by increasing cyber threats, regulatory requirements, and digital transformation initiatives.

AI-Powered Security: CrowdStrike’s investment in artificial intelligence and automation positions the company to capitalize on the next generation of cybersecurity needs, including autonomous threat detection and response capabilities.

Identity Security: The growing market for identity protection presents significant expansion opportunities, particularly with CrowdStrike’s recent enhancements to Falcon Identity Protection.

Cloud Security: As organizations continue cloud migration, CrowdStrike’s cloud-native approach and comprehensive cloud security offerings position the company for continued growth.

International Expansion: Significant opportunities remain in international markets, particularly in Europe and Asia-Pacific, where cybersecurity spending is accelerating.

Key Risks

Competitive Landscape: The cybersecurity market is highly competitive with both established players and emerging startups. Key competitors include Microsoft (growing security portfolio), SentinelOne, Palo Alto Networks, and traditional players like Symantec.

Technology Risk: The July 2024 system outage highlighted the risks of providing critical infrastructure services. While CrowdStrike handled the incident professionally, future operational issues could impact customer confidence.

Market Saturation: As the company grows larger, maintaining high growth rates becomes increasingly challenging, and the addressable market may become more saturated over time.

Economic Sensitivity: While cybersecurity spending is generally resilient, prolonged economic downturns could lead to budget constraints and delayed purchasing decisions.

Valuation Metrics

Current Trading Multiples (as of latest data):

Price-to-Sales (P/S): ~15-20x

EV/Revenue: ~14-18x

Price-to-Free Cash Flow: ~25-30x

Growth Metrics:

Revenue Growth (3-Year CAGR): ~40%

ARR Growth: 23% (latest quarter)

Free Cash Flow Growth: 14% (latest year)

Investment Considerations

Fundamental Strengths:

Market-leading cybersecurity platform

Strong financial performance and cash generation

Expanding customer base with high retention

Technological innovation and AI leadership

Conservative balance sheet management

Growth Profile: CrowdStrike continues to demonstrate strong growth characteristics with expanding market opportunities, though investors should expect growth rates to moderate from historical highs as the company scales.

Risk Assessment: While the company faces competitive and operational risks, its market position, financial strength, and continued innovation suggest it remains well-positioned for long-term success in the growing cybersecurity market.

Investment Outlook

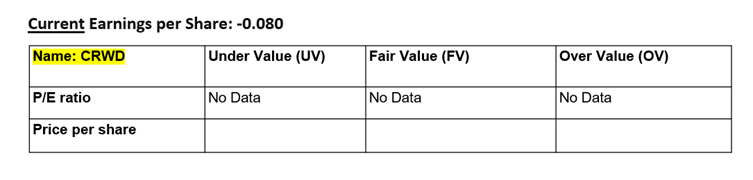

CrowdStrike represents a high-quality growth company in the expanding cybersecurity sector. The company’s platform approach, financial strength, and market leadership position it well for continued growth, though valuation considerations and competitive dynamics require careful evaluation for potential investors. However, the company is back to losses from profitability.

Key Monitoring Metrics:

ARR growth and net new ARR additions

Customer count and retention rates

Module adoption and expansion

Free cash flow generation and margins

Competitive market share trends

Profitability

Kintsugi Analysis

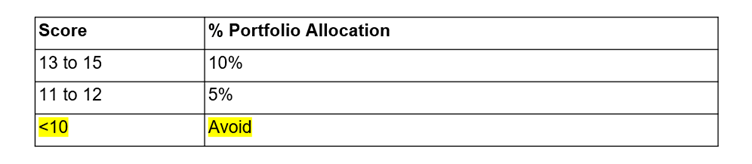

(I) Fundamental Analysis Score: 4/15

(II) Portfolio Allocation

Remarks: Wait and see, till the Company returns to profitability.

(III) Valuation

Remarks: No profit, hence no P/E ratio.

IMPORTANT DISCLAIMER: By reading this document, you agree that any information, commentary, recommendations or statements of opinion provided here are for general information and education purposes only.

The information contained in this publication are obtained from, or based upon publicly available sources that we believe to reliable, but we make no warranty as to their accuracy or usefulness of the information provided, and accepts no liability for losses incurred by readers using our case studies.

It is not intended to be financial advice, personalized investment advice or a solicitation for the purchase or sale of securities. Before purchasing any discussed securities, please be sure actions are in line with your investment objectives, financial situation and particular needs. Please do your own research and speak with a licensed advisor before making any investment decisions.

International investors may be subject to additional risks arising from currency fluctuations and/or local taxes or restrictions.

Please remember that investments can go up and down, including the possibility that a stock could lose all of its value. Past performance is not indicative of future results.

Couldn't agree more. It's truly amazing how AI and ML are totally changing real-time threats detection, kinda makes you wonder what comes next for protecting all our digital stuff.