How to Time the Market? Perfectly?

The market rewards patience, not prophecy.

Dear Investors,

Zee here. As someone who's watched countless investors and mentees chase the "perfect entry point" over the years, I want to share a story that might change how you think about market timing forever. The story was told by personal finance club, which is now on my wall as a lasting reminder.

Here goes..

Meet Three Investors: A Tale of Timing vs. Time

Let me introduce you to Sarah, Brittany, and Tiffany, three fictional investors with dramatically different approaches to the same goal. Each invested exactly $96,000 over 40 years in S&P 500 index funds, but their timing strategies couldn't have been more different.

Sarah was the steady tortoise. Every month, rain or shine, market up or down, she automatically invested $200 into her index fund. No analysis, no predictions, no waiting for the "right moment." Just consistent, boring investing.

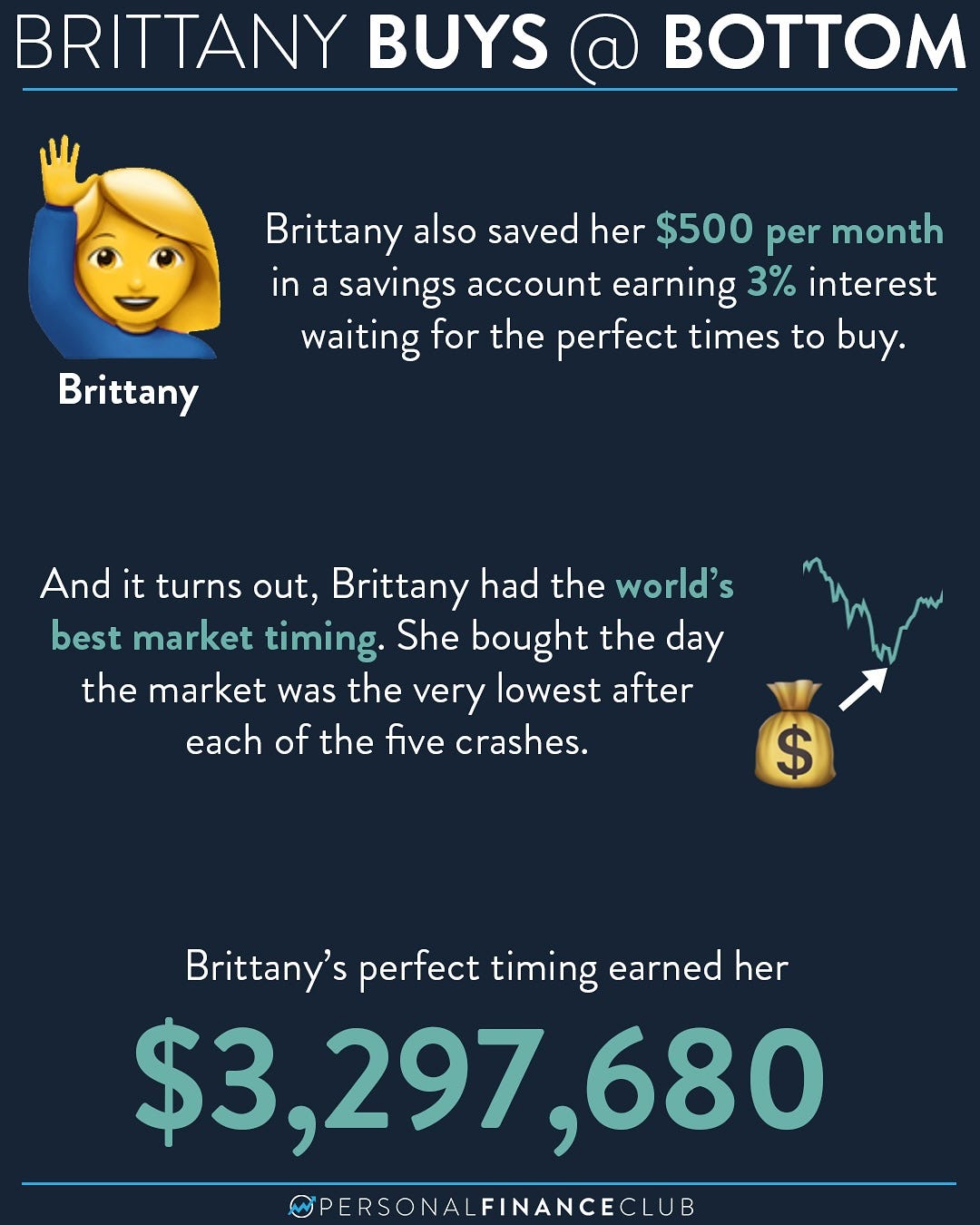

Brittany was the impossible perfectionist. With supernatural market timing abilities, she managed to invest her $2,000 annually at the exact market bottom every single year. Not just close—the precise lowest point. This level of timing is literally impossible in real life, but let's see what perfect timing achieved.

