Has Tesla Hit the Brakes or Just Changing Gears?

What's next for Tesla after paying Elon $1Trillion.

Dear Investors.

Zee here. This week, all eyes are back on Tesla as Banks downgrade its estimates (see below infographics).

Tesla continues to sit at the crossroads of innovation, competition, and investor anxiety, and every shift, whether in strategy, pricing, technology, or leadership tone. Markets remain sensitive to even small moves, and Tesla’s latest developments have once again raised the question: is the company entering a new chapter or simply adjusting its pace?

In this issue, we welcome back our newly minted father + resident Analyst Aaron, who will do a deep dive on what’s been unfolding, why it matters, and how investors can make sense of the noise and what they might mean for the months ahead.

Earlier in November, 77% of shareholders voted to support CEO Elon Musk’s trillion dollar package. While a trillion dollars seem like a huge paycheck, it is far from guaranteed. To unlock the full package, Musk has to achieve the following operational and market capitalization milestones over the next 10 years:

● $8.5 trillion market cap (currently $1.4 trillion)

● 20 million vehicles delivered (estimated 7 million today)

● 10 million active subscriptions for full self-driving

● 1 million Optimus robots delivered

● 1 million Robotaxis commercially deployed

This aggressive package incentivizes a complete shift from automaker to AI powerhouse, but its success hinges entirely on commercializing two highly challenging ventures: Robotaxis & Optimus.

Tesla then and now

Tesla began with a mission to accelerate the world’s transition to sustainable energy. Over the decade, it has transformed from being a niche EV manufacturer into the world’s largest, supported by a fast-growing ecosystem spanning automotive, energy storage, solar, software, and now - robotics and artificial intelligence.

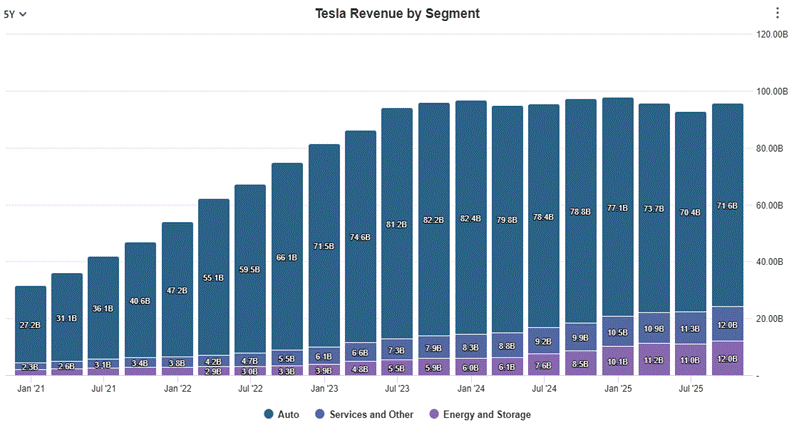

Initial revenue growth

Tesla’s annual revenue has surged from $4.05 billion in 2015 to $97.7 billion in 2024, reflecting the scale unlocked by the Model 3 and Model Y. The company’s revenue is mainly generated from automotive sales, supported by energy & storage and other services.

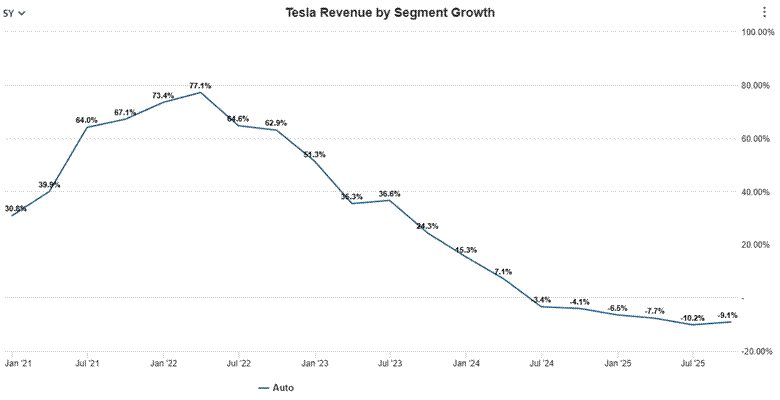

Compressed margins & slowing automotive sales

As sales volumes rose, Tesla expanded margins through manufacturing scale, software and energy services. But margins have recently shown more volatility due to product mix, price competition in some markets, and production costs.

