NVIDIA Corporation (US: NVDA) Stock Analysis

Updated September 2025

Company Profile

NVIDIA Corporation is an American multinational technology company incorporated in 1993 with its headquarters located in Santa Clara, California. The company designs graphics processing units (GPUs) for the gaming and professional markets, as well as system on a chip units (SoCs) for the mobile computing and automotive market. NVIDIA is now considered the world's most valuable semiconductor company and a leader in artificial intelligence (AI) computing.

NVIDIA designs and manufactures GPUs, data processing units (DPUs), and system-on-chip (SoC) units worldwide. The company operates through two primary segments: Graphics and Compute & Networking. Its product portfolio includes GeForce for gaming, professional visualization solutions, data center platforms, and automotive AI solutions. NVIDIA also provides software platforms including CUDA, cuDNN, and TensorRT for AI development, as well as cloud services and enterprise AI solutions.

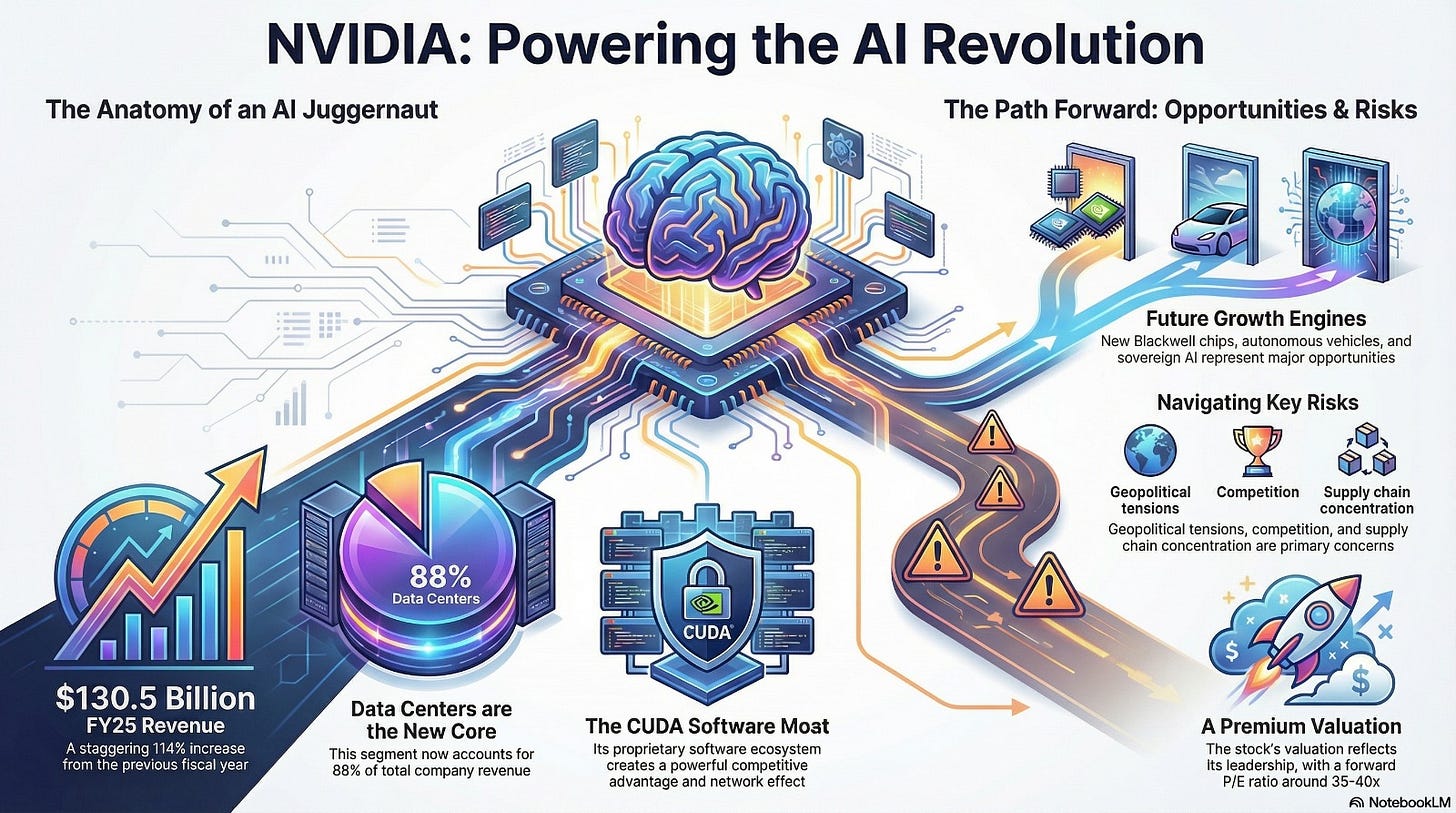

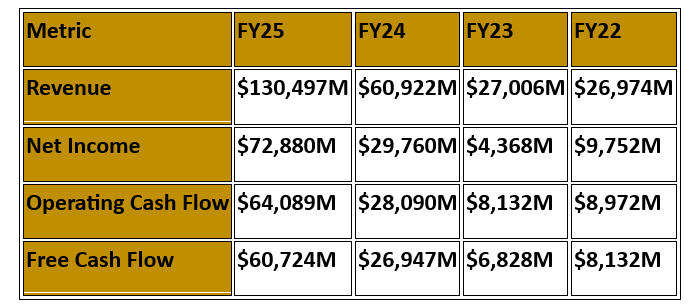

For fiscal year 2025, global revenue reached $130.5 billion, representing a 114% increase from the previous year, making NVIDIA one of the fastest-growing technology companies in the world. The company achieved this milestone primarily driven by unprecedented demand for AI computing infrastructure.

The company serves data centers, gaming enthusiasts, creative professionals, automotive manufacturers, and enterprise customers globally. NVIDIA distributes its products through authorized board partners, original equipment manufacturers (OEMs), original design manufacturers (ODMs), system builders, add-in-board manufacturers, retailers, and distributors worldwide.

