What’s Next for Markets in November?

Is the rally running out of steam or just catching its breath?

Dear Investor.

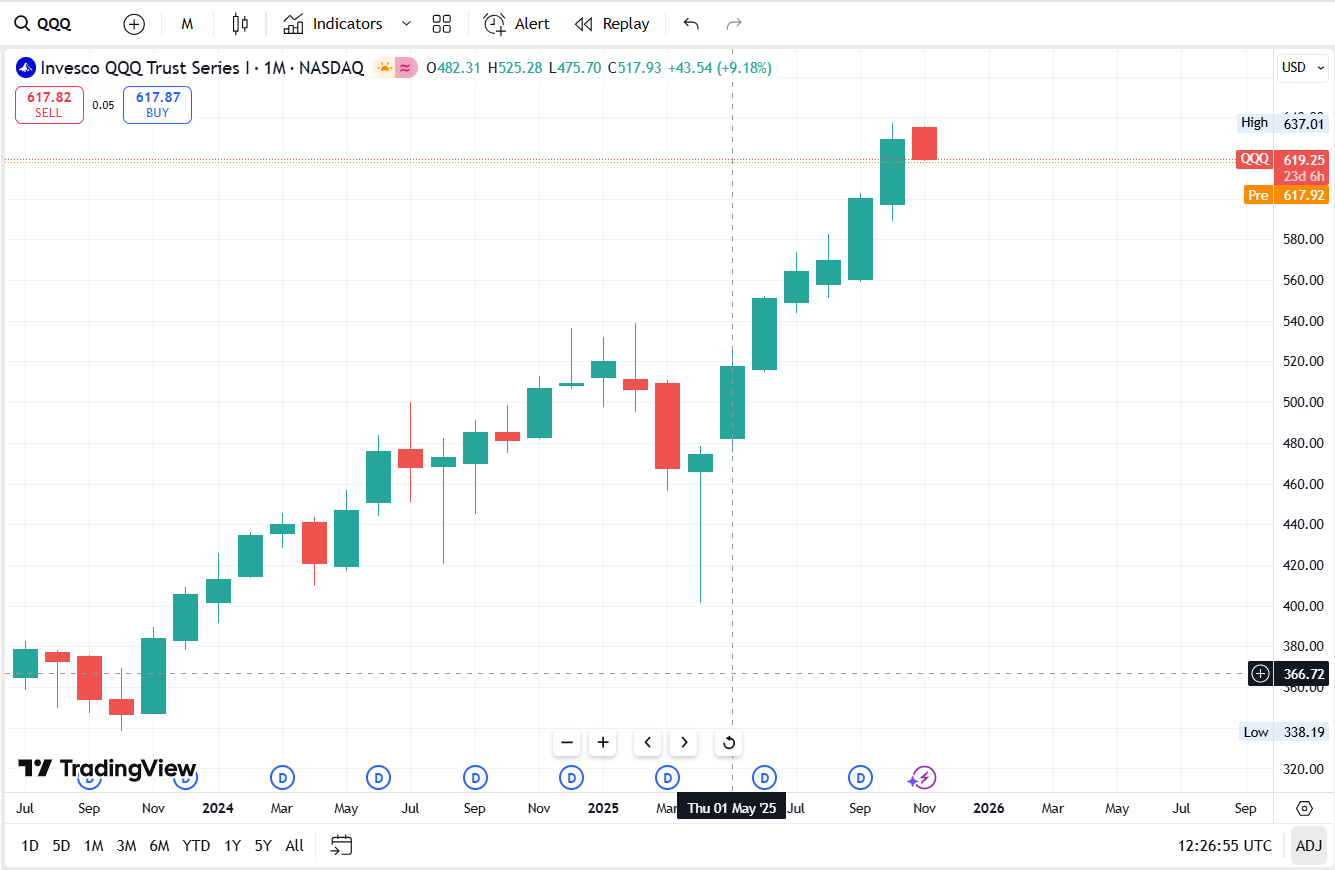

Zee here. The S&P 500 and Nasdaq 100 has now gained for six consecutive months.

After a strong October rebound, investors are stepping into November with cautious optimism.

