The Jackson Hole Speech That Changed Everything

What This Means for You?

Dear Investor,

Zee here. After two decades watching Federal Reserve chairs deliver carefully crafted speeches that move markets by fractions, you develop an ear for when something truly significant is happening.

Last Friday, at Jackson Hole, Wyoming in the United States., Jerome Powell delivered what will likely be remembered as one of the most consequential Jackson Hole addresses in the symposium's 47-year history.

This wasn't just another Fed speech about data dependency and measured approaches. This was Powell's final show, his final Jackson Hole keynote as Fed Chair and he used it to fundamentally reframe how we should think about monetary policy in an era of unprecedented economic complexity.

Markets only needed one phrase.

Jerome Powell said the Fed “may need to cut rates” as the labour market weakens and inflation pressures ease. That was all Wall Street needed to hear.

Within hours:

Odds of a September cut surged to over 85%.

The S&P 500 ripped higher, closing the week at fresh highs.

Treasury yields dropped, pulling the dollar down with them.

And in classic risk-on fashion, Bitcoin and Ethereum spiked.

The Fed Chair didn’t just talk policy, he shifted the entire market’s psychology.

The Labor Market: A “Curious Balance”

Powell’s description of the jobs market stuck with me: a “curious balance.”

Job creation has slowed sharply: from an average of 168,000 per month in 2024 to just 35,000 per month this year.

Unemployment has ticked up but remains stable at ~4.2%.

Both supply and demand in the labor market are cooling at the same time.

A weaker job market is not something to cheer for:

Yes, lower rates can boost stock prices

Yes, that’s good for valuations in the short term

But let’s not forget these:

Slower hiring

Rising unemployment

Cautious business spending

Layoffs

Powell even said it himself: If job market risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.

Inflation and Tariffs: One-Time Bumps

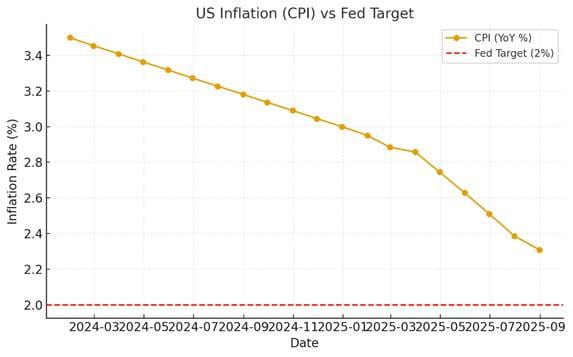

Yes, tariffs are pushing some prices higher. But Powell framed them as a “one-off adjustment”, not a structural inflation risk.

That distinction matters. If markets believed tariffs would unanchor inflation expectations, rate cuts would be off the table. Instead, Powell signaled confidence that inflation is contained.

CPI vs Fed Target inflation easing back toward 2%.

A Pivot Back to Basics

Powell also used the stage to quietly announce a policy framework shift:

Out: Flexible Average Inflation Targeting (FAIT), which allowed inflation to “run hot” post-pandemic.

In: Old-school Flexible Inflation Targeting, reaffirming a hard 2% goal.

That’s the Fed returning to orthodoxy. Why? Likely because FAIT was politically messy, it was misunderstood, and it left Powell open to criticism for “letting inflation run.”

What This Means for You?

Borrowers: Cheaper loans are coming. Mortgages, credit cards, and personal loans could all see rates ease.

Savers: Lock in today’s high yields. When cuts hit, bank CDs and savings APYs will slide.

Investors: Risk assets are back in favour. Tech, growth stocks, and crypto are the obvious winners.

Powell’s Legacy: He’ll be remembered for two things: taming inflation after the pandemic, and preserving Fed independence under political fire.

The Unanswered Question

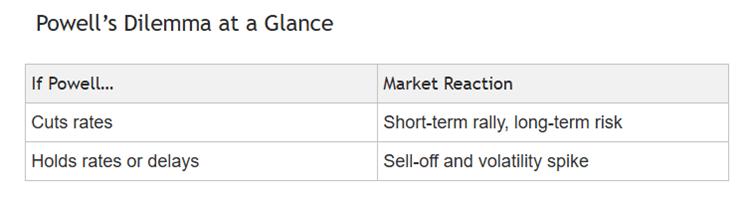

September’s cut now feels inevitable. But the real question is what comes after:

Does the Fed under new leadership stay on Powell’s cautious path?

Or does political pressure force a more aggressive easing cycle?

Not everyone agrees with Powell's approach. Critics argue that the Fed is abandoning its inflation-fighting credibility just when it's needed most, and that acknowledging the limitations of monetary policy could become a self-fulfilling prophecy.

A Trump-appointed successor in 2026 could tilt policy looser, but they'll have to contend with the framework Powell established. Any dramatic deviation from the approach outlined at Jackson Hole would require explicit justification, creating political and market costs.

Final Thoughts

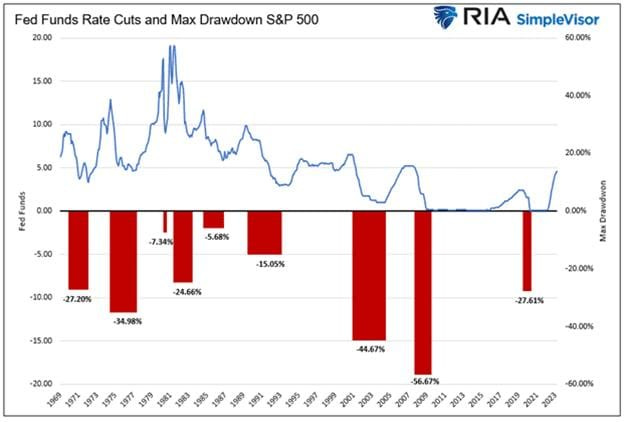

The market wants rate cuts. But it also wants strong earnings, confident consumers, and stable growth.

The chart below shows how rate cuts often precede a market pullback.

How to take advantage of this?

Stay focused, get educated.

(i) Target quality businesses

(ii) Track labour and inflation data closely

(iii) Manage risk prudently, and avoid chasing rate-cut hype

(iv) Explore Index Investing

P.S. Want to get financially educated fast? Our investing programs guide you step by step, just practical moves on both ETF and Stock Investing in just 4hrs.

Disclaimer: All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.