The Cheapest S&P 500 ETF You Can Buy Today

So you’re hunting for the lowest-cost S&P 500 ETF out there? Let’s talk fees, winners, and why your wallet might smile.

Dear Investors,

Zee here. Let’s be honest, nobody likes paying more than they have to. Especially not when it comes to investing. The beauty of owning the S&P 500 is that you’re already buying a slice of America’s biggest and best companies…. so why hand over extra fees to do it?

The good news: there’s an S&P 500 ETF out there today that’s so cheap, it practically whispers, “I’m here to make you richer, not poorer.” Over time, those tiny savings can quietly grow into a pretty impressive sum, without you lifting a finger.

In our 3rd issue, we’ll uncover the cheapest S&P 500 ETF you can buy right now and show you why every basis point saved matters more than you think.

Let’s jump in.

🔍 Who’s Playing in the Money-Saving Arena?

First off, all these ETFs track the same index the crème de la crème of U.S. stocks but fees vary by provider.

SPDR Portfolio S&P 500 ETF (SPLG) currently offers an ultra-low 0.02% per annum expense ratio, making it the cheapest pure S&P tracker around .

Close on its heels are Vanguard S&P 500 ETF (VOO) and iShares Core S&P 500 ETF (IVV), both charging just 0.03% per annum, and boasting gigantic assets under management hundreds of billions .

🏛️ What’s the Trade‑Off with SPLG?

Lower cost: yes. But SPLG is still less liquid than SPY, IVV, or VOO .

SPY, the original S&P 500 ETF launched in 1993, charges 0.09% per annum, yet remains the most heavily traded and liquid option, making it a favorite for active traders or institutional players .

🧠 Why Should You Care About These Tiny Fee Differences?

It might seem trivial: 0.02% vs. 0.03%. But over decades and with large amounts, that difference adds up. For instance, on a $100,000 investment over 10 years, you might pay ~$90 less per year in fees with SPLG instead of SPY—and that compounds alike .

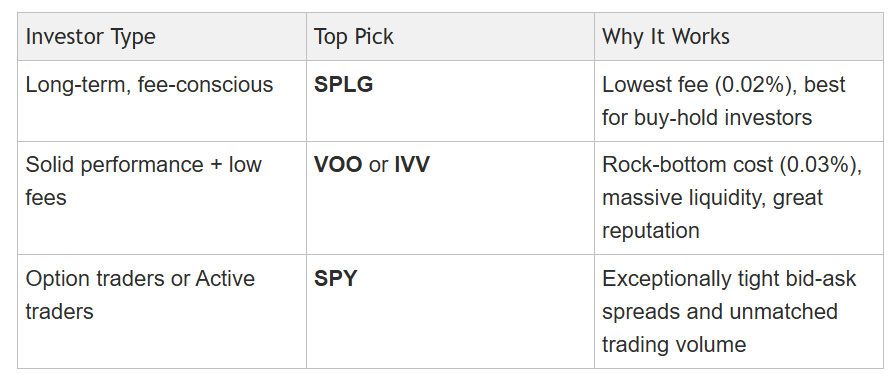

✅ Who Should Consider What?

🌍 What About Investors Outside the U.S.?

You might consider UCITS‑compliant ETFs such as SPDR’s SPY5 or SPYL, which also offer 0.03% expense ratios and carry tax efficiencies like avoiding U.S. estate and withholding taxes

Investors can also consider leaning toward iShares Core S&P 500 UCITS ETF (Acc) or Vanguard S&P 500 UCITS ETF, typically around 0.07% Total Expense Ratio (TER), combined with accumulating share classes to avoid dividend withholding tax complications . Still, SPY5 or SPYL now often beat those on cost.

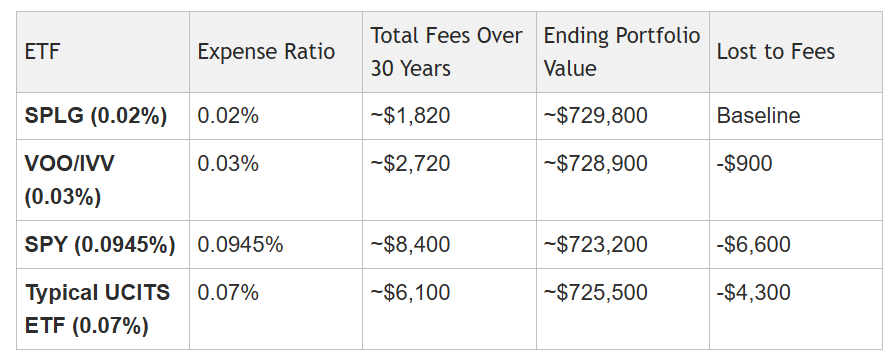

💰 1. How Much Does That 0.01% Actually Cost You?

Let’s say you invest $100,000 for 30 years, and your portfolio grows 7% annually before fees. Here's how tiny fee differences stack up:

📌 Even a 0.01% fee difference = ~$900 more in your pocket over 30 years. So yes, fees matter.

