December's Santa Rally

What Investors Need to Know for December 2025 and 2026

Dear Investor.

Zee here. This year has been anything but typical. The market has experienced unusual volatility, with none of the months behaving according to seasonal patterns. Investors witnessed the DeepSeek meltdown in February, surprise tariff announcements in April, and persistent concerns about AI valuations that created a roller-coaster ride for equity markets.

Despite this turbulence, the S&P 500 has shown resilience. October saw the index gain 2.27%, bringing year-to-date performance to 16.30%, with the market posting new closing highs and breaking through the 6,700, 6,800, and 6,900 point levels. November delivered modest gains, with the S&P 500 ending the month within 1% of record highs.

If you’re worried, take a deep breath. Let me explain why this is completely normal and share some genuinely encouraging news about where we stand as investors.

But first, let me tell you about the Santa Rally, December’s traditional year-end surge.

Announcement:

Join us on Tuesday 9th Dec 2025, for a live webinar “How to invest in 2026”.

This will be our LAST live webinar for the year. We will feature a special guest to share about investing in Gold.

👉🏼 Click here to reserve a spot. (LINK)

What Is the Santa Rally?

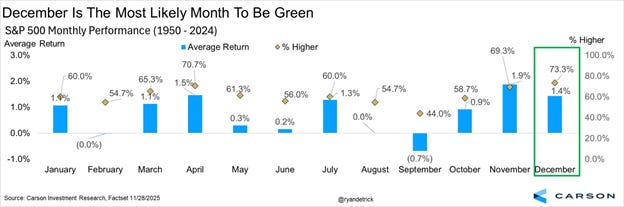

The Santa Rally refers to stocks rising during the last five trading days of December and the first two days of January. Since 1950, this seven-day period has seen the S&P 500 gain approximately 1.3% on average, with positive returns occurring roughly 79% of the time.

While that may not sound like much, it represents exceptionally strong performance for such a brief window.

The term was coined back in 1972, and several factors typically contribute to this phenomenon: holiday optimism among investors, lighter trading volumes as institutional players take time off, strong consumer spending, year-end portfolio rebalancing, and anticipation of January gains.

Now what about for the whole month of December? Here are some charts to shed light on what December is.

The Case for Caution

However, significant headwinds could prevent the traditional Santa Rally from materializing:

Valuation Concerns: The market is trading at elevated levels, with the forward price-to-earnings ratio above both five-year and ten-year averages. High valuations leave stocks vulnerable to profit-taking, especially after a strong year.

Tech Sector Volatility: Over the past month, Meta stock has declined 13%, Nvidia shares have fallen approximately 8%, and Oracle has lost nearly 30%. These megacap technology names have been crucial drivers of market performance, and their weakness raises concerns.

AI Bubble Fears: Questions persist about whether AI-related capital expenditures will translate into meaningful returns. Some strategists have noted increased bearish sentiment in the options market, with investors buying more downside protection rather than relying on seasonal strength.

Uncertain Fed Path: While a December rate cut appears likely, the trajectory for 2025 remains unclear. Market expectations for future cuts have swung dramatically in recent months, creating uncertainty.

Historical Precedent: In 2024, the S&P 500 declined 2.4% in December, with the index falling during every business day between Christmas and New Year, something that had never occurred before in the index’s history. This serves as a reminder that seasonal patterns can fail, especially during unusual market conditions.

What Investors Should Watch

As December unfolds, several key factors will determine whether Santa arrives:

The December 10 Fed Meeting: Not just the rate decision itself, but the Fed’s guidance on future policy moves. The Markets are predicting a high probability of further rates cuts this month.

Holiday Shopping Data: Real-time indicators of consumer spending strength

Market Breadth: Whether gains are concentrated in a few stocks or broadly distributed across sectors

AI Earnings Updates: Any new information about return on investment for major AI capital expenditures

Economic Data Flow: Employment reports, inflation figures, and consumer sentiment readings

The Case for Optimistic

Despite the recent volatility, there’s genuinely a lot to be grateful for as we close out 2025. Here are seven compelling reasons why:

1. It’s Been a Fantastic Year Across the Board

The S&P 500 is up approximately 14% this year, which is impressive considering we just came off back-to-back years of 25% gains. But the good news doesn’t stop there. All 11 market sectors are positive for the year, and international markets have performed even better than the US. Emerging Markets are up 26%, while European, Australasian, and Far East markets have gained 23%.

Even bonds are having their best year since 2020, and gold is posting its strongest performance since 1979. For once, being diversified across different investments is paying off beautifully.