Business Segments

Data Center:

AI Training & Inference

High Performance Computing (HPC)

Cloud Computing Infrastructure

Enterprise AI Solutions

Gaming:

GeForce RTX Graphics Cards

Gaming Laptops

Cloud Gaming Services

Professional Visualization:

Workstation Graphics

Virtual Workstations

Rendering Solutions

Automotive:

Autonomous Driving Platforms

AI Cockpit Solutions

Robotics Solutions

Business Segments & Revenue

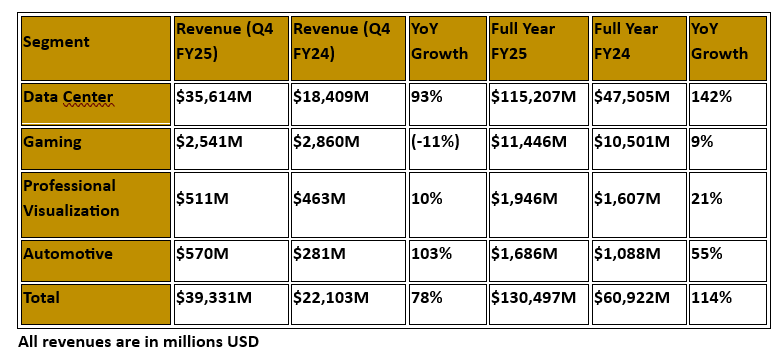

The table above shows exceptional growth across most segments, with Data Center leading the charge with 93% quarter-over-quarter growth and 142% year-over-year growth for the full fiscal year. The Gaming segment experienced a slight decline in Q4 but maintained overall positive growth for the full year. Automotive showed particularly strong growth at 103% for the quarter and 55% for the full year.

Currently, the company's biggest revenue stream is coming from Data Center sales, which accounts for approximately 88% of total revenue in fiscal 2025, a dramatic shift from previous years when Gaming was the primary driver.

How have the individual segments been performing throughout the years?

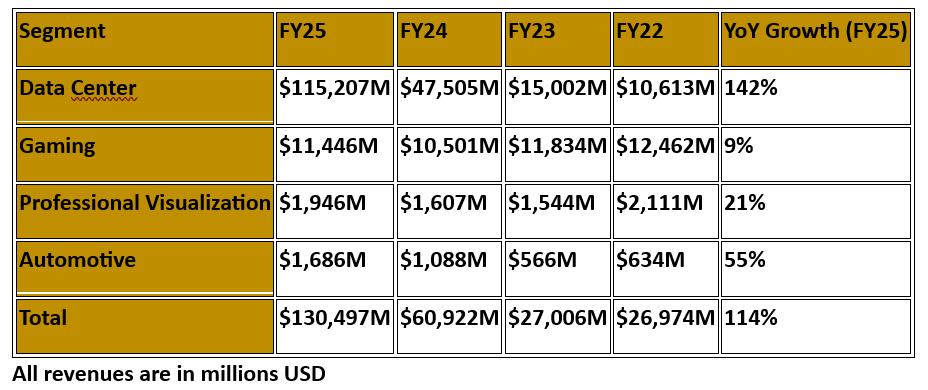

The Data Center segment has shown exponential growth, increasing from $10.6 billion in FY22 to $115.2 billion in FY25. This represents the AI boom that NVIDIA has capitalized on exceptionally well. Gaming has remained relatively stable, while Professional Visualization and Automotive show steady growth trajectories.