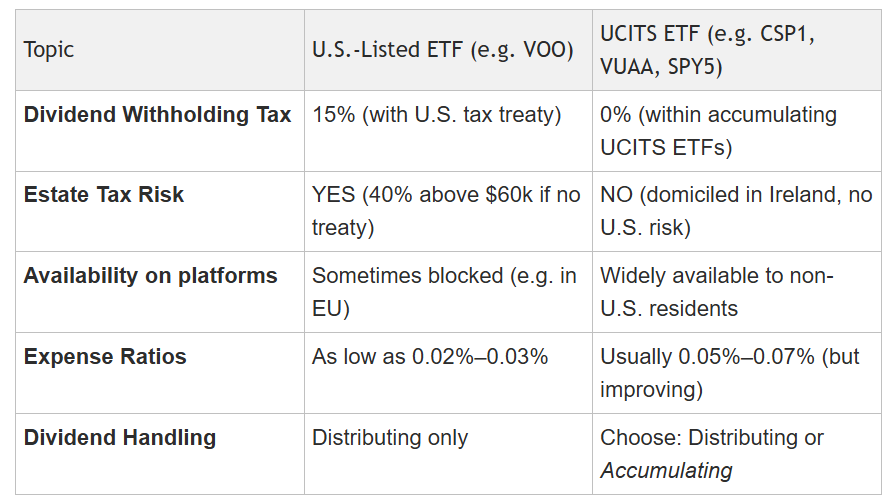

🌍 2. US Listed vs. UCITS ETFs: What International Investors Need to Know

If you’re and investor outside the U.S. , you have a big tax and legal reason to avoid U.S.-listed ETFs even if they’re cheaper.

⚠️ Example:

If you’re a non-US citizen investor and hold VOO (U.S.-listed):

You’ll pay 15% dividend withholding.

If you die with >$60,000 in U.S. ETFs, 40% estate tax kicks in 😨.

If you hold SPY5 (UCITS ETF) instead:

No dividend withholding (if accumulating class).

No U.S. estate tax risk.

🧠 Bottom line: Slightly higher TER is often worth it to avoid thousands in tax headaches.

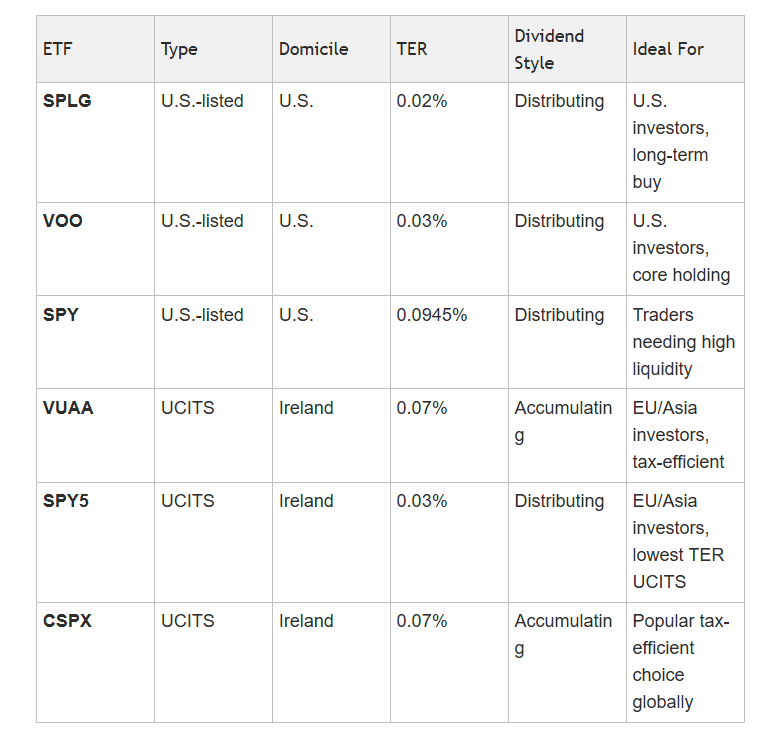

⚖️ 3. ETF Comparison Table: What Should You Pick?

🧾 Final Word

Best pure S&P 500 ETF if you care only about cost: SPLG at just 0.02%, ideal for long-term, passive investing.

Best blend of cost + liquidity: VOO or IVV, both at 0.03% with good trading volumes.

If you trade actively or use options: stick with SPY for its liquidity and narrow spreads, even though fees are higher.

Non-U.S. investors: look into UCITS ETFs like SPY5 or SPYL (0.03%), which are tax efficient and low cost.

P.S. Want to go beyond just buying the cheapest S&P 500 ETF?

Knowing where to put your money is important but knowing when and how to boost your returns is the real game-changer. That’s exactly what we teach inside, our signature investing programs that shows you how to build a market-beating portfolio without spending hours glued to the screen.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.