7 Things Every Investor Should Know about Pop Mart (HKG: 9992)

The Billion Dollar Bunny

Dear Investor.

Zee here. What started as a quirky blind-box toy has evolved into a global investing sensation. Labubu, the mischievous elf-like character, has propelled Chinese Company Pop Mart International Group Ltd (HKG: 9992) from niche fandom to financial phenomenon.

With a market value of US$38 billion, Pop Mart now towers over household names like Barbie and Hello Kitty’s creators. But beneath the cute designs lies a serious business strategy and seven crucial points every investor should know.

On 28 Oct, we’ll be conducting a live webinar “Investing in Q4 2025 – Opportunities and Risks”. We’ll also break down a stock that’s recently dropped but may be setting up for a turnaround.

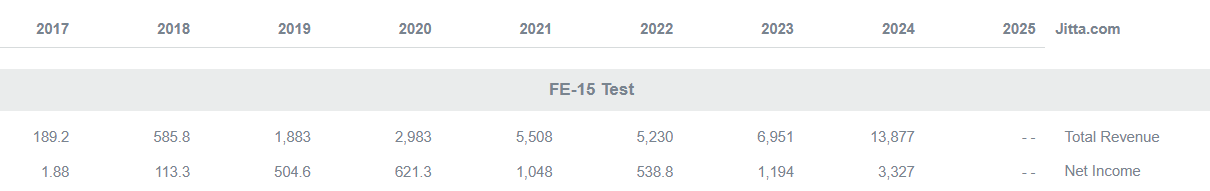

1. Explosive Financial Growth That Exceeded Expectations

Pop Mart’s financial performance in 2025 has been nothing short of remarkable. In the first half of the year, the company generated revenue of 13.88 billion yuan ($1.93 billion), representing a stunning 204% increase compared to the same period last year. Even more impressive, net profit soared 397%, reaching 4.57 billion yuan ($636 million).

These numbers didn’t just meet expectations, they shattered them. CEO Wang Ning confidently stated the company would surpass its 20 billion yuan annual revenue target and that reaching 30 billion yuan ($4.18 billion) “should also be quite easy.”

2. International Markets Are the Real Growth Engine

While Labubu started as a Chinese sensation, the real growth opportunity lies overseas. International markets now account for roughly 40% of Pop Mart’s sales, with Asia-Pacific regions seeing a remarkable 258% revenue jump and the Americas experiencing over 1,000% growth. The company expects foreign sales to surpass domestic Chinese sales in 2025, with North America projected to outperform Southeast Asia.

Pop Mart operates nearly 600 stores and 2,600 automated vending machines across more than 30 countries. The company is actively expanding into previously untapped markets including the Middle East, Central Europe, and Central/South America.

3. Labubu Is Evolving Beyond the “Blind Box” Toy

To maintain momentum, Pop Mart is strategically expanding Labubu’s product ecosystem.

The company launched a miniature version of Labubu designed to clip onto mobile phones, following Labubu’s previous popularity as a handbag charm. Additionally, Pop Mart has collaborated with major international brands including Uniqlo, Disney, and Coca-Cola to create exclusive Labubu editions.

The company has released over 300 different Labubu styles since 2019 and is actively investing in animated series and theme park attractions to deepen the character’s cultural reach.

4. Celebrity Endorsements Drive Viral Growth

Labubu’s status as a luxury accessory has been solidified by high-profile celebrity endorsements. Stars including Rihanna, Blackpink’s Lisa, David Beckham, Kim Kardashian, Dua Lipa, and Marc Jacobs have been spotted carrying Labubu toys, providing the company with millions of dollars worth of free publicity. These endorsements transformed Labubu from a collectible toy into a fashion statement.

Celebrity adoption expands market appeal beyond typical toy buyers to fashion-conscious consumers willing to pay premium prices. This broader audience increases the addressable market.

5. The “Blind Box” Model Keeps Customers Coming Back

Pop Mart pioneered the “blind box” concept where customers purchase mystery boxes containing toys without knowing which specific version they’ll receive. These boxes sell for $10 to $20 and encourage repeat purchases as collectors hunt for rare editions. This scarcity-driven model has been brilliantly executed—products frequently sell out in stores worldwide, and some rare versions command resale prices over 2,000% above retail.

However, Pop Mart is now intentionally increasing production from 3 million units monthly to 30 million—a tenfold increase. This decision aims to reduce scalper markups and make toys more accessible to genuine fans, shifting the focus from speculative investment to sustainable consumer enjoyment.

The blind box model creates a psychologically engaging purchase experience that drives higher profit margins. The production scaling suggests management is prioritizing long-term brand health over short-term speculation premiums.

6. Massive Success on E-Commerce Platforms Like TikTok Shop

Pop Mart’s digital expansion is equally impressive. On TikTok Shop in the United States alone, the company’s sales have exploded from $429,259 in May 2024 to $4.8 million in May 2025, representing a 1,128% increase. By June 2025, Pop Mart surpassed $5.5 million in monthly sales on the platform. The company’s 2025 TikTok Shop revenue has already quadrupled its entire 2024 annual performance on that channel.

Strong e-commerce performance demonstrates the ability to reach customers directly and potentially with higher margins. TikTok’s young, engaged user base aligns perfectly with Pop Mart’s target demographic.

7. Significant Market Risks Remain Despite Growth

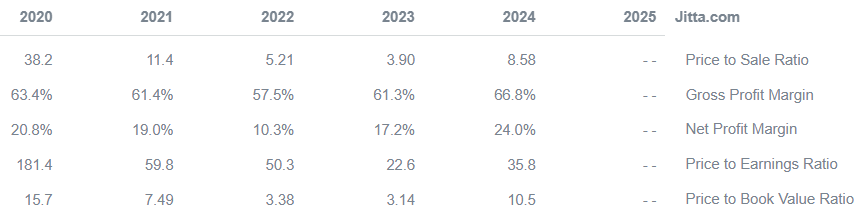

While the growth story is compelling, important headwinds exist. Some analysts worry about the long-term sustainability of the Labubu craze, noting that toy trends can shift rapidly.

JPMorgan analysts warned that the company’s valuation was “priced for perfection” and that any misstep could trigger underperformance. The stock has already experienced volatility, losing nearly a quarter of its value from its August peak.

Additionally, China’s government has scrutinized blind-box toys, suggesting potential regulations requiring age verification and parental consent for purchases targeting young children. Consumer preferences can also change unpredictably—what’s hot today may be forgotten tomorrow.

The Bottom Line

Pop Mart represents a fascinating case study of how a well-executed brand strategy, international expansion, and consumer psychology can create explosive growth.

The company’s fundamentals are strong, international expansion is accelerating, and management has clear plans to evolve the Labubu brand beyond collectible toys. However, the stock’s valuation already reflects very optimistic expectations.

IMPORTANT DISCLAIMER: By reading this document, you agree that any information, commentary, recommendations or statements of opinion provided here are for general information and education purposes only.

The information contained in this publication are obtained from, or based upon publicly available sources that we believe to reliable, but we make no warranty as to their accuracy or usefulness of the information provided, and accepts no liability for losses incurred by readers using our case studies.

It is not intended to be financial advice, personalized investment advice or a solicitation for the purchase or sale of securities. Before purchasing any discussed securities, please be sure actions are in line with your investment objectives, financial situation and particular needs. Please do your own research and speak with a licensed advisor before making any investment decisions.

International investors may be subject to additional risks arising from currency fluctuations and/or local taxes or restrictions.

Please remember that investments can go up and down, including the possibility that a stock could lose all of its value. Past performance is not indicative of future results.