Is NVIDIA still a strong company?

NVIDIA has emerged as the dominant leader in AI computing due to these key factors:

First-mover advantage in AI/ML hardware

Comprehensive software ecosystem (CUDA platform)

Strong research & development capabilities

Excellent execution in scaling production

Strategic partnerships across cloud providers

During the AI boom period starting in 2023, NVIDIA experienced unprecedented growth with Data Center revenue increasing by over 1000% from pre-AI boom levels. The company successfully transitioned from being primarily a gaming graphics company to becoming the backbone of AI infrastructure globally. Major cloud service providers including AWS, Microsoft Azure, Google Cloud, and Meta have become significant customers, driving massive demand for NVIDIA's H100 and newer Blackwell architecture chips.

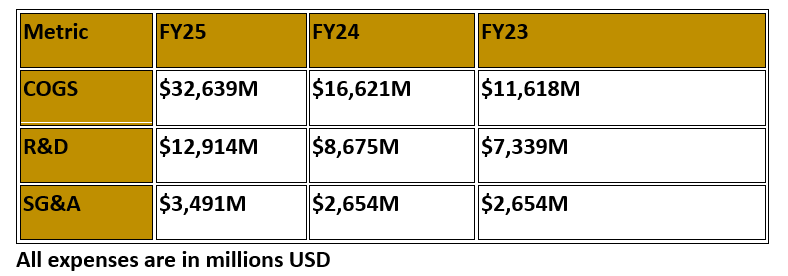

Efficiency of NVIDIA

NVIDIA Cost Structure (% of Revenue)

Range for past 3 years:

Cost of goods production: 25% to 43%

Research & Development: 9.9% to 27.2%

Sales, general & administrative: 4.4% to 9.8%

FY25 Breakdown:

Cost of goods production: 25.0%

Research & Development: 9.9%

Sales, general & administrative: 2.7%

NVIDIA demonstrates exceptional efficiency with gross margins of 75% in FY25, significantly higher than most technology companies. The company maintains strong investment in R&D at nearly 10% of revenue while keeping SG&A costs remarkably low.

Strongest Moat of NVIDIA

NVIDIA maintains the strongest competitive moat in the semiconductor industry through:

CUDA Software Ecosystem - Proprietary programming platform with millions of developers

Hardware-Software Integration - Optimized performance across the entire stack

Advanced Manufacturing Partnerships - Strategic relationships with TSMC for cutting-edge nodes

Network Effects - More users attract more developers, creating a virtuous cycle

R&D Investment Scale - $12.9B in FY25, enabling continuous innovation

Revenue Distribution by Geography (FY25)

Americas: $56.9B (44%)

Asia-Pacific: $55.3B (42%)

Europe, Middle East & Africa: $18.3B (14%)

Most of NVIDIA's revenue comes from Americas and Asia-Pacific regions, with significant exposure to data center buildouts globally. The company has navigated geopolitical tensions through export controls while maintaining strong growth.

General Finances of NVIDIA

NVIDIA has generated exceptional financial performance with revenue growing 384% from FY22 to FY25, while net income increased from $9.8B to $72.9B over the same period.

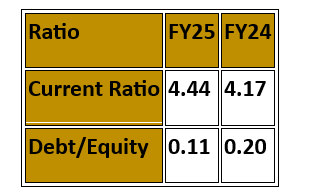

NVIDIA maintains an extremely strong balance sheet with minimal debt and substantial cash generation capabilities.

Possible Growth Opportunities

AI Infrastructure Market The global AI infrastructure market is expected to grow at a compound annual growth rate (CAGR) of over 25% through 2030, driven by increasing enterprise AI adoption, autonomous systems, and continued model scaling.

Blackwell Architecture NVIDIA's new Blackwell architecture promises significant performance improvements for AI workloads. Early demand has been described as "amazing" by CEO Jensen Huang, with billions in sales achieved in the first quarter of availability.

Autonomous Vehicles & Robotics The autonomous vehicle market and industrial robotics represent massive long-term opportunities. NVIDIA's partnerships with Toyota, Hyundai, and robotics companies position it well for this growth.

Edge AI Computing The deployment of AI at the edge through smaller, more efficient chips presents significant opportunities as AI moves from data centers to end devices.

Sovereign AI Countries building their own AI infrastructure to maintain digital sovereignty represents a growing market opportunity.

