November’s Market Dip, Why?

This too shall pass...

Dear Investor,

Zee here. If you’ve been watching your portfolio this November, you might be feeling a bit uneasy. After months of steady gains, stocks have hit a rough patch. Let me break down what’s happening in and more importantly what it means for your investments.

For starters, I didn’t plan on writing this article today. In fact, I had a stock analysis on Crowdstrike ready. But due to the weakness yesterday, I’ve pushed that one back to first week of December 2025. For now, enjoy this one.

Join us on Tuesday 9th Dec 2025, for a live webinar “How to invest in 2026”.

This will be our last live webinar for the year. We will feature a special guest to share about investing in Gold.

👉🏼 Click here to reserve a spot. (LINK)

What’s Actually Happening?

Think of the stock market like a car that’s been speeding uphill for months. Eventually, it needs to take a breather. That’s essentially what we’re seeing now.

The tech-heavy Nasdaq has declined approximately 3.5% this month, marking its first losing month since March. Meanwhile, the S&P 500 remains up about 12+% for the year overall, which is still a solid performance.

Two Main Reasons for the Pullback

#1 The AI Reality Check

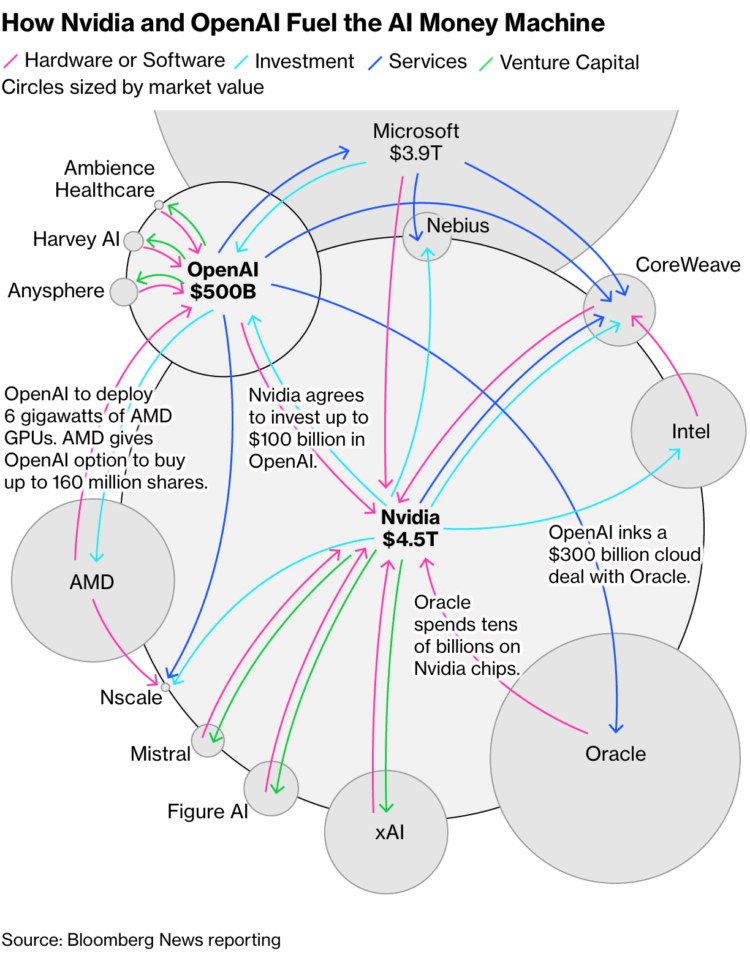

For the past year, artificial intelligence has been the rocket fuel propelling tech stocks higher. Companies like Nvidia, Meta, and Microsoft have seen incredible gains based on massive investments in AI technology.

But here’s the thing: investors are now questioning whether these companies’ heavy spending on data centers will translate into profitable returns. It’s like watching someone buy an expensive oven for a bakery, it’s a great investment, but only if people actually buy enough bread to justify the cost.

This doesn’t mean AI is going away. Rather, the market is simply asking, “Are we paying too much, too soon?”

However, last Wednesday’s Nvidia’s record beating earnings calls help allay market fears.

#2 Interest Rate Uncertainty

Remember how everyone was expecting the Federal Reserve to cut interest rates again in December? Well, those expectations have cooled dramatically. The probability of a December rate cut has dropped from 96% a month ago to just 46%.

Why does this matter? Lower interest rates typically make it cheaper for companies to borrow money and grow, which is good for stocks. When rate cuts seem less likely, investors get cautious.

The Bigger Picture

Here’s what’s important to remember: This isn’t a catastrophe, it’s a correction.