Tiffany had the worst luck imaginable. She also invested $2,000 yearly, but always managed to buy at the absolute market peak, the highest point of each year. Every. Single. Time.

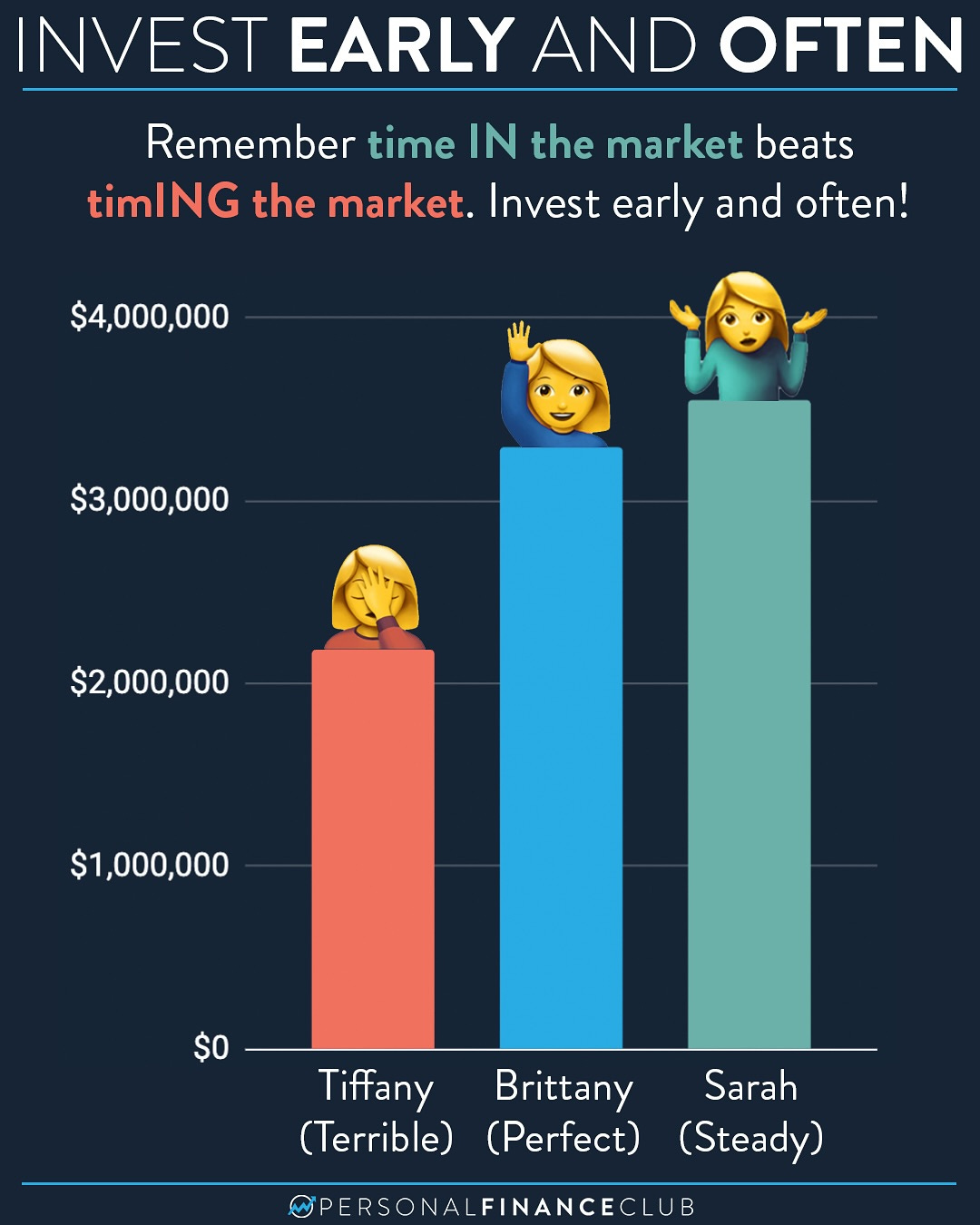

After 40 years of this experiment, here's what happened:

Tiffany (worst timing ever): $735,985

Brittany (perfect timing): $1,101,330

Sarah (steady monthly investing): $1,234,403

Read that again. Sarah, with her boring monthly contributions, beat even the impossible perfection of Brittany's market timing.

