The Real Secret Behind Stock Price Movements

It’s Not Just News or Earnings.

Dear Investor.

Zee here. Ever wondered why stock prices jump around so much during the day?

Most people think stock prices move because of big news, investor sentiment, or the economy. And while those factors play a role, they’re not the real engine behind market movement.

Beneath every price tick lies a simple negotiation between buyers and sellers, each trying to outbid the other. Once you understand this negotiation and how it behaves under stress, urgency, or surprise, you begin to see the market in a completely different way.

Announcement:

Join us on Tuesday 9th Dec 2025, for a live webinar “How to invest in 2026”.

This will be our LAST live webinar for the year. We will feature a special guest to share about investing in Gold.

👉🏼 Click here to reserve a spot. (LINK)

It’s All About the Negotiation

Most people imagine the stock market as a smooth line moving up and down. But in reality, prices jump, stall, surge, or collapse because of one core truth:

Stocks move because buyers and sellers are constantly negotiating.

Everything else, news, algorithms, earnings is simply fuel that changes how badly each side wants to trade.

A stock market is really just a giant marketplace. At every second:

Someone wants to buy

Someone wants to sell

And both sides are trying to get the best possible deal

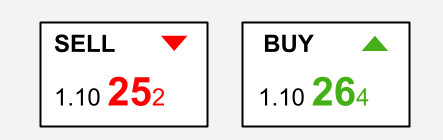

This negotiation shows up through two prices:

Bid (Buy) — the highest price a buyer is willing to pay

Ask (Sell) — the lowest price a seller is willing to accept

If Apple is trading with a bid of $250.00 and an ask of $250.05, that tiny 5-cent gap is the spread.

When you place a market order, you take the price that’s already available. Buyers hit the ask, sellers hit the bid.

If more and more buyers keep hitting the ask while sellers refuse to lower their price, the market is forced to move upward to find equilibrium. This is how price “walks” from level to level.

But sometimes, price doesn’t walk, it jumps.

Why Stocks Gap: The Overnight Jump Explained

Ever check a stock at night and wake up to a completely different price?

That sudden leap is a price gap, and it happens because markets close but information never sleeps.

