Why Fourth Quarter Could Be Good News for Your Investments

Time for Uptober

Dear Investor,

Zee here. Somehow we blinked and it’s already October, potentially a welcome sign for those hoping to see stock prices climb.

Let me explain why the final three months of the year have historically been great for stock market returns, and what this means for you heading into 2026.

Sidenote: Next Tuesday (7th Oct), at 830pm (GMT+8), We’re breaking down a stock that we’re studying as an opportunity live on Zoom, using the same methods we apply in our own investing.

We’ll also be sharing more about our investing course that has helped over 2000+ students (to date) achieve their goals. No fluff, just clear insights you can use.

Sign up for free here

Understanding the Fourth Quarter Effect

Think of the stock market like seasons. Just as certain times of year are better for planting or harvesting, certain quarters tend to be better for stock returns. The fourth quarter (October through December) has historically been the strongest period for stocks.

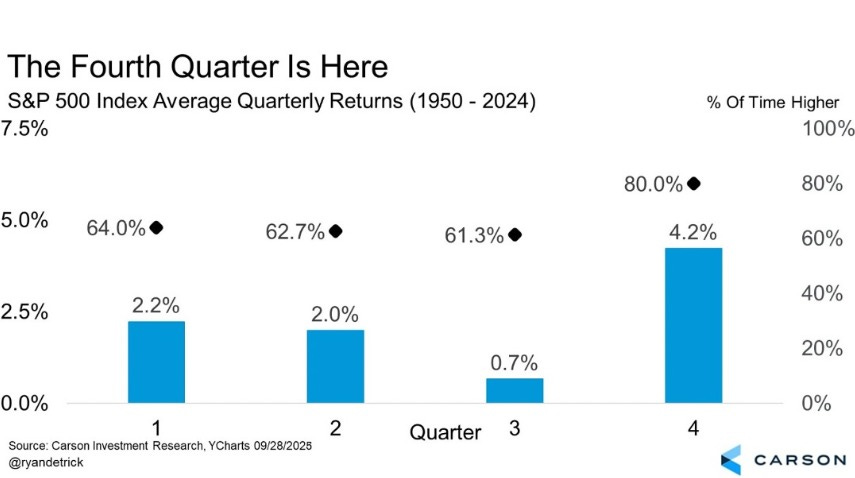

Here’s what the numbers show: The S&P 500, which tracks 500 of America’s largest companies, has averaged a 4.2% gain during the fourth quarter. Even better, stocks have gone up during this period nearly 80% of the time. That’s a pretty reliable pattern.

Why This Year Could Be Special

While past performance doesn’t guarantee future results, there are several reasons to feel optimistic as we head into the final stretch of 2025:

#1 The Year-End Rally Pattern

History shows that stock markets often finish strong. Think of it like a marathon runner who saves energy for the final sprint. November and December have traditionally been strong months for investors, with many companies reporting solid earnings and holiday shopping boosting economic activity.

Q4 higher 14 out of the past 15 times.

#2 Recovery After Difficult April 2025

“You make most of your money in a bear market, you just don’t realize it at the time.” - Shelby Cullom Davis.

The choices investors make during a bear market can have lasting effects on their portfolios. When the stock market experiences significant declines, the recovery period that follows can be quite strong. It’s like a rubber band that’s been stretched, eventually, it snaps back.

On average, stocks have risen about 23% in the year following major market corrections.

Last September has been an outlier in many ways:

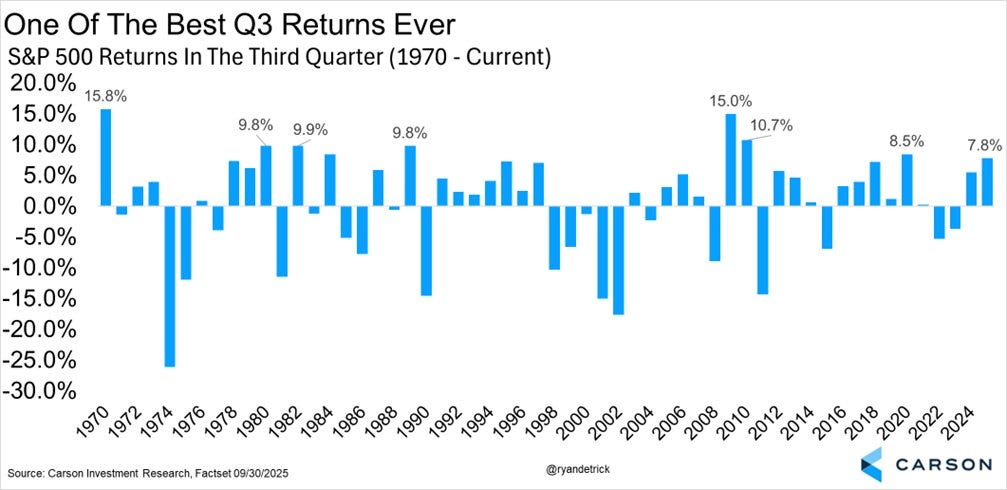

(i) Defied the usual September sell-off month, posting one of the best Q3 returns

(ii) Was the 2nd best September for the past 27years

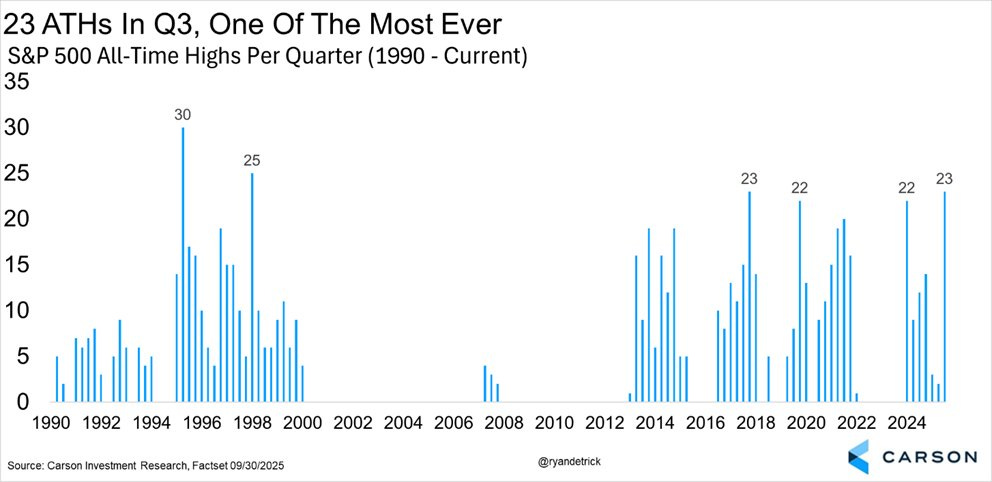

(iii) Achieved 23 All Time Highs (ATHs), one of the most ever.

#3 Q4 in a post-election year tends to do well.

The Bottom Line

Here is how we are investing in October:

(i) Prepare a shopping list of High quality stocks and ETFs

(ii) Use market dips wisely. If you have money to invest and a long-term timeframe, periods of market weakness can actually be opportunities to buy quality investments at lower prices.

(iii) Don’t try to time the market. Instead of trying to predict the perfect moment to buy or sell, focus on staying invested according to your financial plan. Dollar Cost Average (DCA) as the market dips using the Moving Averages as a guide.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.