From Gold rush to silver boom.

can it last?

Dear Investor,

Zee here. This week, we’re welcoming back our mentee Aaron. You may remember his deep dive on gold’s record-breaking rally, a piece that had one of the highest readership.

Today, he returns with a fresh look at silver. Often overshadowed by its more glamorous counterpart, silver has been gaining attention as a compelling alternative for investors seeking value, diversification, and asymmetric upside. Aaron unpacks what’s driving renewed interest, how silver behaves differently from gold, and what opportunities may lie ahead.

Let’s dive in.

Join us on Tuesday 9th Dec 2025, for a live webinar “How to invest in 2026”.

This will be our last live webinar for the year. We will feature a special guest to share about investing in Gold.

👉🏼 Click here to reserve a spot. (LINK)

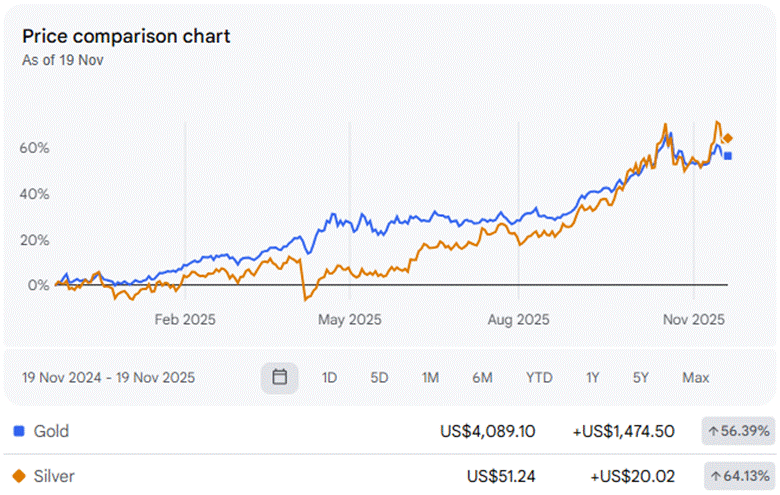

After observing gold’s surge to $4,000, an acquaintance of mine closed all his gold positions and rotated to purchase silver. At that time, silver was trading at $48 and it seemed like a FOMO trade to me. Silver eventually surged to $54 for a brief couple of days, dipped sharply and is now hovering around $51.24 on 19 November.

Silver shines brighter than gold

The precious metals rally has been broad-based, but more importantly for silver, the rally has out-paced that of gold this year. For reference, in the London market silver is reported to have gained ~70% YTD compared with ~55% YTD for gold, mainly due to a short squeeze in silver after a major drawdown of freely available supplies.

The key drivers behind the gold and silver surge are broadly similar - dedollarisation, interest rate cuts and safe-haven secondary inflows (central banks do not hold silver in their reserves). To briefly recap:

Reduction the US dollar in global trade and financial transactions, resulting in a weaker US dollar and inversely higher silver prices.

With expectations of further rate cuts by the Fed and declining real yields, non-yielding assets like silver become more attractive.

Amid global uncertainties and trade tensions, silver receives spill-over safe-haven flows after gold.

Silver’s unique characteristics vs. Gold

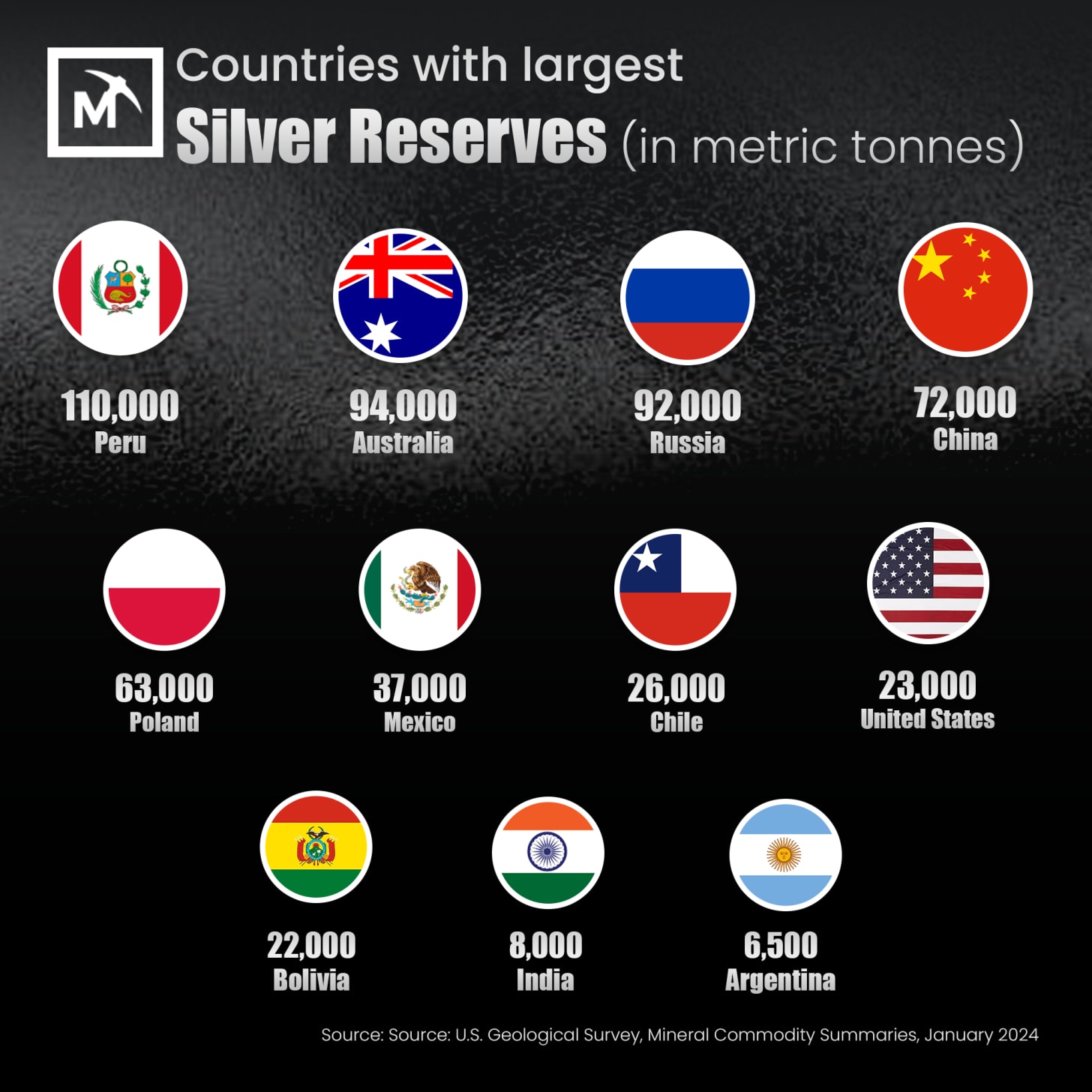

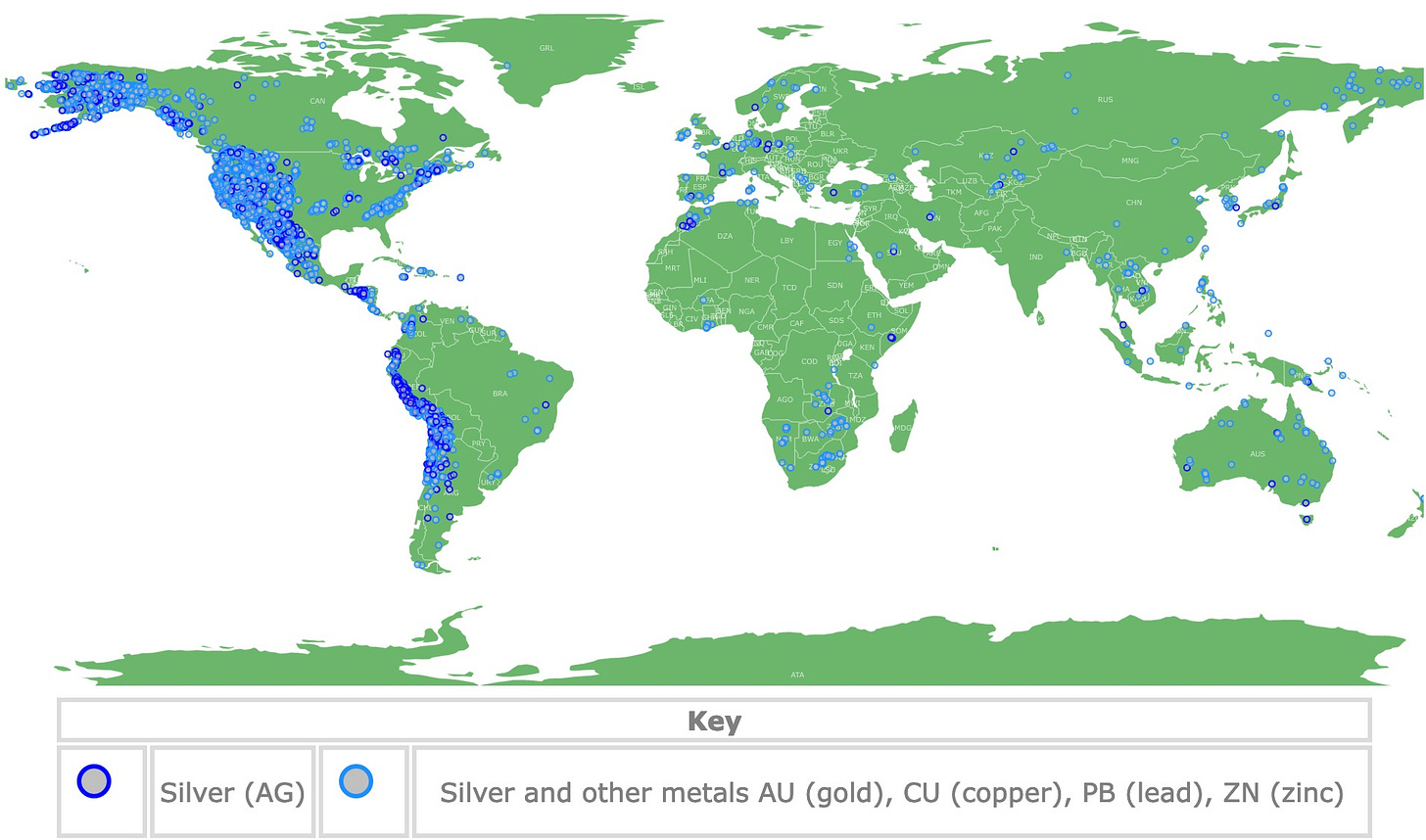

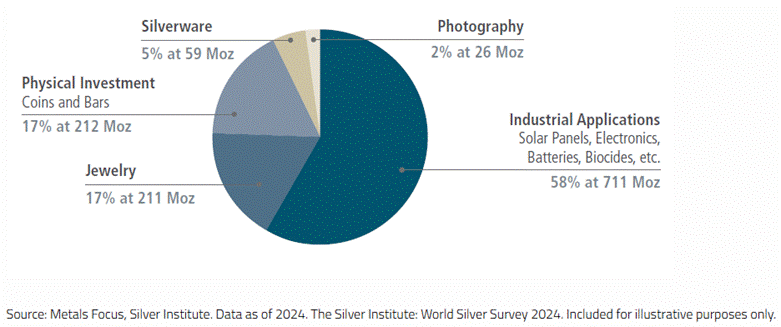

Unlike gold which is seen as a monetary asset, silver has a dual role. It is more cyclically exposed given its industrial end-use for electronic products like solar panels and EVs. There is currently a structural deficit where industrial demand consistently outpaces available supply.

About 60% of silver in the market is used for industrial production, while 10 to 20% goes to investors. The rest is used in jewellery, silverware and for other purposes. That means it has more upside if industrial demand strengthens and vice versa.

Gold by contrast, is more purely a safe-haven asset and held by central banks (but not silver). Because silver’s market is less liquid and roughly nine times smaller than gold’s, price swings can be larger up or down.

Potential method to optimise your precious metals portfolio

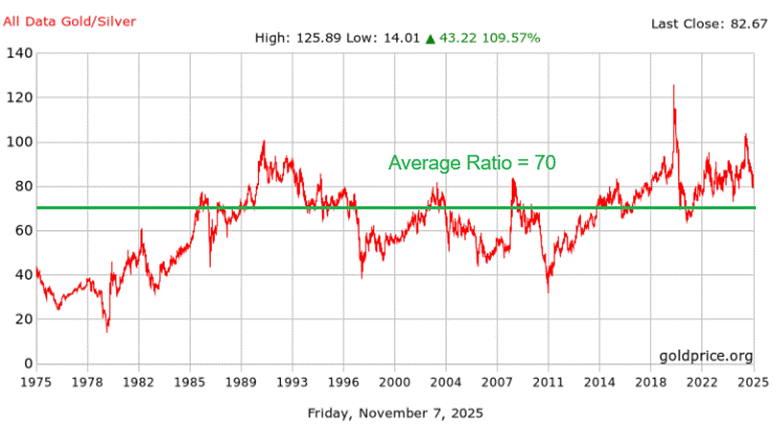

The gold-to-silver ratio indicates how many ounces of silver are needed to buy one ounce of gold. This is often used as a key metric for investors, as a high ratio suggests gold may be overvalued relative to silver, while a low ratio suggests otherwise.

Currently the ratio is at elevated levels of 83:1, which suggests that silver is undervalued when compared to its long-term average of around 60-70. If the ratio reverts to 70, this provides an upside scenario for silver. Assuming the current gold price of $4,000 remains constant, the projected silver price would be around $70.

