Gold's record rally. What’s behind the surge?

What this golden breakout means for your portfolio in 2025.

Dear Investor,

Zee here. This week, we welcome back our mentee Aaron, who did a deep dive on Gold’s record rally.

Aaron is a keen analyst who explores the global economy through the lens of human behavior and philosophy. He wishes to help readers understand market movements and make better investment decisions.

Here goes…

Early in September, a friend shared with me a Bloomberg article quoting Goldman Sachs that “Gold could rally to almost $5,000 an ounce if the Fed’s independence were damaged and investors shifted a small portion of holdings from Treasuries into bullion”.

Gold had already risen from $2,800 to $3,600 since the beginning of 2025, and $5,000 seemed like a ridiculously high number to me. However my view started to look shaky as Gold surged to record highs of above $4,300 by late October.

So…what is driving the surge in gold this year?

Devaluation of the US dollar & de-dollarization

The dollar for many years has been seen as the safe-haven of the market because of its widespread use in global trade and reserve currency status. However its dominance has come into question in recent times due to geopolitical and geostrategic shifts.

The dollar saw its biggest decline of 11% in the first half of 2025, the worst start since the early 1970s. Investors have been selling the dollars due to concerns that US tariffs announced have eroded international trust and threatened its safe-haven role.

There are also concerns around the level of US debt, which has reached a record high-over $36 trillion, or 120% of the country’s GDP. The “Big Beautiful Bill” provides funding for large-scale government programmes and infrastructure developments over the next decade, prompting doubts about how much the US government can repay its debt.

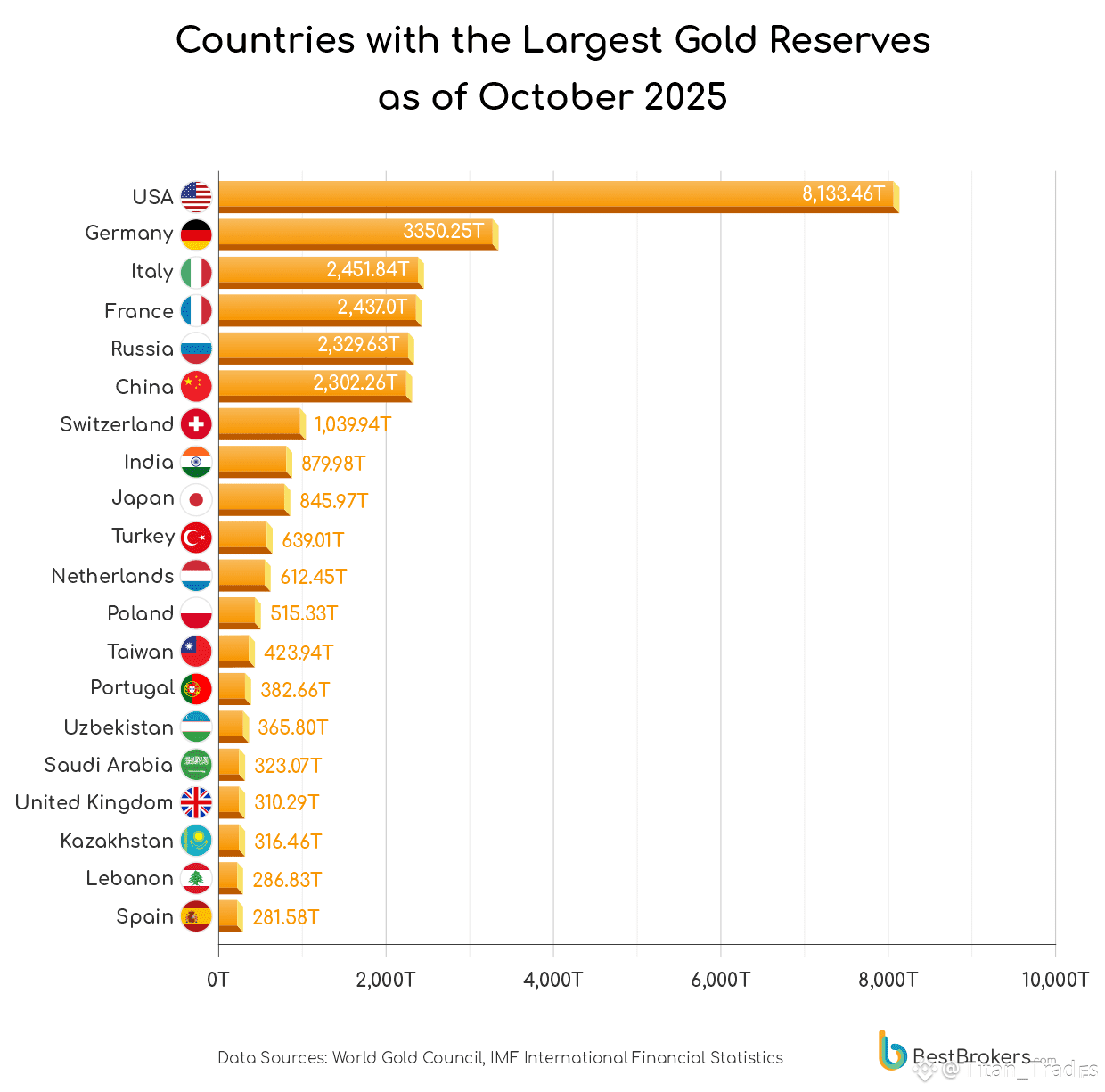

Central banks and sovereign wealth funds respond by diversifying away from USD-denominated reserves and increasing their gold holdings. In 2025, China’s central bank (PBoC) continued adding gold for 23 consecutive months, bringing official reserves above 2,300 tonnes, part of a broader “de-dollarization” trend.