Risks

Competition in the Market

Key Risk Factors:

Geopolitical tensions and export restrictions affecting sales to China

Competition from custom ASICs developed by hyperscale customers

Cyclical nature of semiconductor demand

Potential AI bubble concerns affecting long-term sustainability

Supply chain concentration with TSMC manufacturing

Valuation

Current Metrics (as of August 2025):

P/E Ratio: ~35-40x (based on forward earnings)

Price-to-Sales: ~20x

Market Capitalization: ~$2.8 trillion

Historical Context:

NVIDIA became the world's most valuable company by market cap in 2024

Stock has experienced significant volatility but maintained strong long-term trajectory

Valuation reflects premium for AI leadership and growth prospects

Investment Outlook

NVIDIA represents a unique opportunity in the AI revolution with unparalleled market positioning. However, investors should be mindful of high valuations and potential volatility as the AI market matures. The company's strong fundamentals and dominant market position support long-term growth, but position sizing should reflect the inherent risks in high-growth technology investments.

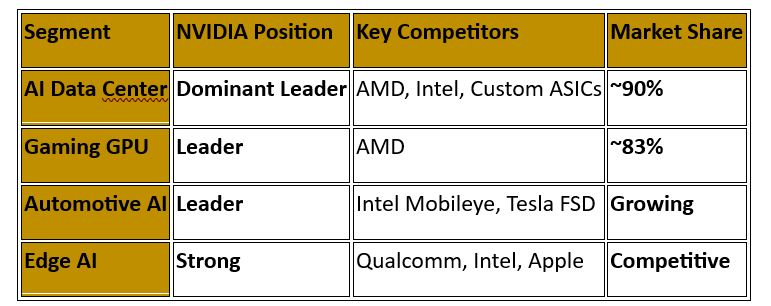

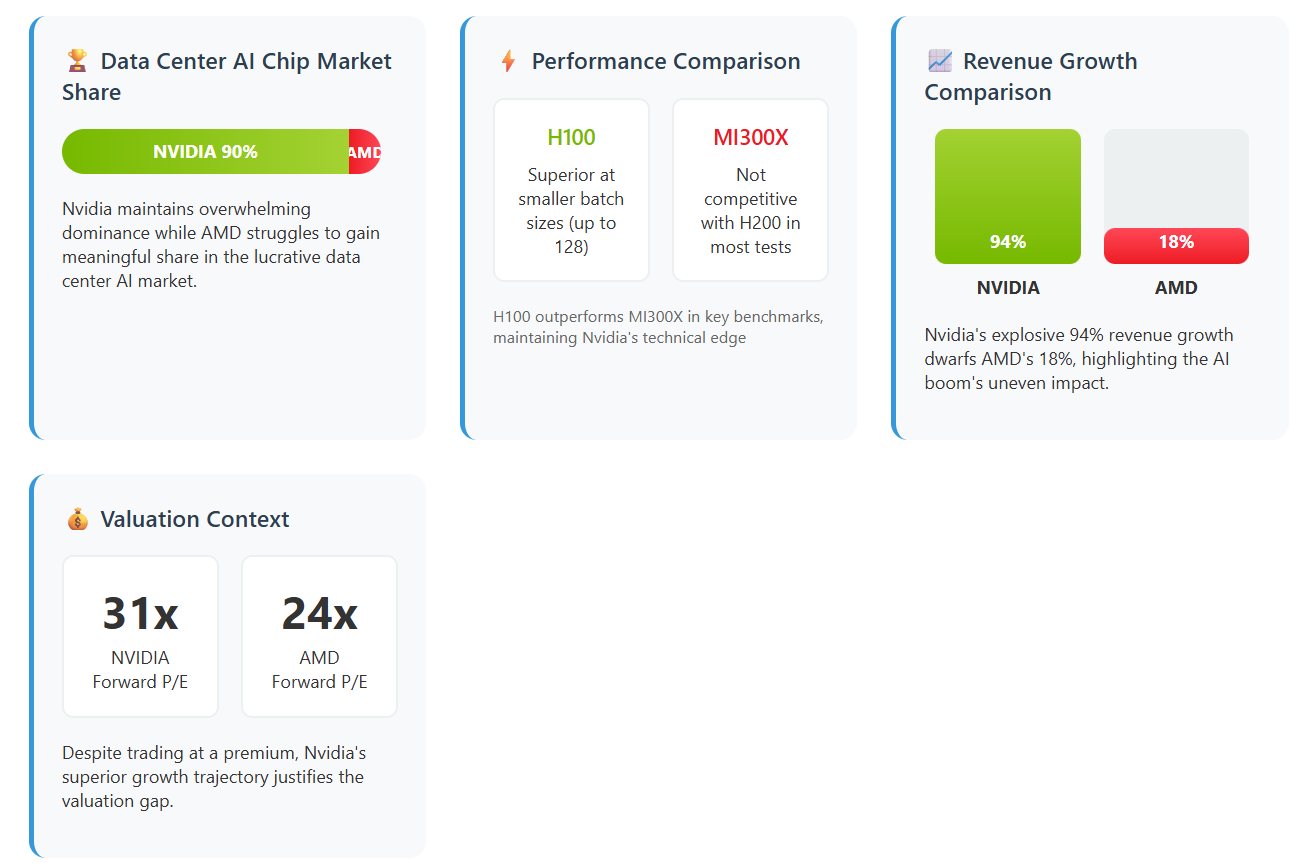

BONUS: Key AMD vs Nvidia comparisons

Market share reality: Nvidia holds over 90% of the data center AI chip market while AMD struggles to gain meaningful share

Performance metrics: H100 outperforms MI300X at smaller batch sizes up to 128, and MI300X is not competitive with H200 in most test

Growth comparison: Nvidia growing revenue 94% vs AMD's 18%

Valuation context: AMD trades at forward P/E of 24 vs Nvidia's 31, but the growth differential justifies the premium