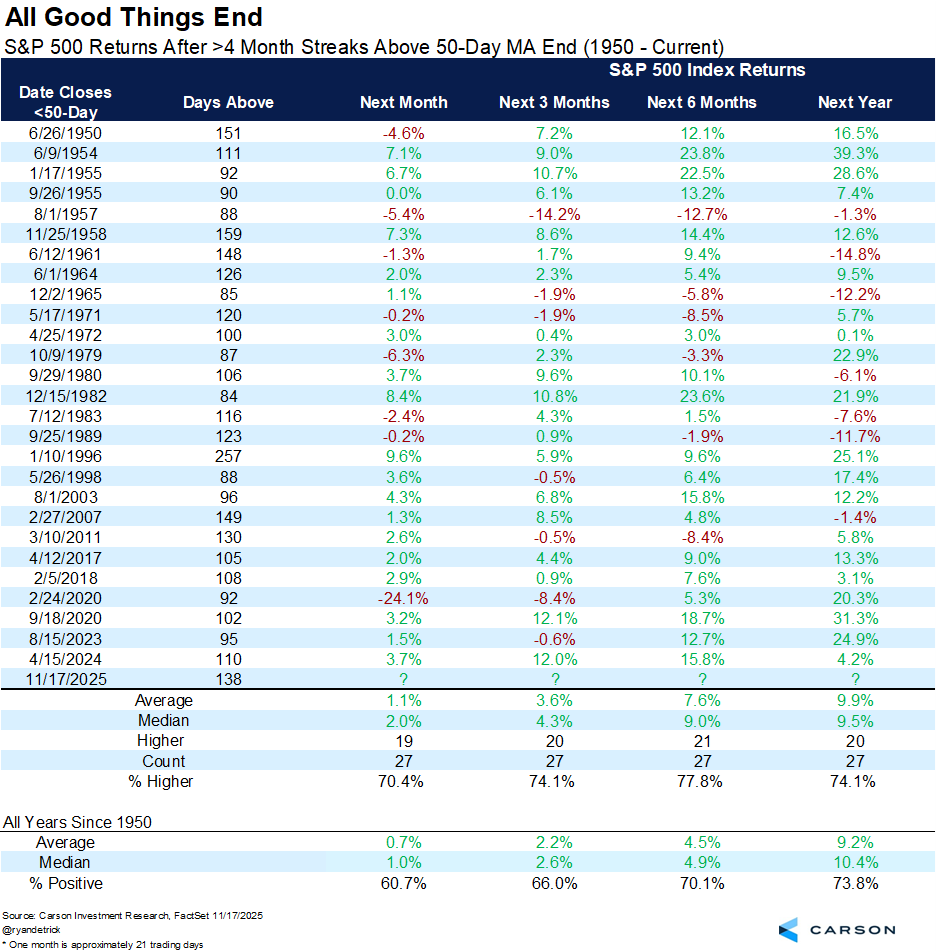

Despite recent declines, the S&P 500 has still climbed 12.29% in 2025. That’s above the historical average annual return. What we’re experiencing is a normal part of how markets work, they don’t go straight up forever.

Think of it this way: If you climbed a mountain all year, would you panic if you had to take a few steps downhill to navigate around a boulder? That’s all this is a brief detour on a longer journey.

What Should You Do?

Based on what’s happening, here’s our approach:

(i) Stay calm and keep perspective This is not 2008 or even April 2025 when tariff fears rattled markets. The economy remains resilient, companies are still earning profits, and consumer spending is holding up.

(ii) View this as a potential opportunity If you have cash available and a long-term investment horizon, market dips can be chances to buy quality investments at better prices. As Warren Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.”

(iii) Stick to your plan If you’re investing regularly through dollar-cost averaging, keep doing exactly that. You’re now buying at lower prices than you were a few weeks ago, which will benefit you over time.

(iv) Review, don’t react Take this moment to review your portfolio. Are you properly diversified? Do you have too much in any one sector? Use this as a chance to rebalance thoughtfully, not react emotionally.

The Bottom Line

November’s market dip is a reminder that investing isn’t a straight line upward. It comes with bumps, curves, and occasional downhill stretches. But for long-term investors, these moments are often opportunities in disguise.

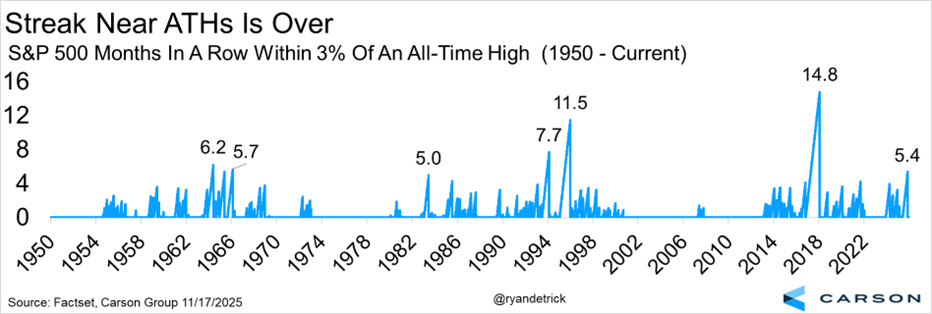

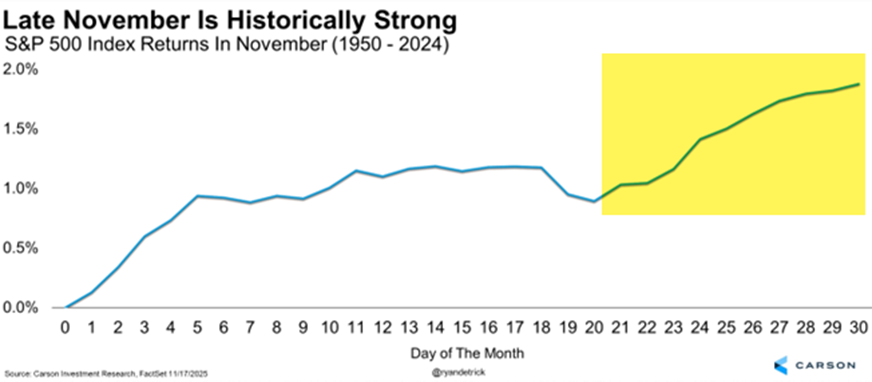

The fundamentals of the economy remain solid, innovation continues, and companies are still earning money. This isn’t the end of anything, it’s just the market taking a pause after a strong run. Also, the last part of November is historically one of the most bullish times of the year

Stay invested, stay patient, and remember that every position should have a purpose.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns.