Gain 200% in 1 Year...from Investing Passively??

Is it possible?

Dear Investors,

Zee here. This is concludes our 5 part series on ETFs.

Before we dive deeper, I want to personally invite you to our Market Quickies Live Session next Tuesday, 19th August 2025, from 8:30–9:30 PM GMT+8. We’ll be unpacking fresh data showing why August and September have historically been the market’s trickiest months and how you can take advantage of it. It’s going to be an interactive, so bring your questions, your curiosity, and maybe even your skepticism, you’ll walk away with insights you can use immediately.

I still remember the first time I came across leveraged ETFs. I was scrolling through market data and saw something wild a fund that was up over 200% in a single year. Naturally, I clicked. Then I learned about TQQQ (Return: +234%, from Jan 1 to Dec 31, 2020). Then UPRO. And then the rest of the leverage-powered friends.

It felt like unlocking a cheat code. Why settle for regular S&P 500 returns when you could triple them? Of course, I didn’t fully grasp the risks back then. I thought I had discovered a shortcut to compounding. What I actually found was a high-speed roller coaster that rewards precision but punishes passivity.

This article is everything I wish I had known earlier about leveraged ETFs, from the thrill of outsized gains to the hidden risks that quietly erode returns. Whether you’re just curious or seriously considering these tools, this guide will help you make better, clearer decisions.

Let’s get into it.

If regular index funds are like cruising down the highway in a comfortable sedan, leveraged ETFs are the financial equivalent of strapping yourself into a turbo-charged sports car.

They can get you to your destination faster… but also crash harder if you’re not careful.

Today, we’ll look at five of the most popular leveraged ETFs: QLD, SSO, UDOW, UPRO, and TQQQ what they do, why they can be tempting, and what you need to watch out for.

What Are Leveraged ETFs?

A leveraged ETF is designed to deliver two or three times the daily return of its underlying index. For example:

QLD: 2x daily return of the Nasdaq-100

TQQQ: 3x daily return of the Nasdaq-100

SSO: 2x daily return of the S&P 500

UPRO: 3x daily return of the S&P 500

UDOW: 3x daily return of the Dow Jones Industrial Average

The idea is simple. If the Nasdaq goes up 1% today, QLD should go up about 2% and TQQQ about 3%. Same for the others with their respective indexes.

The catch is in the details, they are built to track daily moves, not long-term compounding. That “daily reset” changes the game.

The Appeal: Big Gains, Quickly

There’s no denying the thrill. In a roaring bull market, leveraged ETFs can produce spectacular gains.

Let’s look at a couple of examples:

In 2023, the Nasdaq-100 gained around 55%. TQQQ, its 3x cousin, soared about 180%.

Over a strong month, SSO or UPRO can turn modest index gains into very impressive portfolio bumps.

The math is straightforward. In an uptrend, multiplying returns means you can build wealth much faster, without picking individual stocks. You’re still tracking an index, just with more horsepower.

This is why traders, short-term momentum investors, and risk-seeking speculators are drawn to them.

The Risk: Bigger Losses, Compounding Pain

The flip side is equally true. If the index drops 1% in a day, a 3x leveraged ETF could fall roughly 3%. And if the market chops sideways or whipsaws, that daily reset can start eroding returns over time.

Here’s why:

Leveraged ETFs rebalance daily to maintain their leverage ratio. This works great when the market moves consistently in one direction, but it hurts when volatility spikes. Losses compound faster, and gains in between don’t fully recover what you’ve lost.

Example:

If you lose 10% one day and gain 10% the next, you’re still down overall. Now imagine that with triple leverage.

During the 2022 tech sell-off, TQQQ dropped over 75%. If you didn’t sell before the storm, it was a brutal ride.

Costs: Expense Ratios and More

Leveraged ETFs come with higher expense ratios compared to traditional index funds.

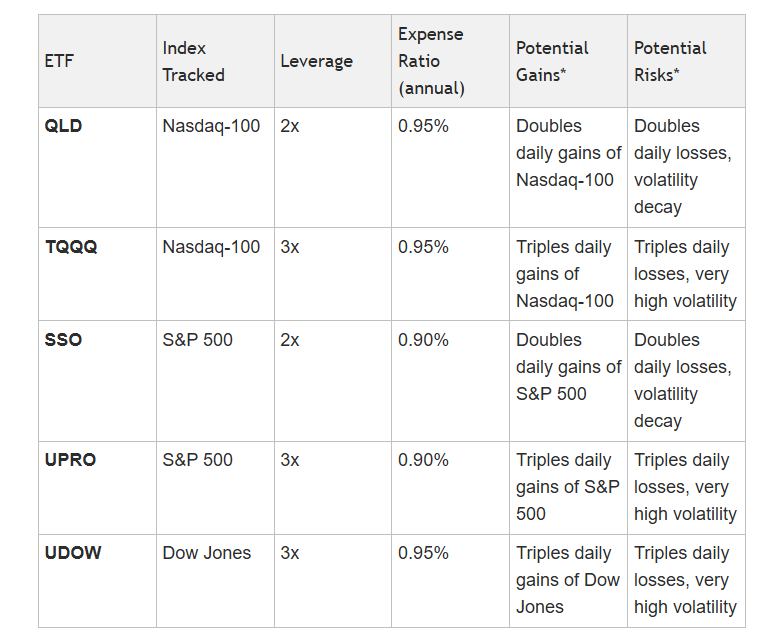

QLD: 0.95%

TQQQ: 0.95%

SSO: 0.90%

UPRO: 0.90%

UDOW: 0.95%

These might look small, but over time they matter, especially if the ETF is underperforming due to volatility decay. There are also hidden costs in the form of trading slippage, spreads, and the cost of maintaining leverage through derivatives.

When They Work Best

Leveraged ETFs tend to shine in:

Strong Trending Markets — preferably uptrends. The fewer big pullbacks, the better.

Short-Term Tactical Trades — days to weeks, sometimes months.

Situations Where You Want to Use Less Capital — for example, instead of putting $30,000 into the Nasdaq-100 ETF (QQQ), you could use $10,000 in TQQQ for a similar exposure, freeing the rest for other investments.

When They Can Be Dangerous

They can be dangerous when:

Markets are choppy or range-bound

You plan to “buy and forget” for years (volatility decay eats returns)

You don’t have a clear exit strategy

You underestimate how quickly losses can stack up

Think of them like hot sauce, great in small doses, but you probably don’t want it as your main course every day.

When They Can Be Dangerous

Here’s a clean and simple table comparing the risk, gains, and expenses for QLD, SSO, UDOW, UPRO, and TQQQ:

*Gains and risks are relative to daily moves, not long-term compounding.

The Bottom Line

Leveraged ETFs like QLD, SSO, UDOW, UPRO, and TQQQ are powerful tools. They can supercharge your gains in the right conditions, but they can also magnify losses just as fast.

They’re not for everyone. If you’re comfortable with big swings, can watch the market closely, and understand how daily compounding works, they can be exciting tactical plays. If you prefer sleeping soundly at night, sticking to unleveraged index funds might be the wiser choice.

In investing, speed and excitement are optional. Survival is not.

P.S. If you found this article helpful and want to boost your portfolio with leveraged ETFs, do check out our Accelerate program.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.