From Caracas to Wall Street

The Venezuela Effect on US Stocks

Dear Investors.

Zee here. In a dramatic turn of events over the weekend, US forces captured Venezuelan President Nicolás Maduro in a major military operation. President Trump has announced the US will temporarily “run” Venezuela and has ambitious plans for American oil companies to rebuild the country’s energy infrastructure.

Here’s what this means for your investments.

Announcement:

Join us on Monday 9th Feb 2026, for our live Free webinar “One CEO, Two Universes: Tesla Today, SpaceX Tomorrow?”.

👉🏼 Click here to reserve a spot. (LINK)

1. Oil Company Stocks Are Surging

Energy stocks jumped immediately after the news broke. Chevron shares rose by $7.95, or 5.1%, while Exxon Mobil increased 2.2% and ConocoPhillips gained 2.6%. Oil service companies saw even bigger gains, with Halliburton and Schlumberger both adding more than 10%.

Why it matters: President Trump announced that major US oil companies will invest billions to modernize Venezuela’s aging oil infrastructure. Chevron, which is the only major American oil company still operating in Venezuela, stands to benefit most directly. Other companies like Exxon and ConocoPhillips, which had assets seized years ago, are now exploring opportunities to recover those investments.

2. The Oil Price Situation Is Complicated

Oil prices have been swinging back and forth. US crude rose 1.4% to $58.13 per barrel, while Brent crude climbed 1.2% to $61.50 in initial trading, but the long-term picture is uncertain.

The two possible scenarios:

Short-term instability: If Venezuela becomes chaotic like Libya after Gaddafi, oil supply could decrease, pushing prices higher

Long-term abundance: If the country stabilizes and American companies successfully rebuild infrastructure, Venezuela could eventually flood the market with oil, driving prices down