With the dollar depreciating against the world’s major currencies such as the euro and the yen, gold prices tend to rise. Because the price of gold is traded in dollars, a softer dollar makes it cheaper for investors holding other currencies to buy gold — spurring additional demand and upward pressure on prices.

To give you an idea How different assets have performed historically when the dollar fell, here is a chart showing inflation-adjusted annual returns for major periods of dollar weakness since 1973. All figures use US dollars as the base currency and are based on quarterly data.

Geopolitical tensions between the US and China

For almost a decade, the US has been vocal about China as a competing power in the global world order. Trade tensions have ramped up earlier this month when China expanded their rare earth restrictions and limited exports to overseas defence and semiconductor users.

When investors fear potential market disruptions or economic slowdowns. They typically shift money out of risk assets (e.g. equities, bonds or currencies) and into perceived safe stores of value such as gold.

From 2020 to 2025, China reduced its US Treasury holdings by about $339 billion (from U$1,070 billion to U$731billion), a decline of over 30%. The steepest drop occurred from 2022 to 2024, when the G7 countries froze about U$300billion of Russia’s foreign reserves due to the Ukraine war, which raised strategic concerns in China.

Falling USD yields & rate cut expectations

Because gold doesn’t pay interest or dividends, its attractiveness depends on what investors forgo by holding it instead of yield-bearing assets. When interest rates — particularly inflation-adjusted (real) rates - are falling, the expected yield on bonds and savings drop, making gold relatively more attractive.

Additionally, low interest rates often correspond with looser monetary policy, higher liquidity, and inflation/uncertainty risk - all of which boost gold’s safe-haven or hedge appeal.

When real US interest rates have fallen — a dynamic often associated with looser monetary policy — gold has broadly surged. Between 2001 and 2012, when the 10-year real U.S. Treasury yield dropped around 400 basis points, the “real” price of gold increased more than five-fold.

Did you know? Buffett has long maintained his skepticism about gold as a long-term investment. In his 2011 Berkshire Hathaway shareholder letter, he described gold as ”neither of much use nor procreative,” emphasizing that it does not produce cash flow or create value over time.

Fed independence

When investors believe the Fed can set monetary policy free from political interference, confidence in the US dollar and Treasury markets typically strengthens. However, when that independence is questioned — for instance, amid political pressure to cut rates ahead of elections or to finance large fiscal deficits — investors worry that monetary policy could turn overly accommodative, fueling inflation or undermining the dollar’s value. In such scenarios, gold tends to rally as a hedge against policy missteps and currency debasement.

Global demand & supply

Driven by the various factors mentioned above, Gold ETFs have recorded their largest monthly inflow in September, resulting in the strongest quarter on record. This is mainly driven by North American, followed by Europe and then Asia.

Should you consider holding gold in your portfolio?

Ray Dalio, founder of Bridgewater Associates, includes gold in his All Weather Portfolio — a strategy designed to perform across all economic environments. He has suggested that a reasonable 10-15% allocation to gold would be suitable for investors optimizing the risk-return profile of their investment portfolios.

However, he also acknowledged that gold has lower long-term expected returns and typically yields returns similar to cash, indicating that adhering strictly to this allocation could lower the overall expected returns of the portfolio over the long term.

While gold’s latest surge past $4,000 per ounce has captured headlines and drawn a rush of new buyers, investors should tread carefully. Market history shows that late-cycle rallies driven by FOMO often end with sharp corrections once speculative demand fades or policy expectations shift.

In previous peaks such as 2011 and 2020, gold prices retraced more than 15–20% within months after enthusiasm cooled. Maintaining a measured allocation and rebalancing periodically would seem to be the wiser path than following the crowd into exuberant territory.

IMPORTANT DISCLAIMER: By reading this document, you agree that any information, commentary, recommendations or statements of opinion provided here are for general information and education purposes only.

The information contained in this publication are obtained from, or based upon publicly available sources that we believe to reliable, but we make no warranty as to their accuracy or usefulness of the information provided, and accepts no liability for losses incurred by readers using our case studies.

It is not intended to be financial advice, personalized investment advice or a solicitation for the purchase or sale of securities. Before purchasing any discussed securities, please be sure actions are in line with your investment objectives, financial situation and particular needs. Please do your own research and speak with a licensed advisor before making any investment decisions.

International investors may be subject to additional risks arising from currency fluctuations and/or local taxes or restrictions.

Please remember that investments can go up and down, including the possibility that a stock could lose all of its value. Past performance is not indicative of future results.