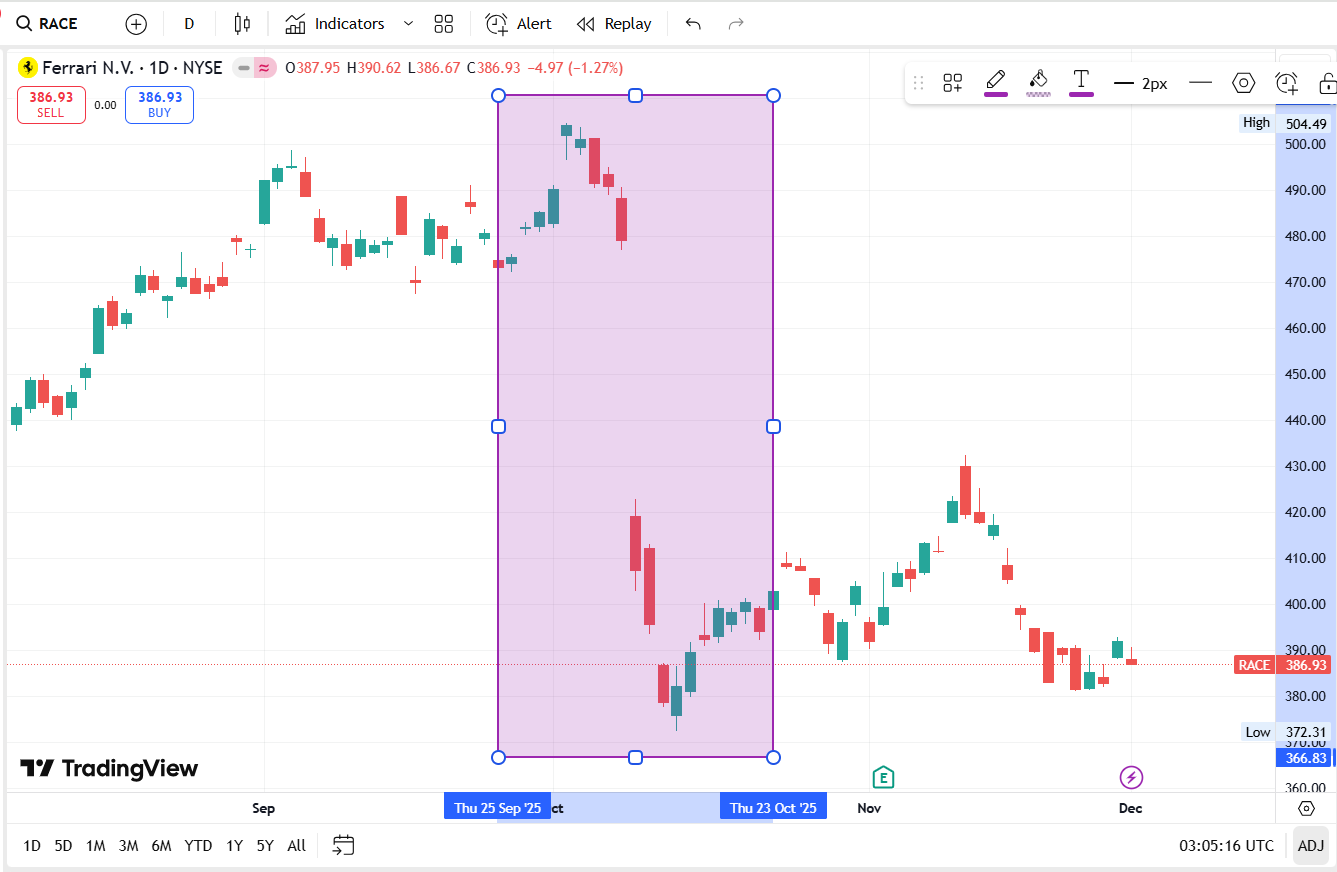

An example of price gap down in Ferrari stock recently due to post-market news on lower earnings estimates.

How a gap forms

Imagine a stock closes at $50. After the bell, the company announces a major contract. By the next morning:

Sellers demand more for their shares

Buyers are willing to pay more

The old price is no longer acceptable

The first trade prints at $55. No gradual climb, just a jump. The market simply reprices instantly to reflect the new information.

Lets take a look at an actual example below. There was a gap up in Intel shares when the US government announced investing an 10% stake. You can read more about it here.

Trading Doesn’t Stop When You Think It Does

Regular U.S. hours run from 9:30 AM to 4:00 PM ET, but the reality is:

Pre-market starts as early as 4:00 AM

After-hours runs until 8:00 PM

Some brokers even offer overnight access

The catch? These sessions are thin. With fewer traders and wider spreads, a single order can move prices dramatically. That’s why after-hours charts can look chaotic compared to regular trading.

When regular hours resume, when liquidity returns, prices often settle.

What Causes Gaps and Sharp Moves?

1. Order Imbalances

If there are many more buyers than sellers (or vice versa), the market must “jump” to the nearest level where both sides agree.

2. Major Information Shocks

Earnings surprises, analyst upgrades, regulatory news, mergers, geopolitical events, anything that changes how the market values a company.

3. Thin Liquidity in Off-Hours

With fewer participants, prices become much more sensitive to even small orders.

4. Algorithmic Reactions

High-speed systems adjust instantly to new data, often moving faster than human traders.

The Market’s Safety Brakes

During extreme volatility, the various stock market exchanges built-in protections to prevent panic spirals.

For the entire market:

A 7% drop → trading paused 15 minutes

A 13% drop → another pause

A 20% drop → the market closes for the day

Individual stocks have their own “limit up/limit down” rules to prevent wild swings from a single order or sudden imbalance.

The Behind-the-Scenes Players That Shape Price

(1) Market Makers

They constantly post bids and asks to ensure trading flows smoothly.

They earn from the spread.

But in chaotic moments, they may pull back, causing spreads to widen and volatility to spike.

(2) Trading Algorithms

Algorithms execute most modern trades. They:

react to news instantly

identify short-term patterns

shift large volumes in seconds

This can magnify price swings far beyond what human traders expect.

(3) Dark Pools

Large institutions use private market transactions to avoid revealing their intentions. When these huge trades eventually influence the public market, prices can adjust suddenly and sharply.

Bottom Line

Every price tick up or down, is simply the result of a negotiation:

What buyers are willing to pay

What sellers demand

And who is more urgent at that moment

When a stock moves 5% in minutes, it’s not magic, luck, or chaos. It’s a new meeting point between the two sides.

Short-term price movement is almost never about a company’s true worth.

It’s about the current balance of power, sentiment, and urgency.

Once you understand that:

volatility becomes less frightening

gaps make sense

wild swings feel less mysterious

You begin to see the market not as randomness, but as a continuous auction, constantly adjusting to new information and human emotion.

Disclaimer: All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.