Our Monthly Portfolio Update

October 2025

Dear Investor,

Zee here. Time of the month again, to share our monthly update on our portfolio. We are already contented with the annual results, simply because our benchmark is to beat the S&P500 index, which we have been doing so since 2016.

You can read last month’s portfolio update here. Here goes:

On 28 Oct, we’ll be conducting a live webinar on “How to Invest in 2026, and Our Outlook for the Year Ahead.”. We’ll also break down a stock that’s recently dropped but may be setting up for a turnaround.

Public Portfolio Update: October 2025

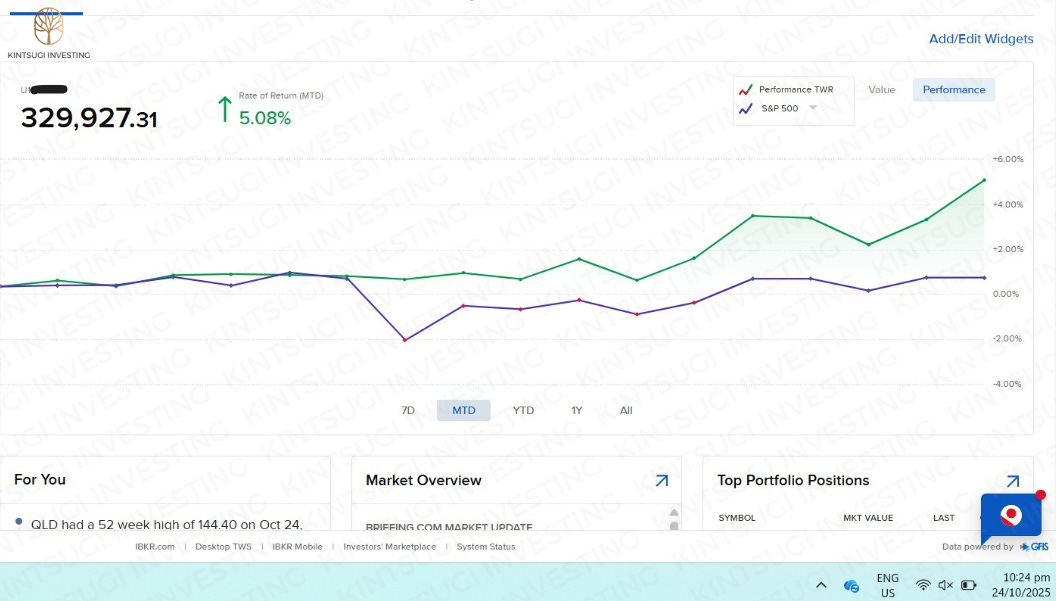

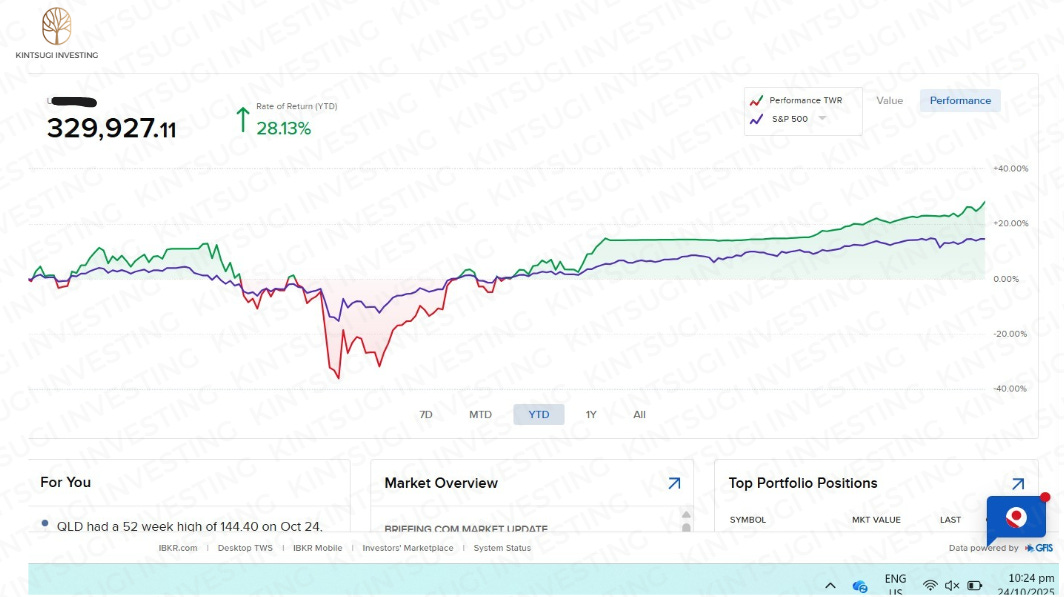

YTD performance: +28.13%

MTD performance: +5.08%

S&P500 YTD: trailing behind.

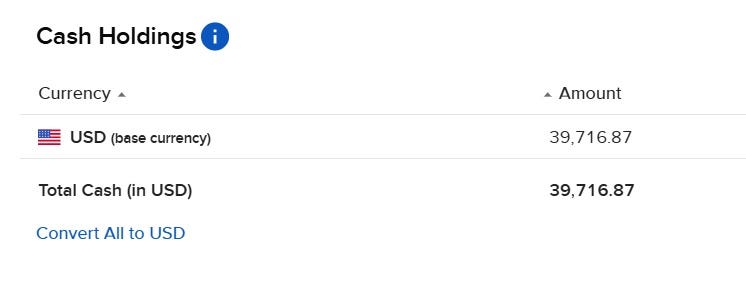

Cash left uninvested: USD 39,716.87

What we could have done better:

(1) Lack of research time to uncover more opportunities, as we now spend most of our time on preparing for classes or teaching our mentees.

What we did well:

(1) When the market went down on 10th October, we entered. So did our mentees, proud of them.

(2) Had a watchlist ready of high quality conviction stocks.

(3) Had a watchlist ready of good ETFs.

(4) Stick to proper risk management rules. If you break your rules, you’ve lost the trade.

(5) Avoid borrowing to invest. There were horror stories post-10th October, where funds/ savvy investors wiped out their account due to margin calls.

Disclaimer:

All information here is for educational purposes only. This is not financial advice. Please do your own research and speak with a licensed advisor before making any investment decisions. Past performance is not indicative of future returns. How we invest may not suit your investment goals and risk management profile.