Unpacking the Index: How to Live Off the S&P 500

Can You Really Live Off the S&P 500? Here's the Playbook.

Dear Investor,

Zee here. This week, Howie and I will talk about the question that many of our readers and students ask us: How do we live off our portfolio?

We will demonstrate this by using an example portfolio that is fully invested in the S&P500 index.

You will see how powerful yet surprisingly easy to follow this strategy is.

Since 1 issue is not enough to complete the article, we break it down into 4 newsletter issues sent to you each week.

Enjoy this, and let us know what you like about this strategy!

Introduction

Welcome to our 4-part series where we dive into what really makes the S&P 500 tick. Whether you're just getting started with investing or you've been in the game for years, this series aims to give you a clearer, more practical take on the index we all know and watch.

We’ll unpack its history, performance, strategies, and more. And if you're part of our investing community or considering joining, you’ll find this series a helpful complement to the hands-on lessons in our programs.

So, what is an index anyway?

Before we get into living off the S&P 500, let’s quickly look at the three major U.S. stock indices.

1. Dow Jones Industrial Average (DJIA)

The oldest of stock indices. It tracks 30 big-name companies like Apple and Coca-Cola. It’s price-weighted, which means stocks with higher prices sway the index more. It’s a classic gauge of the economy, but doesn’t always capture the tech-heavy world we live in today.

2. S&P 500

The S&P 500 includes 500 of the largest U.S. companies. It’s market-cap weighted, so bigger players like Microsoft and Amazon have more say in how the index moves. Thanks to its size and spread across industries, this one’s the go-to benchmark for most investors.

Source: Finviz.com

3. Nasdaq-100

Tech lovers, this one’s for you. The Nasdaq-100 focuses on 100 of the largest non-financial companies on the Nasdaq exchange. It’s packed with names like NVIDIA and Meta. Think of it as a reflection of innovation and future-facing businesses.

How to Invest in These Indices

You can’t directly buy the index, but you can invest in ETFs (Exchange-Traded Funds) that track them. Here are some examples:

If you’re wondering which to choose, we think a combo of S&P 500 (VOO) and Nasdaq-100 (QQQ) works beautifully. VOO gives you the solid, diversified core. QQQ brings the innovation and growth.

VOO is the foundation. QQQ is the accelerator.

Is it really possible to live off the S&P 500?

Short answer: yes, for some people.

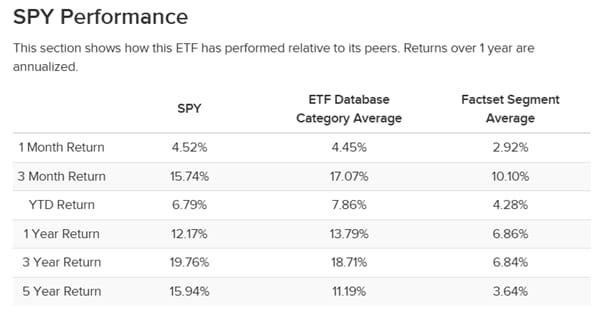

Historically, the S&P 500 has returned around 10 to 11% annually before inflation. In the last 5 years, thanks to the AI and tech boom, SPY has done even better, averaging 15.94% annually

Source: etfdb.com

But past returns aren’t guaranteed. The trick is how you plan and withdraw.

How to Live Off the S&P 500: A Simple Guide

1. Start with a Portfolio That’s Big Enough

You’ll need a portfolio that can fund your lifestyle. One of our past students has been using a 6% withdrawal rate successfully since 2018.

Let’s break it down:

Need $20,000 per year?

You’d aim for a $333,000 portfolio.

Formula: Annual expenses ÷ 0.06 = Target Portfolio Size

We’ve built a calculator to help you run your own numbers:

👉 Try the Calculator

2. What if You Don’t Have That Kind of Portfolio?

Here’s where it gets interesting. You can use option-selling strategies to enhance your income.

Selling covered calls or cash-secured puts can potentially bump your returns from 10% closer to 15% to 25% annually. It’s not magic, but it works with the right skills.

It’s not for everyone. You’ll need:

Some comfort with active trading

An appetite to learn

The ability to manage risk

We teach this in our Accelerate Program. Check it out if you want to go deeper into this kind of strategy.

3. Stick to Reputable Index Funds

Don’t get fancy. Don’t throw everything into one meme stock or exotic ETF. Stick to proven, low-cost funds that mirror the S&P 500. You want:

Low fees

Broad diversification

Steady long-term growth

4. Withdraw the Smart Way

There are two main ways to fund your lifestyle:

Dividends, which yield about 1.5% to 2% annually

Selling shares, when needed, in small amounts

Combined, this can provide the cash you need each year.

5. Be Ready for Volatility

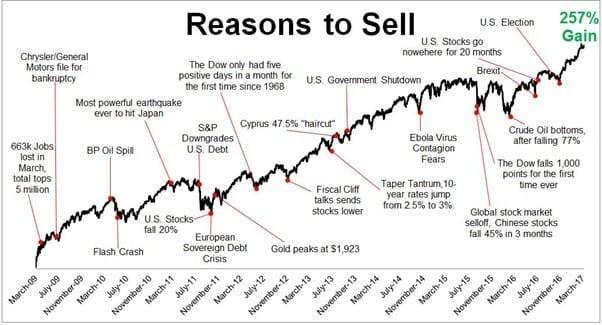

The market won’t go up every year. There’ll be corrections, crashes, recessions. That’s part of the ride.

To protect your cash flow:

Keep 1 to 2 years of expenses in cash or short-term bonds

Withdraw less in bad years, a bit more in good years

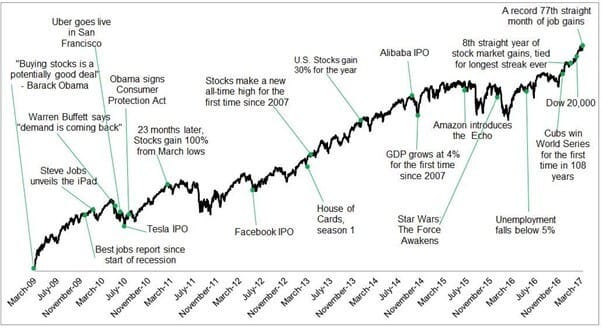

Markets react to news. But long term, they go up. The U.S. stock market has always climbed the "wall of worry."

Source: Michael Batnick, “Wall Of Worry” Chart of US markets

Source: Michael Batnick, “Reasons to Buy” chart of US markets

6. Rebalance Your Portfolio

If your S&P 500 holdings grow too large, your portfolio could get lopsided. Rebalance once a year to stay in line with your goals. You might also want to mix in some international stocks or bonds for added stability.

Final Thoughts

Living off the S&P 500 is doable, but it takes intention.

It’s not about quick wins. It’s about consistency, discipline, and a long-term mindset. If you can manage the ups and downs, this strategy can give you freedom, flexibility, and a future that isn’t chained to a paycheck.

P.S. We teach our students how to build a low-effort portfolio using ETFs and some stocks and still beat the market in our course Intellivestor, check out the details here.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.