Vehicle deliveries climbed from 50,500 units in 2015 to 1.81 million in 2023, before experiencing a slight pullback with 1.789 million delivered in 2024. This is mainly due to rising global EV competition, especially in China, causing the automotive segment to display negative growth as of late 2024.

The Next Frontiers: Autonomous Driving & Robotics

Robotaxis & Full-self driving: The next profit engine

Tesla’s robotaxi and full self-driving (FSD) initiatives represent what could become the company’s most profitable business segment by the end of 2030. Tesla currently generates an estimated $3-4 billion annually from FSD sales and subscriptions, but the revenue potential grows exponentially if the company achieves supervised or unsupervised autonomy at scale.

In a moderate-adoption scenario where 10% of Tesla’s global fleet subscribes to FSD by 2030, Tesla could generate $12 billion annually from software alone, given an estimated average revenue per user (ARPU) of about $1,500 annually, including subscription and amortized upfront purchases.

Fleet participating

● Tesla has approximately 7 million cars globally, assume 10% are robotaxi / FSD-enabled = 0.7 million vehicles

Utilization-adjusted active Robotaxi fleet

● With 40% utilization, 0.7 million vehicles effectively generate ride-hailing revenue for ~280,000 vehicles in “full usage” terms.

Revenue from Robotaxis

● If each active robotaxi-equivalent generates $40,000/year, then: 280,000 x $40,000 = $11.2 billion/year

FSD subscription revenue

● For all 0.7million participating vehicles, assume a $1,500/year ARPU = 700,000 x $1,500 = $1.05 billion/year

Total combined revenue (Robotaxi + FSD)

● $12.25 billion/year in this scenario.

If Tesla succeeds in launching a fully functional robotaxi network in a handful of major cities, the economics can shift dramatically. At an estimated utilization rate of 50%, a robotaxi can generate $40-60,000 in gross annual revenue, implying $20-30 billion in high-margin service revenue by 2030 with just 1-1.5 million active robotaxi-enabled vehicles.

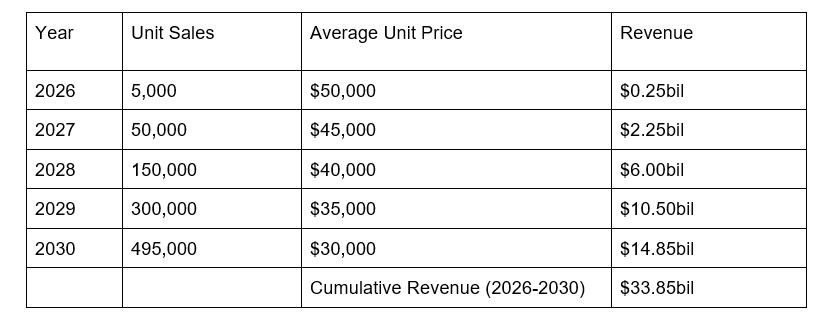

Optimus launch: The humanoid revolution

Tesla has publicly positioned its humanoid robot “Optimus” as its key strategic product and intends to start selling it in 2026 to enterprises and eventually consumers. The company aims to produce 1 million units by 2030 and expects unit costs to come around $20,000 - $30,000 when scaled to mass production.

In order for Tesla to achieve the targets mentioned above, it will have to increase production from zero to roughly half a million per year by 2030. Production costs per robot is also expected to be high in the early years, similar to EVs when unit cost per car decreased from $80,000 in 2017 to approximately $35,100 in 2024. As production scales, higher volumes should drive down costs to the target $30,000.

Forecasting an optimistic scenario where targets are met by 2030, Optimus could potentially bring in $34billion in cumulative revenue over the next 5 years.

If successful, Optimus could become one of Tesla’s highest-margin products, unlocking new revenue streams in manufacturing automation, logistics, retail, and eventually consumer markets. The potential benefits are plentiful: autonomous general-purpose robots could reduce labor costs, operate around the clock, and fill workforce gaps in industries struggling with manpower shortages.

