Warren Buffett’s Real Secret Was Never Stock Picking

It’s about being patient.

Dear Investor.

Zee here. This week is a reflective piece, because November is a usually a reflective month for the year.

When most people think of Warren Buffett, they picture the legendary investor who always knows what to buy and when to buy it. The “Oracle of Omaha,” worth over $100 billion, always one step ahead of the market.

But ask Buffett himself why he’s so successful… and he doesn’t talk about the latest earnings report or a hot new tech stock.

Here’s what he said:

It’s the last one that gets overlooked the most: compound interest. The thing Albert Einstein allegedly called the “8th wonder of the world.” Buffett calls it the most powerful force in finance.

And once you understand how he used it, not just to grow wealth, but to multiply it over decades, you’ll see that the true magic isn’t about being brilliant.

It’s about being patient.

The Snowball Effect: How Buffett Actually Got Rich

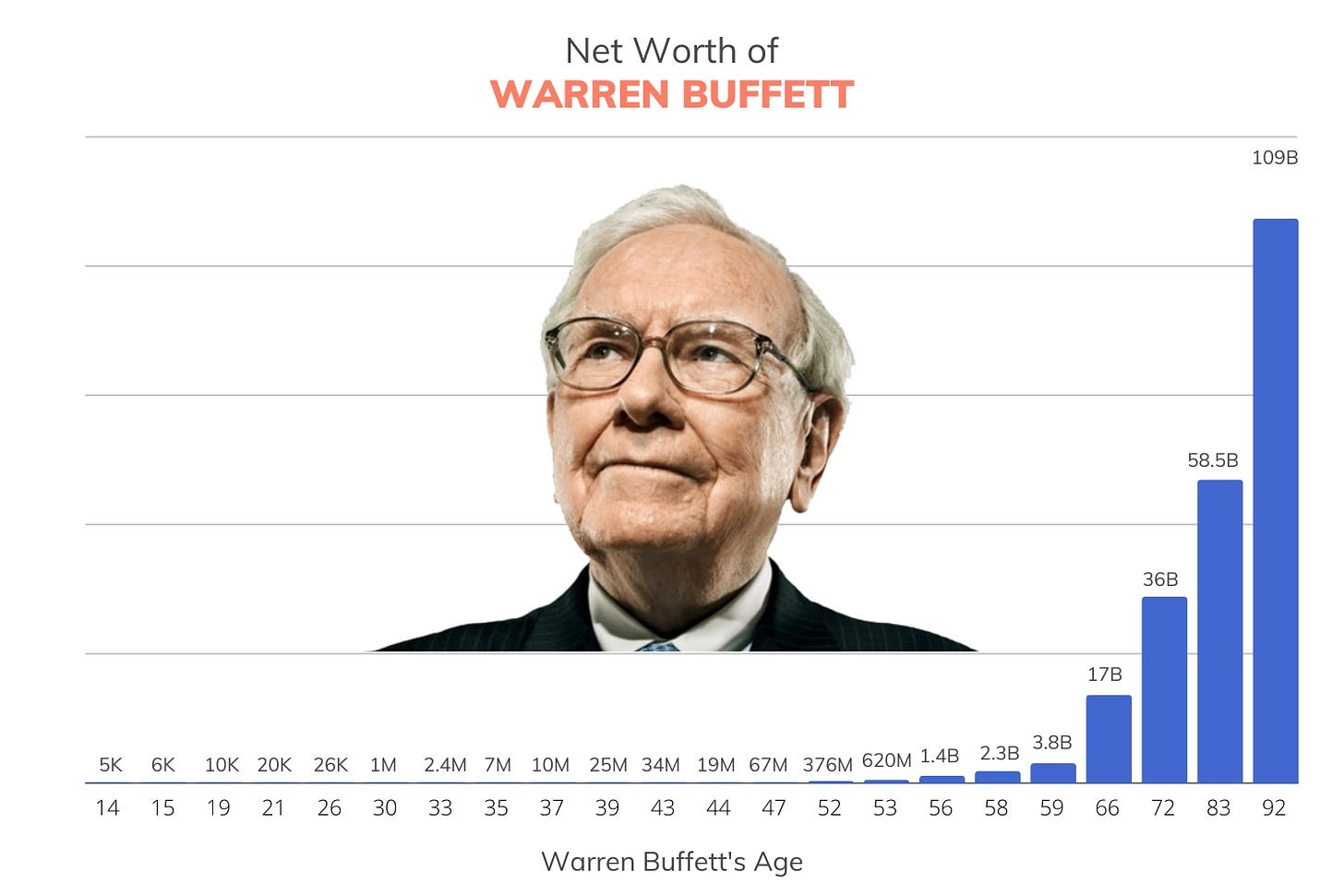

Let’s bust a myth right now: Buffett didn’t become a billionaire in his 30s or even his 40s.

He was a millionaire by then, sure. But 99% of his net worth came after he turned 50.

Why? Because compounding isn’t about sudden explosions of growth. It’s about the slow, steady build. Like rolling a snowball down a hill. It starts small. It gathers speed. Then, all of a sudden, it becomes unstoppable.

Buffett didn’t sell quickly. He didn’t chase the next shiny thing. He bought great businesses and held them, for years, even decades, letting time do the heavy lifting.

“The stock market is a device for transferring money from the impatient to the patient.”

—Warren Buffett

A Quick Compounding Thought Experiment

Let’s say you invest $10,000 in a business that grows 10% a year.

That’s not unrealistic. The S&P 500 has done roughly that long-term.

Here’s what happens:

After 10 years → $25,900

After 20 years → $67,200

After 30 years → $174,500

Nice, right?

But let’s level it up. What if, instead of just a one-time $10K investment, you add $10K every year?

Now we’re talking:

After 10 years → $175,300

After 20 years → $630,000

After 30 years → $1.98 million

This is how Buffett really built his wealth.

He didn’t chase big wins.

He played the long game.

He kept investing, reinvesting, and staying the course.

Why Most People Miss Out

So if compounding is so powerful, why aren’t more people wealthy?

Because most of us are in too much of a hurry.

We switch strategies. Panic during market drops. Jump into trends. Sell too soon. Or we try to time the market: buy low, sell high, when in reality, we just end up buying high and selling low.

Buffett? He just stayed put. And while others were busy reacting to the noise, he was quietly letting time and patience do their work.

So, What Can You Take From This?

If there’s one thing to walk away with, it’s this:

Time and consistency beat timing and cleverness.

Forget trying to be the smartest investor in the room. Instead, aim to be the most consistent one.

Keep investing.

Choose quality.

Stay invested.

Let your money compound.

And trust that the magic happens not in days or months, but in decades.

Your Action Step Today:

Take a moment to reflect on your own portfolio:

1️⃣ Are you letting compounding work for you—or are you interrupting the process by over-trading or chasing hot tips?

2️⃣ Are you giving your investments enough time to grow—or are you selling too quickly when things get boring?

3️⃣ And here’s a simple one: How long, on average, do you hold a stock?

(If it’s under a year, Buffett would probably raise an eyebrow.)

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns. How we invest may not suit your investment goals and risk management profile.

This is so true. The real wealth doesn't come in the first few decades in the final ones.