Our Monthly Portfolio Update 🎄

December 2025

Dear Investor,

Zee here. Time of the month again, to share our monthly update on our portfolio. You can read last month’s portfolio update here.

Before that, on behalf of the Kintsugi Team, here is my short Christmas message:

As the year draws to a close and Christmas arrives, I want to take a moment to thank you, not just for reading, but for thinking deeply, staying curious, and committing to the long game.

Investing, much like life, rewards patience, discipline, and the ability to stay calm when the noise gets loud. This year has reminded us that markets move in cycles, uncertainty is inevitable, and conviction matters most when it’s hardest to hold.

Christmas is a season of reflection and gratitude. It’s a time to step back from charts and headlines, to appreciate family, friendships, health, and the freedom to think independently about our future. Wealth compounds best when it’s built on clarity, humility, and sound decision-making values that matter far beyond investing.

As we head into the new year, my hope is that you continue to invest not just for returns, but for resilience, peace of mind, and long-term freedom.

Wishing you and your loved ones a joyful Christmas and a steady, purposeful year ahead.

….and Enjoy the Santa Rally.

Announcement:

Join us on Wednesday 7th Jan 2026, for our live Free webinar “ETF vs Funds sold by Insurance Companies, which is better?”.

👉🏼 Click here to reserve a spot. (LINK)

Public Portfolio Update: December 2025

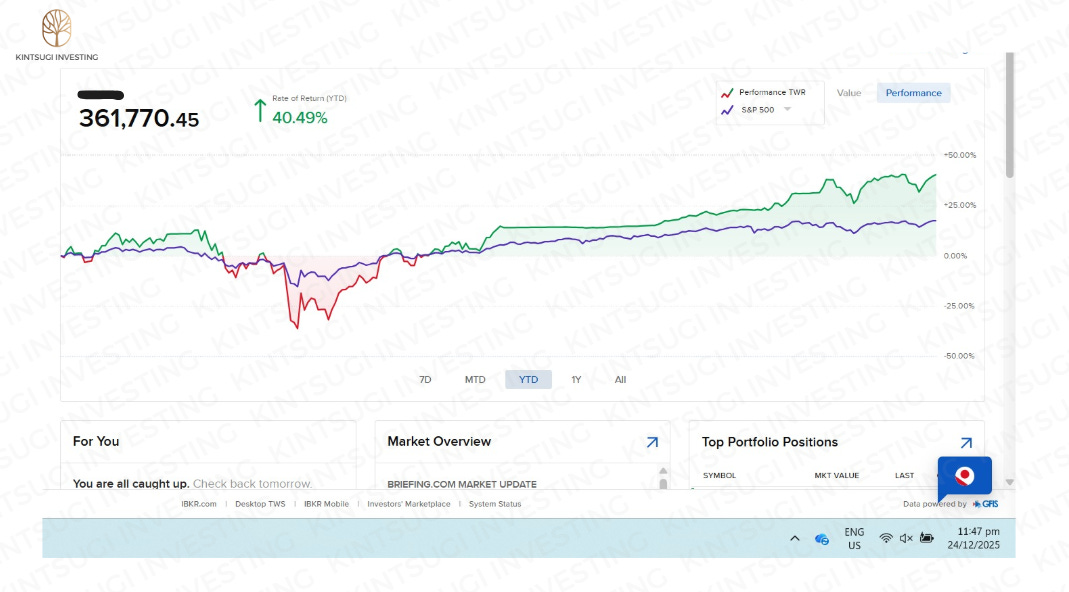

YTD performance: +40.49%

MTD performance: +1.34%

S&P500 YTD (Dark Blue line): trailing behind.

Cash left uninvested: Fully invested

Note: No new additions to the portfolio

As we close the year, here are 5 investing lessons I learnt in 2025:

1. Don’t cut your flowers and water your weeds

Most investors sell winners too early and hold onto losers, hoping they recover

The better approach:

Sell what clearly isn’t working

Let what’s working continue to run

2. The most common regret: selling great companies too soon

Even professional investors struggle with taking profits early

Truly good businesses can compound for a very long time

If the original investment thesis still holds, time is your biggest ally

3. What truly set Buffett apart (according to Famous Value Investor Klarman)

Quick and decisive thinking

Simple, clear reasoning

Deep focus, with minimal distraction

Willingness to adapt and improve over time

4. The “10 punch card” mindset

Imagine you only have 10 investment decisions in your lifetime

This forces:

Higher conviction

Better preparation

Less overtrading

Many investors diversify not for safety, but because they lack confidence in their best ideas

5. Wealth as a scoreboard, not a lifestyle upgrade

Buffett’s wealth never changed who he was: Same home, same city, same long-term friendships

Money was a way to measure results, not an excuse to change values

Great investing isn’t about doing more. It’s about thinking clearly, acting patiently, and avoiding the mistakes that quietly compound against us.

Wishing you a reflective year-end and a disciplined year ahead.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns. How we invest may not suit your investment goals and risk management profile.