The question now is whether the momentum can hold. With central banks nearing the end of their rate hikes, inflation cooling, and corporate earnings surprising on the upside, sentiment has improved, but not without mixed signals.

This month, all eyes are on key data releases, Fed commentary, and whether geopolitical tensions or slowing consumer demand could spark renewed volatility. In short, November could be a test of market resilience and an opportunity for disciplined investors to position ahead of year-end moves.

Join us on 11 Nov, for a live webinar “Our Outlook for Nov 2025”.

We will share where we think the risks and opportunities are this month, and breakdown a stock analysis on Google, using our value-quality investing framework.

👉🏼 Click here to reserve a spot. (LINK)

Sell in May Myth and go away?

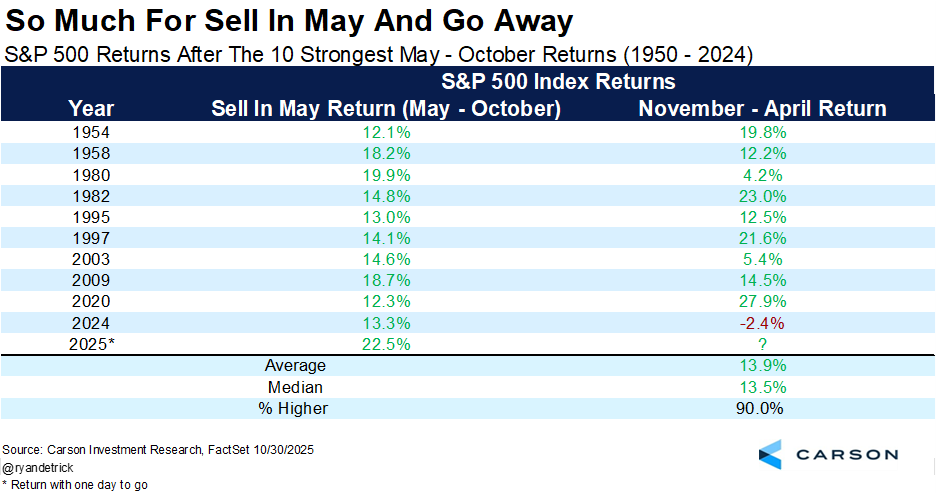

You’ve probably heard the old Wall Street adage: “Sell in May and go away.” Well, 2025 just threw that out the window.

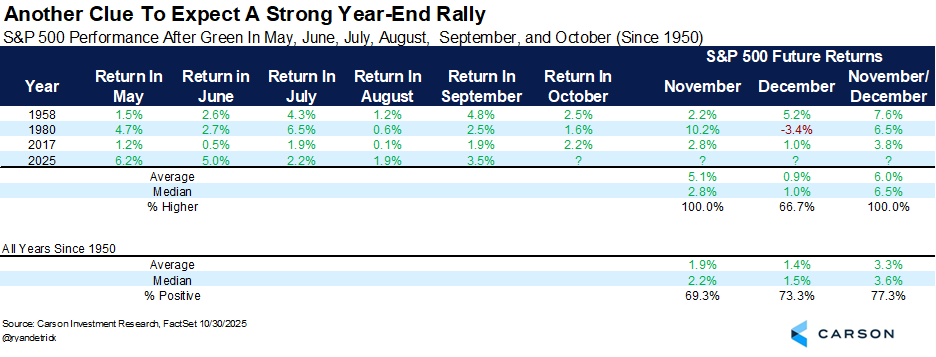

Here’s what actually happened: The S&P 500 gained ground all six months from May through October 2025, only the fourth time this has ever happened (joining 1958, 1980, and 2017). Even more impressive? The index surged over 22% during these historically “weak” months, the best “Sell in May” return ever recorded.

When the typically weak months perform this well, history shows the strong months ahead tend to be even better. In the 10 best “Sell in May” periods, the following six months were up 9 out of 10 times, averaging a 13.9% gain—nearly double the typical return.

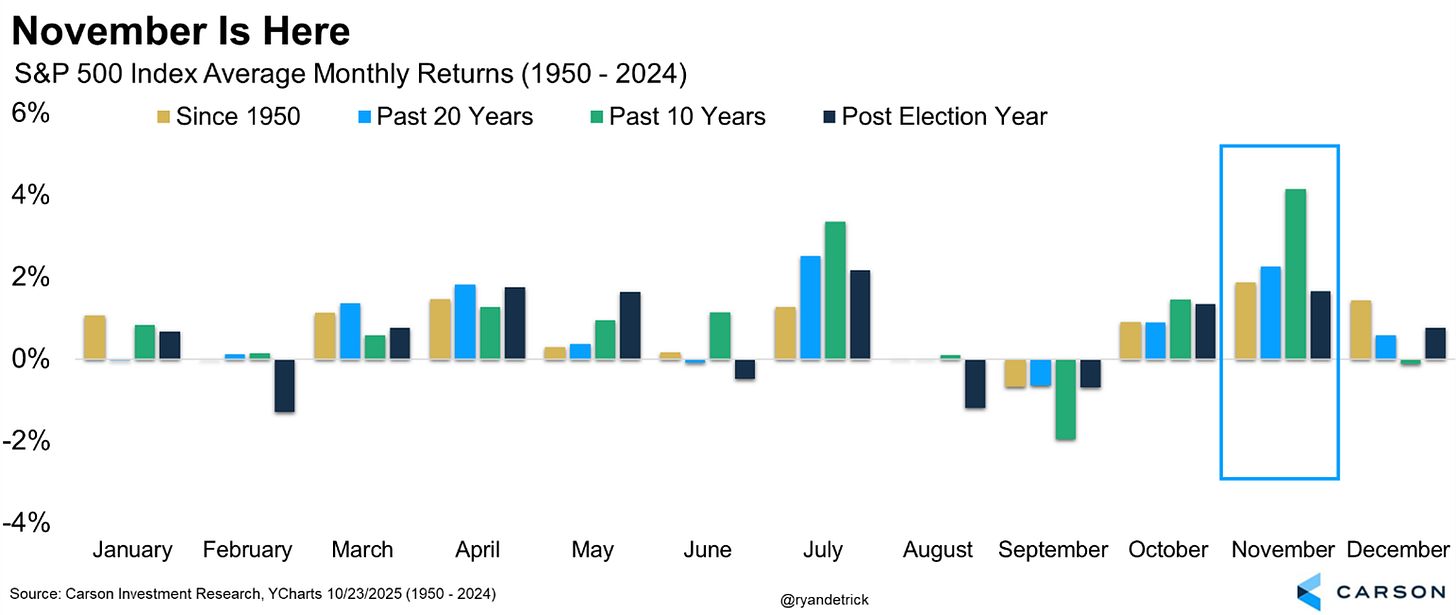

November: Historically The Best Month of the Year

Let’s talk about why November deserves special attention:

Best month on average since 1950

Second best month over the past 20 years

Best month of the last decade

Third best month in post-election years

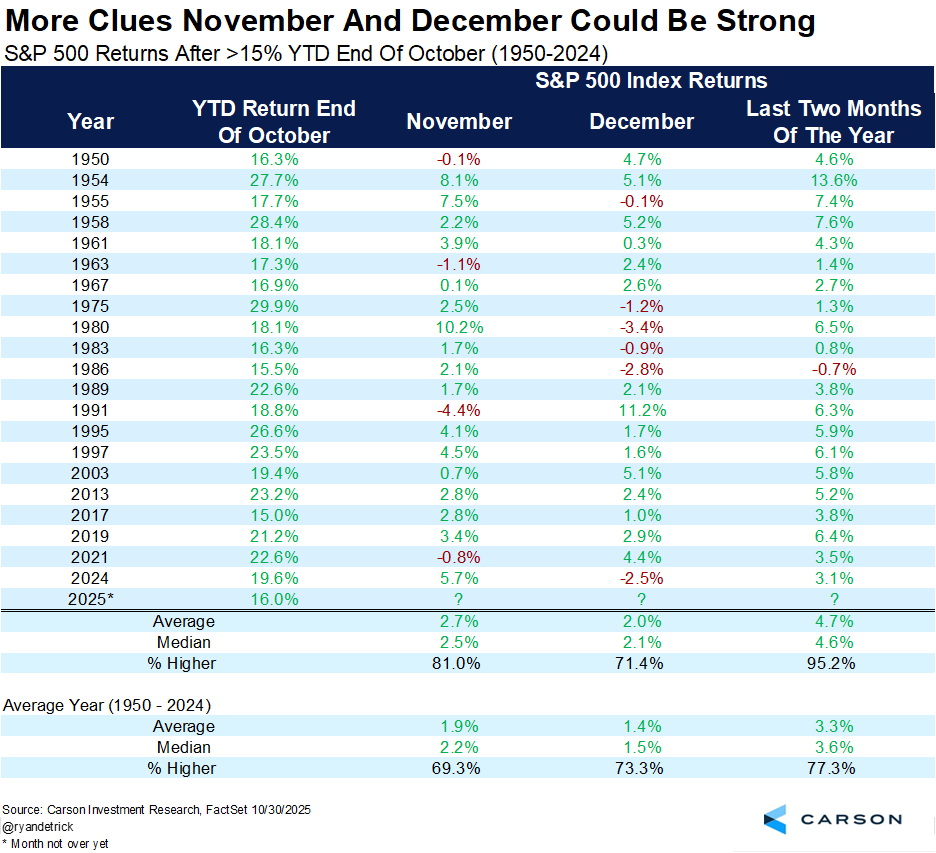

The cherry on top? When the S&P 500 is up more than 15% heading into November (like right now), the eleventh month typically delivers 2.7% gains versus the usual 1.9%. And December tends to follow suit with above-average returns.

Important Caution: Pullback Risks Ahead?

While the bullish case is compelling, it’s crucial to acknowledge growing warnings from top analysts about potential near-term volatility:

What the Experts Are Saying

Goldman Sachs CEO David Solomon warns that market sentiment can shift quickly. Speaking at a recent financial summit, he noted that “there are things that will change sentiment and will create drawdowns, or change the perspective on the growth trajectory, and none of us are smart enough to see them until they actually occur.”

Morgan Stanley CEO Ted Pick echoes this caution, suggesting investors “should welcome the possibility that there would be drawdowns, 10% to 15%, that are not driven by some sort of macro cliff effect.” He points to policy error risk and geopolitical uncertainty as ongoing concerns.

Market concentration concerns: The “Magnificent 7” tech stocks (Apple, Amazon, Alphabet, Microsoft, Nvidia, Meta, and Tesla) now comprise over 30% of the S&P 500 a level exceeding even the dot-com bubble concentration. As one analyst noted, “It remains unclear whether such expenditures will be met with corresponding revenues.”

Historical Context for Pullbacks

The S&P 500 typically experiences three drawdowns of 5-10% each year. Corrections of 10-20% are also normal, occurring once per year on average. In 2024, the maximum pullback has been just 8.5%, well below typical volatility.

Key Risk Factors to Watch

Elevated valuations: The Buffett Indicator which expresses the value of the US stock market in terms of the size of the US economy. The buffet indicator today is 221.3%, indicating that the stock market is Significantly Overvalued

Economic slowdown: GDP growth is expected to moderate, which could weigh on earnings

Concentration risk: Heavy reliance on tech giants makes the market vulnerable to sector-specific shocks

The Balanced Perspective

Despite these cautions, several factors support continued market strength:

✅ Strong corporate earnings continue to justify current valuations

✅ Moderating inflation gives the Fed room to ease policy

✅ Declining interest rates expected over the next few years

✅ Historical seasonality remains on our side

✅ Economic resilience with no recession in sight

Your Action Plan

Stay invested: The bull market shows no signs of ending, but expect normal volatility along the way.

Stay diversified: Don’t get over-concentrated in tech stocks, even if they’ve been the biggest winners.

Stay patient: Pullbacks are normal and often healthy. They’re not reasons to panic, they’re opportunities for long-term investors.

Stay educated: Learn how to invest and find high quality growth companies for just USD$9. (LINK)

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns. How we invest may not suit your investment goals and risk management profile.