Pricing power: Nvidia charges up to four times more for H100 GPUs than AMD's competing MI300X

Ecosystem advantage: Nvidia's dominance attributed to its full-stack solution including CUDA software

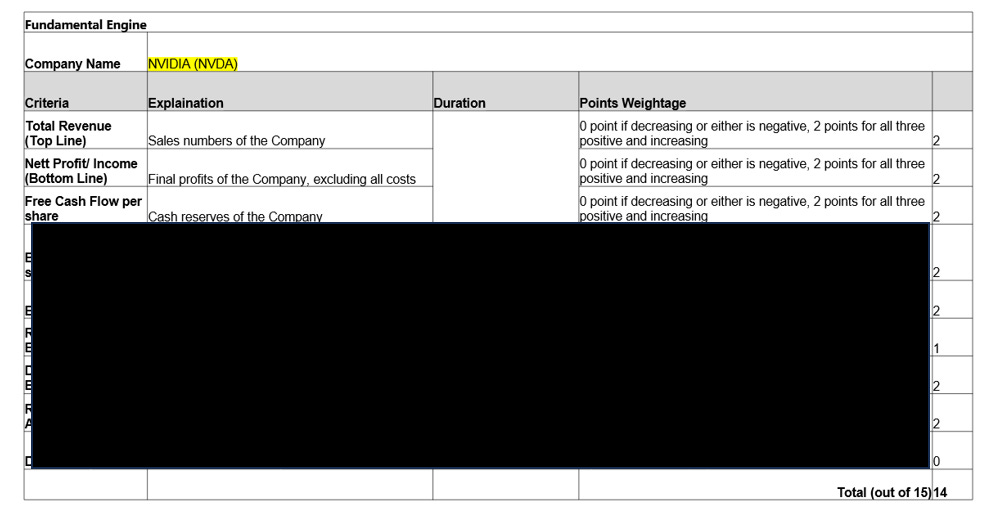

Kintsugi Analysis

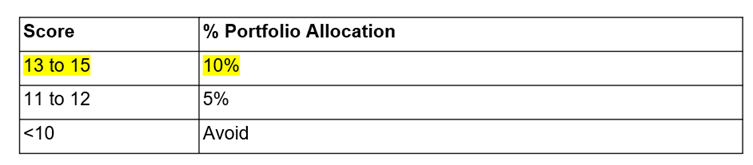

(I) Fundamental Analysis Score: 14/15

Kintsugi’s Fundamental Engine

(II) Portfolio Allocation

(III) Valuation

NOTE: We teach our fundamental analysis and valuation methods in our classes. Find out more here.

IMPORTANT DISCLAIMER: By reading this document, you agree that any information, commentary, recommendations or statements of opinion provided here are for general information and education purposes only.

The information contained in this publication are obtained from, or based upon publicly available sources that we believe to reliable, but we make no warranty as to their accuracy or usefulness of the information provided, and accepts no liability for losses incurred by readers using our case studies.

It is not intended to be financial advice, personalized investment advice or a solicitation for the purchase or sale of securities. Before purchasing any discussed securities, please be sure actions are in line with your investment objectives, financial situation and particular needs. Please do your own research and speak with a licensed advisor before making any investment decisions.

International investors may be subject to additional risks arising from currency fluctuations and/or local taxes or restrictions.

Please remember that investments can go up and down, including the possibility that a stock could lose all of its value. Past performance is not indicative of future results.