2. History Suggests More Upside Ahead

Historically, the S&P 500 has only peaked for the year in October six times. While the market hit a high on October 28th and we’ve seen some November volatility, the odds favor a strong year-end rally with potential new highs before 2025 concludes.

3. The Economy Is Actually Improving

Despite negative headlines, the US economy is growing above its typical trend. Economic indicators show genuine improvement beneath the surface, with the Atlanta Fed estimating an impressive 4.2% GDP growth for the third quarter. The data tells a much more positive story than the news cycle suggests.

4. The “Top Heavy” Market Concern Is Overblown

You’ve probably heard that only a few giant tech stocks are driving market gains. The reality is more nuanced. While the top 10 stocks account for nearly 40% of US market value, this percentage was 39% last year when markets performed well. More importantly, when compared globally, the US is actually one of the least concentrated markets, with only Japan and India being more diversified.

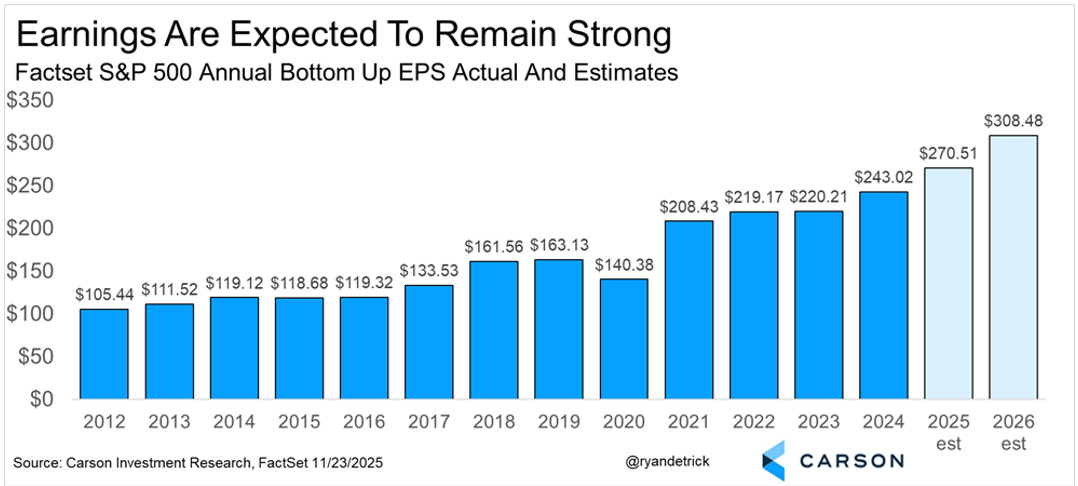

5. Corporate Earnings Are Strong and Broad-Based

We’re wrapping up an excellent earnings season. Third-quarter earnings growth jumped from an expected 7.9% at the quarter’s start to an impressive 13.4%. Even more encouraging, while the seven largest tech companies saw earnings rise 18.4%, the other 493 companies in the S&P 500 posted nearly 15% earnings growth. This broad-based strength suggests the rally has solid fundamentals behind it.

6. Consumers Are Managing Well

Despite concerns about consumer debt, the overall picture is healthier than headlines suggest. Recent New York Fed data shows that 95.5% of all debt is being paid on time, which is actually better than before the 2007 financial crisis. While total debt has increased, so have incomes and wealth levels. Household debt payments as a percentage of income remain at 5.3%, well below the 15% we saw before the 2008 crisis. Year-to-date, disposable income has grown 3.5%, outpacing the growth in both total debt and credit card debt.

7. History Is on Our Side

In years without a recession, stocks finish higher 85% of the time and post double-digit gains 68% of the time. Since a recession isn’t expected in 2026, history suggests next year could deliver another solid performance for patient investors.

The Bottom Line for December and Beyond

While history suggests December should be positive for stocks, 2025 has repeatedly demonstrated that traditional patterns don’t always hold. The Santa Claus rally occurs approximately 79% of the time, which means it still fails about one in five years.

Rather than betting heavily on a seven-day seasonal effect, investors should focus on longer-term fundamentals. Whether or not Santa arrives this year, maintaining a disciplined, diversified approach aligned with your financial goals remains the most prudent strategy for navigating the final month of 2025.

Volatility is simply the toll investors pay on the road to attractive long-term returns. December 2025 may test our patience, but the broader investment landscape continues to offer opportunities for those who remain focused on fundamentals rather than short-term seasonal patterns.

Start your investing journey today for just $9. (LINK)

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns. How we invest may not suit your investment goals and risk management profile.