Confessions of a Fund Manager

Why DIY Investing Might Beat the Pros

Dear Investor.

Zee here. After two decades in the industry that manages other people’s money, I’ll admit something most fund managers won’t: you probably don’t need us.

The financial services industry has built a comfortable empire on the premise that investing is too complex, too risky, and too time-consuming for ordinary people. But here’s what I’ve learned from the inside, it’s often the fund management structure itself that’s your biggest obstacle to wealth building.

In this 2 part series, I will share how investing on your own (i.e. DIY), albeit if done properly, might be significantly better.

The Fee Monster Hiding in Plain Sight

Let’s talk about what really happens to your money in a managed fund. Most investors focus on returns, but fees are the silent wealth destroyer that compounds against you year after year.

Typical Fund Management Fee Structure:

Management Fee: 1.0% to 2.5% annually (charged regardless of performance)

Performance Fee: 15% to 25% of returns above a benchmark

Administration Fees: 0.1% to 0.5% annually

Sales Charge (once off): Up to 5%

Trading Costs: 0.3% to 1.0% (often buried in the fine print)

Entry/Exit Fees: Up to 5% (less common now, but still exist)

Real Example: Let’s say you invest $100,000 in a fund charging 1.5% management fees plus a 20% performance fee:

Year 1: Fund returns 10% ($10,000)

Management fee: $1,500

Performance fee: $1,700 (20% of returns above 0%)

Your net return: $6,800 (6.8%)

The fund manager took 32% of your returns. And this happens every single year.

The Compound Effect: Where Fees Really Hurt

Over 30 years, the difference is staggering. Assuming an 8% annual return before fees:

DIY investor (0.1% costs per annum): $100,000 grows to $943,000

Managed fund (2% total costs per annum): $100,000 grows to $574,000

That’s a $369,000 difference, nearly 40% of what you could have had lost to just Management fees.