The Shocking Truth About Market Timing

This reveals something profound about investing that most people miss. Even with supernaturally perfect timing, knowing exactly when every market bottom would occur, Brittany couldn't overcome Sarah's simple strategy of consistent investing.

While Brittany was sitting on the sidelines with cash, waiting for each year's perfect moment, Sarah was steadily building her position. The compound growth from being continuously invested more than made up for buying at suboptimal prices.

But here's the even more important lesson: all three investors became wealthy.

Even Tiffany, with her impossibly terrible timing, accumulated nearly three-quarters of a million dollars. Why? Because once she bought in, she held on. She practiced buy-and-hold investing, letting the market's long-term upward trajectory do the heavy lifting.

Why Market Timing Is a Losing Game

The reality is that nobody, can consistently predict market tops and bottoms. When the market drops 20%, there's no way to know in the moment whether that's the bottom before a recovery or just the beginning of a 50% decline.

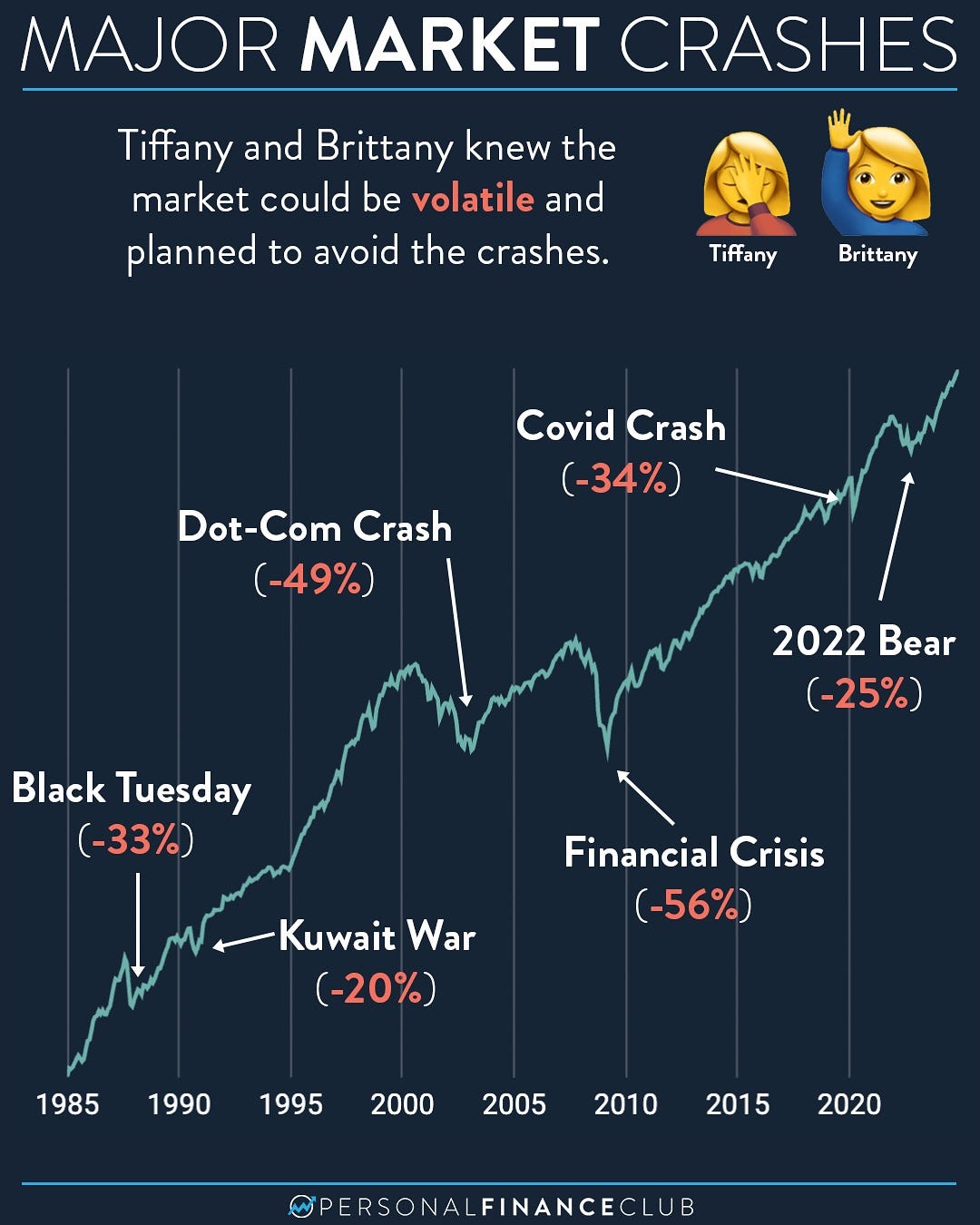

Consider the major market crashes since 1982:

Black Monday (1987): 33.4% drop over 101 days

Dot-com Crash (2000-2002): 49% drop over 768 days

Financial Crisis (2007-2009): 56.5% drop over 514 days

COVID Crash (2020): 34.1% drop in just 33 days

Inflation Crash (2022): 25% drop over 196 days

During each of these crashes, investors faced the same impossible question: Is this the bottom, or is it going to get worse? Those who waited for the "perfect" moment often missed the recovery entirely.

Your Action Plan: Embrace the Boring Strategy

Instead of trying to time August dips or any other market movements, focus on what actually builds wealth:

1. Set Up Automatic Contributions Configure automatic transfers from your Salary Account to brokerage account. Remove the emotion and guesswork from the equation.

2. Choose Broad Index Funds Focus on diversified index funds. These give you exposure to the entire market's growth without having to pick individual winners.

3. Stay Consistent Through Volatility When August (or any month) brings volatility, remember that these moments often provide the discounts that enhance your long-term returns. Your automatic investing will capture these lower prices without you having to guess when they'll occur.

4. Focus on Time in Market, Not Timing the Market The difference between Sarah and Brittany wasn't intelligence or luck—it was time. Sarah spent more time invested in the market, allowing compound growth to work its magic.

The Bottom Line

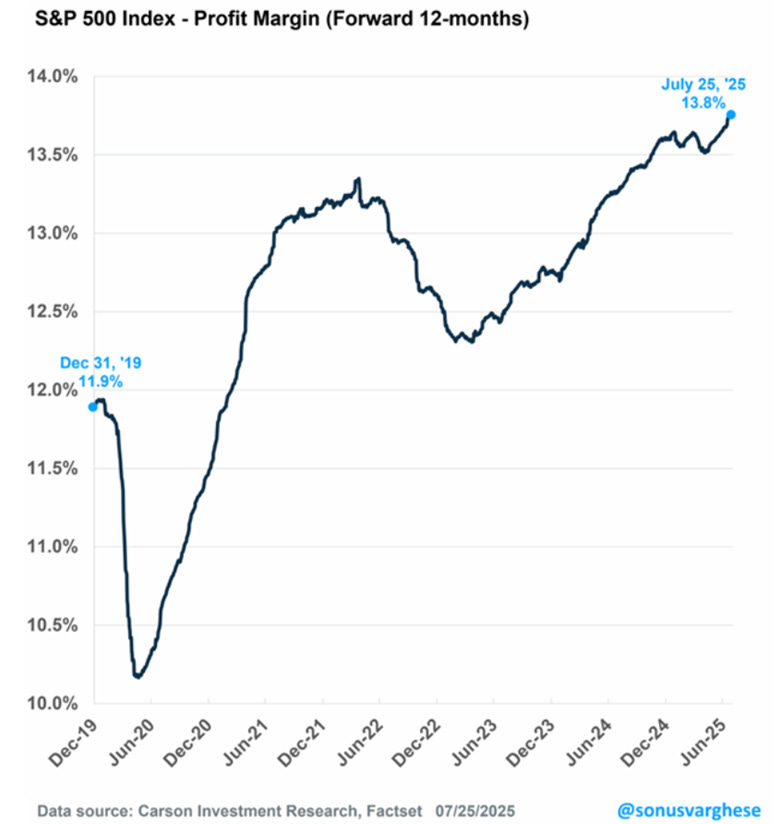

Strong corporate earnings, rising profit margins, and a resilient economy create a favorable backdrop for long-term investing. Today, 97% of S&P 500 companies have beaten earnings expectations this reporting season, with earnings hitting record levels.

This doesn't mean volatility won't happen, it absolutely will. But volatility is the price we pay for superior long-term returns. Those dramatic August or September selloffs that make headlines? They're often the exact moments that create the buying opportunities patient investors benefit from.

Remember Warren Buffett's timeless advice: "Be fearful when others are greedy, and greedy when others are fearful." But more importantly, remember that the best way to capitalize on this wisdom isn't through perfect timing, it's through consistent investing regardless of market conditions.

The market rewards patience, not prophecy.

While others are trying to time the perfect entry point, you can be building wealth the proven way: early, often, and automatically.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.