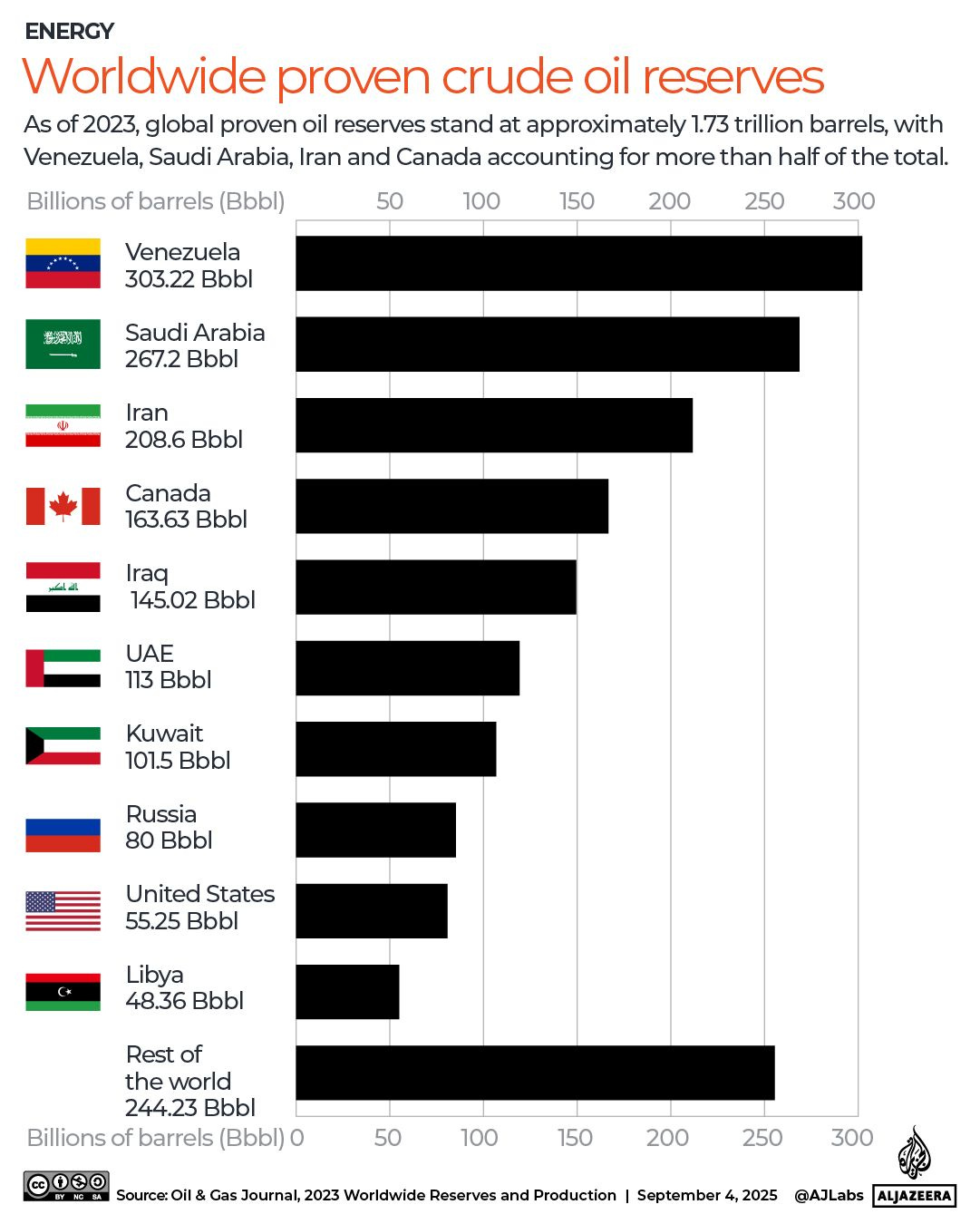

Venezuela currently produces less than 1 million barrels per day, but it sits on proven reserves of more than 300 billion barrels, the world’s largest oil reserves. Some analysts believe production could double or triple within two years under the right conditions.

3. Wall Street Hit Record Highs

Despite the geopolitical uncertainty, the Dow Jones Industrial Average added 549 points, or 1.2%, to close at an all-time high of 48,977 on Monday. The S&P 500 and Nasdaq also posted gains.

Why investors are optimistic: Markets are looking past the immediate chaos and focusing on potential opportunities. The operation was precise and successful, US forces weren’t significantly harmed, and there’s excitement about accessing Venezuela’s vast oil wealth. Major banks also rallied, with JPMorgan Chase rising 2.6% and Bank of America jumping 1.7%.

4. Safe-Haven Assets Are Also Rising

Interestingly, both stocks and traditional “safe haven” investments are going up together. Gold gained 2.8% and silver soared 7.9%, while Bitcoin rose to its highest level since mid-November, hitting $94,700.

What this tells us: While investors are excited about opportunities, they’re also hedging their bets. The simultaneous rise in precious metals shows that some investors are worried about potential instability or conflict. Cryptocurrency platforms like Coinbase jumped 7.8% and Robinhood Markets jumped 7%.

5. Venezuelan Bonds Are Rallying

One surprising winner has been Venezuelan government bonds, which have long been considered nearly worthless. These bonds are now surging as investors bet that a new, US-friendly government will honor the country’s debts.

Eric Fine, an emerging-markets portfolio manager at VanEck Funds, noted there are “much, much greater upsides in the bond market than what investors went to sleep thinking they were on Friday”. Large US financial institutions that have been holding these distressed bonds could see significant profits if Venezuela eventually makes good on its obligations.

What Should Investors Know?

The bottom line: This situation could take years to fully play out. While experts think that significantly boosting oil production in Venezuela could cost upwards of $100 billion and take at least a decade, some are more optimistic about faster progress.

The key questions that will determine market impacts going forward are:

Will Venezuela stabilize quickly or descend into prolonged chaos?

Which US oil companies will actually invest, and how much?

Will a new Venezuelan government honor old debts and contracts?

How will other countries like China and Russia respond?

For now, markets are betting on opportunity rather than disaster, but investors should watch this situation closely as it continues to develop.

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns. How we invest may not suit your investment goals and risk management profile.

Hi,

Good to connect. I’m new to Substack after trading in my PPE and tools, and I now write about markets, risk, and the stories we tell ourselves to stay comfortable.

After the Close is less about prediction and more about process — discipline over drama, and thinking clearly when the screens go dark. The writing is partly a way for me to slow things down and stay honest, especially in a space that tends to reward noise.

If you ever have a moment to look through it, I’d genuinely appreciate any feedback on the process. Good or bad is fine. I can handle it.

Cheers, Andrew