What Fund Managers Won’t Tell You

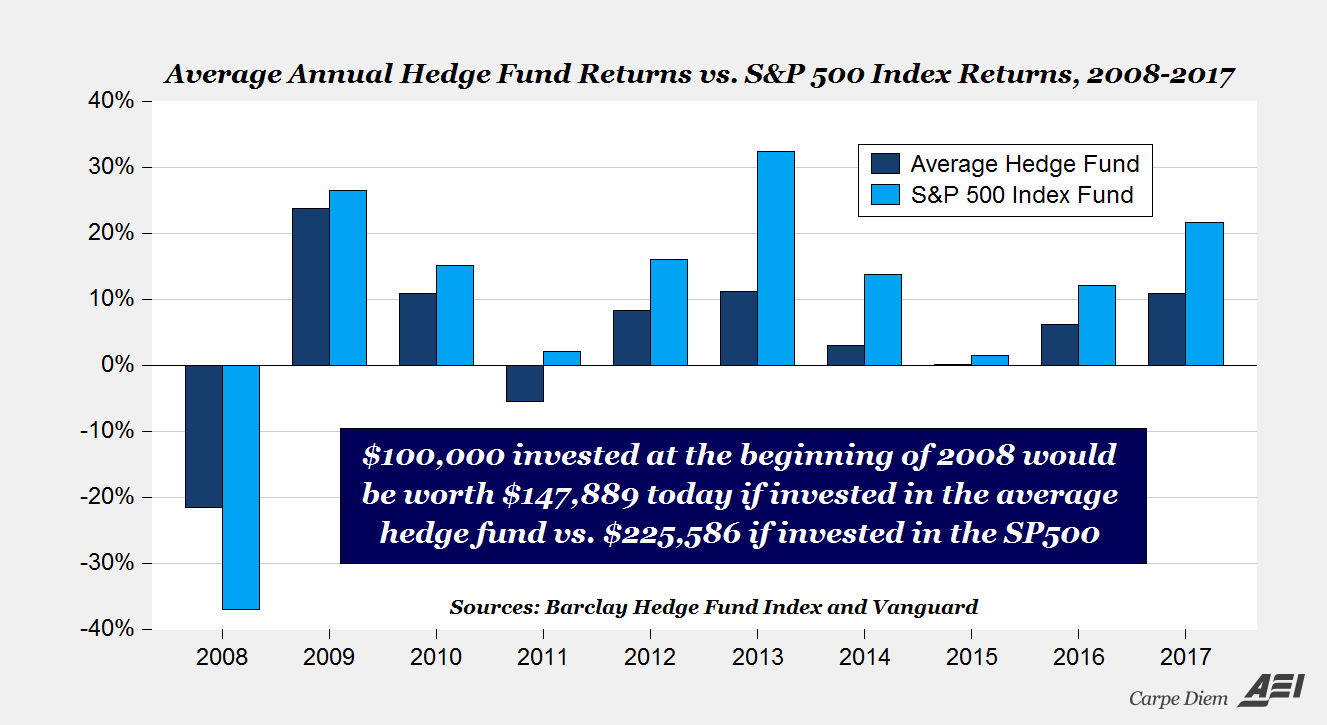

Confession #1: Most of Fund Managers Don’t Beat the Market

Studies consistently show that 80-90% of actively managed funds lose the benchmark index (eg. S&P500) over 10+ year periods. After fees, that number gets even worse. You’re paying premium prices for subpar performance.

Confession #2: Fund Managers Are Not Smarter Than You

The dirty secret? Most professional investors use the same information available to you. They read the same news, analyze the same financial statements, and often make decisions based on similar fundamental analysis. The Bloomberg terminal on my desk doesn’t grant magical foresight.

Confession #3: Perverse Incentives Rule Our Decisions

Fund managers are rewarded for gathering assets, not necessarily for making you wealthy.

A 1.5% fee on $500 million in assets generates $7.5 million annually, whether the fund gains 20% or loses 5%. The Fund Management business model depends on you staying invested and the funds gathering more money, not on maximizing your returns.

Confession #4: Large Funds are Forced to Be Mediocre

Large funds can’t be nimble. When you’re managing billions, you can’t invest in small opportunities without moving the market. Large funds end up buying the same large-cap stocks everyone else owns, creating a very expensive index fund.

Why DIY Investing Makes Sense

1. Cost Advantage

Through low-cost index funds or ETFs, you can build a diversified portfolio for 0.03% to 0.20% annually. That’s 10-80x cheaper than managed funds. This single advantage is often insurmountable. We wrote about this previously.

2. Transparency and Control

You know exactly what you own, when trades happen, and why. No surprises, no style drift, no fund manager changes that alter your risk profile without warning.

3. Simplicity That Works

A simple index fund portfolio rebalanced annually has historically beaten most professional investors. Warren Buffett famously won a decade-long bet that an S&P 500 index fund would outperform hedge funds. I will write more about this in the next issue.

4. Alignment of Interests

When you invest your own money, there’s no principal-agent problem. Every dollar of return goes to you, and every decision is made with your best interest as the sole consideration.

The Path Forward

If you’re considering leaving managed funds for DIY investing, here’s the honest truth: you need to be willing to invest time upfront to educate yourself, but these skills will last you for generations.

But it’s not as complicated as the industry suggests.

Start with these principles:

Invest in low-cost, broad market index funds

Diversify across asset classes and geographies

Rebalance annually to maintain your target allocation

Ignore short-term market noise

Stay invested for the long term

Keep investing costs brutally low

This isn’t sexy. It won’t make for exciting cocktail party conversation. But it works and it works better than what most professionals deliver after fees.

The Bottom Line

The fund management industry has convinced generations of investors that wealth building requires professional intermediaries taking their cut. But in the age of low-cost index funds, accessible information, and simple online platforms, that’s increasingly untrue.

Your money doesn’t need a fund manager to grow. It needs time, diversification, low costs, and discipline. Three of those four things, you already have. The fourth discipline is something no fund manager can provide better than your own commitment to a sound strategy.

The confession?

We fund managers have known this all along.

Now you do too.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns. How we invest may not suit your investment goals and risk management profile.