Impact on share price

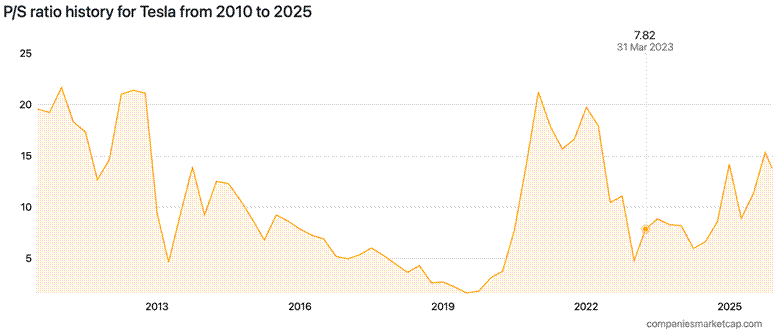

For simplicity sake, suppose investors value both segments with a price-to-sales multiple of 8, $20-30billion & $15billion of annual revenue could add 10-20% & 8.5% of value to Tesla’s current market cap respectively.

Looking further ahead at Musk’s target market cap of $8.5 trillion, assuming shares outstanding remain the same, Tesla would be priced at $2,428 per share indicating an approximate 600% growth over 10 years.

For reference: share price = market cap / shares outstanding = $8,500 trillion / 3.5 billion shares = $2,428/share

Behind the hype, the real challenges

While Optimus and Robotaxis represent Tesla’s future and potentially transformative products, both carry high execution risk.

Regulatory & safety hurdles remain major barriers

Tesla faces significant challenges as it enters a robotaxi market with established competitors such as Waymo. Waymo has already logged millions of paid autonomous trips and reported more than 4 million rides across its active U.S. markets in 2024, giving it a multi-year operational head start.

Regulatory approvals are also fragmented across states, safety incidents continue to attract scrutiny, and scaling autonomous fleets requires heavy capital investment. Tesla must demonstrate that its FSD system can achieve comparable safety and reliability benchmarks before being accepted widely as a credible robotaxi operator.

Humanoid robotics: A far more complex engineering challenge

Unlike cars, humanoid robots must operate in unstructured human environments, interact physically with people, and perform a wide range of tasks with precision and consistency. This complexity means timelines are highly uncertain, real-world utility may lag expectations, and early versions may struggle to deliver meaningful productivity gains for enterprise buyers.

Furthermore, building a humanoid robot that is safe, reliable, affordable, and commercially useful at scale requires breakthroughs across hardware engineering, AI control, manufacturing, supply chains, and regulatory approval. If Tesla cannot solve these challenges faster than competitors, the growth potential associated with Optimus could be significantly delayed.

The Bottom Line

Tesla sits at a crossroad where huge potential growth meets challenging execution risks. Bringing both Optimus and Robotaxis from prototype to everyday reality demands far more than ambitious vision.

Much of the company’s future value depends on technologies not yet commercialized, timelines that have historically slipped, and regulatory environments that remain unpredictable.

If Tesla succeeds in scaling Optimus and autonomous driving, its long-term earnings power should exceed what traditional valuation frameworks capture today.

Investors who believe in Tesla’s ability to execute at scale may view it as a generational opportunity. While those seeking stable, predictable cash flows may find the risks outsize the current rewards.

For reference: share price = market cap / shares outstanding = $8,500 trillion / 3.5 billion shares = $2,428/share

IMPORTANT DISCLAIMER: By reading this document, you agree that any information, commentary, recommendations or statements of opinion provided here are for general information and education purposes only.

The information contained in this publication are obtained from, or based upon publicly available sources that we believe to reliable, but we make no warranty as to their accuracy or usefulness of the information provided, and accepts no liability for losses incurred by readers using our case studies.

It is not intended to be financial advice, personalized investment advice or a solicitation for the purchase or sale of securities. Before purchasing any discussed securities, please be sure actions are in line with your investment objectives, financial situation and particular needs. Please do your own research and speak with a licensed advisor before making any investment decisions.

International investors may be subject to additional risks arising from currency fluctuations and/or local taxes or restrictions.

Please remember that investments can go up and down, including the possibility that a stock could lose all of its value. Past performance is not indicative of future results.

Regarding the topic of the article, it's great to read another insightful analysis from you, Zee, especially with Aaron's deep dive, it always helps make sense of the market noise. The shift to AI powerhouse with the Robotaxis and Optimus goals is definitely where my intrest lies, and your breakdown of Musk's package really highlights the scale of that ambition.