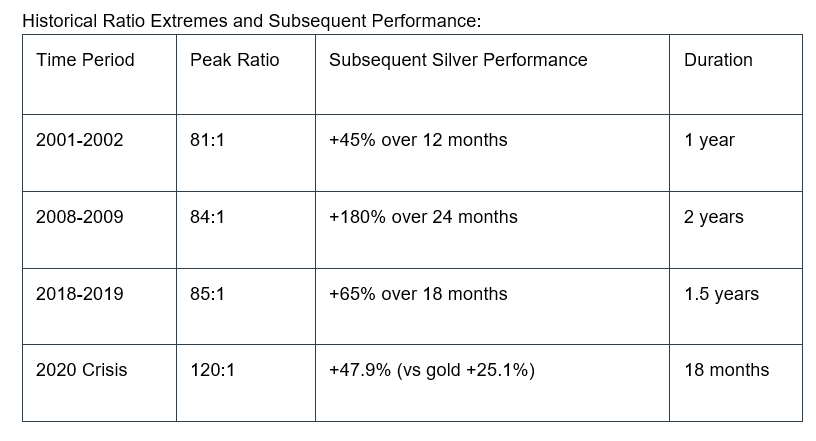

Examining multiple decades of precious metals data reveals consistent patterns where extreme ratio readings preceded significant relative price movements.

The 2020 period provides particularly compelling evidence. As economic uncertainty peaked, the ratio spiked above 120:1, reflecting investor flight-to-safety behaviour concentrated in gold purchases. Silver initially lagged significantly during this risk-aversion phase.

However, as markets stabilised and industrial demand recovered, silver demonstrated exceptional catch-up performance, which gained 47.9% vs gold’s 25.1%. This illustrates how tactical positioning during extreme ratios can capture substantial relative outperformance.

Consider exposure beyond physical silver bars and coins

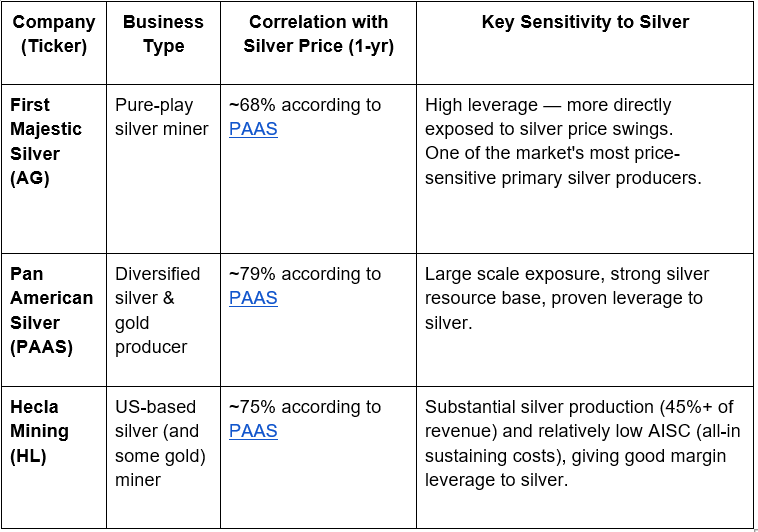

Investors who want exposure to silver can also invest in silver mining companies, which provide leveraged exposure to silver prices. When silver rises, miners’ profits can grow at a faster rate than silver itself, since production costs are relatively fixed while selling prices increase.

Popular miners include major producers like First Majestic Silver, Pan American Silver, and Fresnillo, as well as diversified miners with significant silver output such as Newmont or Hecla Mining.

Substantial silver production (45%+ of revenue) and relatively low AISC (all-in sustaining costs), giving good margin leverage to silver.

However, mining stocks come with different risks such as operational issues, geopolitical exposure, and management execution. The performance of silver mining companies may not correlate perfectly with silver prices during some occasions. For example, the Amplify Junior Silver Miners ETF (ticker: SILJ) had an approximate 5-year return of ~64%, lagging spot silver of ~112%.

The Bottom Line

Silver can offer investors exposure to precious metals and industrial-driven growth potential, especially as clean-energy demand accelerates. But unlike gold, silver prices tend to move with sharper swings, making thoughtful allocation essential.

It can be used as a hedge during inflation or currency weakness, but not a primary growth driver as its long-term returns have been inconsistent.

Keep in mind that silver’s performance has historically not mirrored the broader market sentiment or gold’s trajectory.

IMPORTANT DISCLAIMER: By reading this document, you agree that any information, commentary, recommendations or statements of opinion provided here are for general information and education purposes only.

The information contained in this publication are obtained from, or based upon publicly available sources that we believe to reliable, but we make no warranty as to their accuracy or usefulness of the information provided, and accepts no liability for losses incurred by readers using our case studies.

It is not intended to be financial advice, personalized investment advice or a solicitation for the purchase or sale of securities. Before purchasing any discussed securities, please be sure actions are in line with your investment objectives, financial situation and particular needs. Please do your own research and speak with a licensed advisor before making any investment decisions.

International investors may be subject to additional risks arising from currency fluctuations and/or local taxes or restrictions.

Please remember that investments can go up and down, including the possibility that a stock could lose all of its value. Past performance is not indicative of future results.